Are CBA shares overvalued at $300bn? Here’s 4 arguments why they are, 4 reasons why they aren’t and our judgement

Are CBA shares overvalued? This has a hotly contested question for many months and particularly now that it is capped at over $300bn. What has been happening in the last 18 months is the closest thing we’ve had in Australia to the GameStop saga.

While just about all of the analysts covering the company say it is overvalued and have a mean target price of $115.26, a ~40% discount, enough investors keep buying and buying to send the company up and up. Yet analysts have not given in after all these months and keep recommending to sell the stock, but are proven wrong. And any thought amongst investors that ‘what comes up must go down’ is clearly in a minority, with just $2.2bn of the bank’s equity shorted – less than 1% of $300bn.

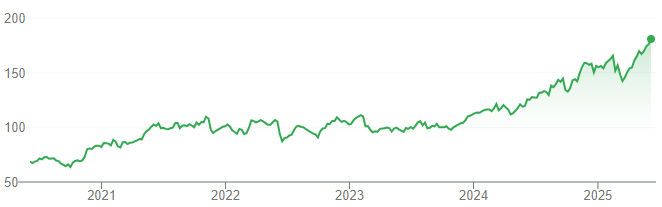

As of mid-June 2025, CBA is up 47% in the last year and 163% in the last 5 years. It is easily the biggest stock on the ASX – BHP (ASX:BHP) is over $100bn smaller.

CBA (ASX:CBA) share price chart, log scale (Source: Google)

Let’s look at both cases in the debate about whether CBA shares are appropriately valued.

Are CBA shares overvalued? 4 reasons why they might be

1. There may not be substantial profit growth for a few years. That’s not say there’ll be no growth at all, but it’ll be slow. Consensus estimates expect modestearnings per share in the next 3 years (i.e. less than 5%). And this could even be inflated by share buybacks.

2. CBA is way ahead of the other banks on several multiples including P/E (where it is 29.5x), PEG (where it is over 7x) and P/B (where it is 4x). What is there to justify the substantial premium it has over its peers? Yes it is the largest bank, but it is not as if it has a particularly large market share or that significant competitive advantages that it doesn’t need to worry about its peers. L1 Capital pointed out last year that CBA shares were trading at a 60% premium to its peers, compared to the historical average of 17%.

3. Interest rates will continue to go down, and this could lead to falling margins. If the bank did not increase its Net Interest Margins so substantially when interest rates rose 13x in a row, how will they go when rates start going down.

4. Technical indicators indicate that CBA is overvalued. One of these is the Relative Strength Index – as of June 5, 2025, the RSI on CBA shares is just over 75. The Moving Average Convergence/Divergence (MACD) suggests it is overvalued too, and while it has been suggesting so for months, it is really getting out of hand.

4 reasons why CBA shares might not be overvalued

1. It is hard to see a realistic scenario that would cause a substantial drop in CBA shares. We saw Trump’s tariffs, yes, but shares only fell 8% after Libration Day. A severe recession could cause a greater impact – even the only pro-CBA analyst (CLSA’s Ed Henning) admitted this. But this is a highly unlikely scenario. A mild recession is possible, but not a severe one. We’ve heard warnings that the interest rate hikes would cause en-masse defaults and this did not happen. Whilst more hikes are likely, it is difficult to see how one or two more could tip the scales in a way that the past 13 have not.

2. CBA makes bumper profits well and ahead of its peers, of over $10bn. No other bank came close, with the rest between $7.