ASX REITs in 2024: Is it finally time to blossom or will it be another year in the doldrums for investors?

![]() Nick Sundich, January 16, 2024

Nick Sundich, January 16, 2024

ASX REITs in 2024 could be set for a better year than the last year, although of course many investors have heard this story for the last few years in a row only to see it not come true. But could things be different this time? Only time will tell.

Nonetheless, there are some factors that suggest 2024 could be a good year that have not been true since pre-COVID. At the same time, even if there is a rebound, not all REITs will see the same gains.

We will take a look at where REITs are headed this year, but first outlining what they are as well as the advantages and disadvantages of investing in them.

What are ASX REITs?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate properties. These can include commercial properties such as office buildings, shopping centers, hotels, apartment complexes, and even healthcare facilities. By investing in a REIT, investors have the opportunity to earn a share of the income produced by these properties without having to physically own or manage them. And they can do so just as easy as buying individual shares on a stock exchange, in effect buying shares in a company (albeit a unique type of company).

Advantages of investing in REITs

There are several advantages to investing in REITs, whether on the ASX or another exchange. We note 5 in particular.

1. Portfolio Diversification

REITs offer investors the opportunity to diversify their investment portfolio beyond traditional stocks and bonds. This can help reduce overall risk and potentially increase returns.

2. High Dividend Yields

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This can result in higher dividend yields compared to other investments.

3. Accessible and Affordable

REITs are publicly traded on major stock exchanges, making them easily accessible for investors. Additionally, they often have lower entry costs compared to directly investing in real estate properties.

4. Professional Management

REITs are managed by experienced real estate professionals who make strategic decisions to maximize returns for investors.

5. Inflation Protection

As rental rates and property values typically increase with inflation, REITs can provide a hedge against inflation for investors.

Disadvantages of investing in REITs

Along with the advantages, there are also some potential disadvantages to consider when investing in REITs:

1. Market Volatility

Just like stocks, the value of REIT shares can fluctuate, potentially resulting in losses for investors. Of course, the opposite can be true and investors can make major gains.

2. Interest Rate Sensitivity

Rising interest rates can negatively impact REITs as it increases their borrowing costs and decreases their profitability. This has proven particularly true in the last couple of years.

3. Limited Control

As a shareholder, investors have limited control over the management and decision-making of the REIT. The degree of control all comes down to how much an individual investor holds. Ultimately, all shareholders have a vote, but only one vote per share.

4. Tax Implications

While REIT dividends may be tax-advantaged, they are still subject to taxation and can impact an investor’s overall tax liability. Of course, this is applicable to most other investments too.

5. The fate of REITs is at the mercy of the Real Estate Market

The success of a REIT is heavily dependent on the performance of the real estate market. Economic downturns or oversupply in certain sectors can negatively impact REIT returns…as long suffering investors would know.

ASX REITs from 2020 to 2023: A period from hell

OK, that might be taking things too far – except of course for those in the office space. Property stocks were indiscriminately sold off during the Corona Crash and the recovery was slow. Several are still below their pre-COVID highs and even some that have surpassed them took many months. Investors feared the pandemic’s impact on various property markets, particularly the office space given Working From Home as well as the retail space.

By early 2022, things were gradually returning to normal. So you’d think REITs would have recovered, right? Wrong. The rapid rise in interest rates have impacted certain segments of the property market. But most relevant for REITs have been higher bond yields as a consequence. So what? Well, this means REITs are less attractive, particularly to investors who saw them as bond proxies for the decade prior to COVID because many offered yields far higher than the most notable government bonds. It is not just the fact that interest rates have risen, but they have gone up so much. The last time interest rates rose a dozen times in a row, it happened over 4 years, this time over barely 1.

ASX REITs in 2024: What does the year hold?

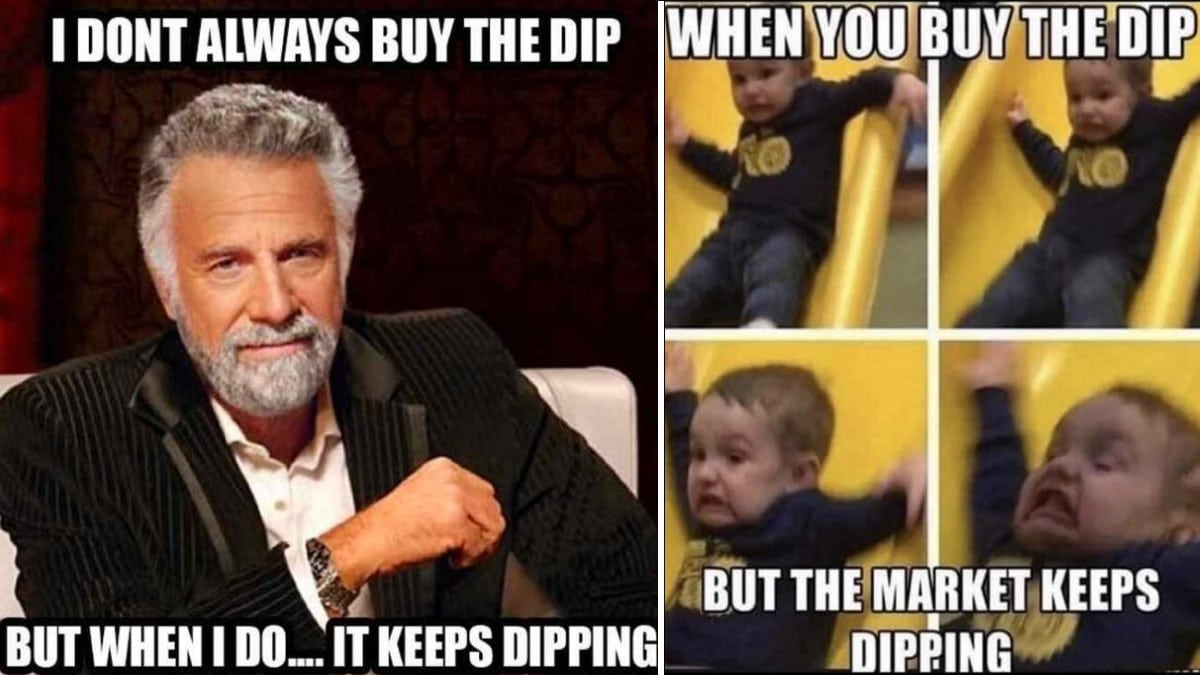

Right now in early 2024, there is hope that interest rate hikes are over and they might decline. Unfortunately, any cuts are unlikely until the latter quarter of the year. And so we wouldn’t say all REITs are a good investment opportunity. Investors need to consider the individual sector a REIT is focused on, as well as its specific property portfolio and its balance sheet. Otherwise, they could be catching a falling knife.

Source: WallStBets/Reddit

We think one sector that might finally rebound is the retail sector, particularly companies like Vicinity Centres (ASX:VCX) that are focused on CBD outlets reliant on tourism. This market appears to have finally recovered and we expect investors to give it the attention it deserves.

Industrial properties, we think they might do well for investors searching for high yields (a distribution). Growth-oriented investors we are less certain about.

Office REITs could unfortunately be in the toilet for some time to come. Even though there’s a legitimate argument to be made that the sector has bottomed out, this is not certain and we do not see a catalyst for the sector to rise, given there’s little upside left from the return of people to the office. It is clear it is not going back to pre-COVID levels and growth has stagnated for a while. Colliers has estimated a bottoming out in September, by which time office values in Sydney would’ve dropped by 25% from June 2022.

For so-called ‘social infrastructure’ focused REITs, this could be an opportunity to consider. This category of ASX REITs is broadly defined and there is no consensus name. But it consists of REITs with childcare centres and emergency services infrastructure. Two examples are Arena REIT (ASX:ARF) and Charter Hall Social Infrastructure REIT (ASX:CQE).

Because they will change hands less often, any valuation decline will matter less and be more than made up for with the guaranteed income stream. This means less upside potential but also less downside risk.

And finally, it goes without saying that any ETFs that are focused on property stocks will likely follow the way of the sub sector they are focused on.

What are the Best shares to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…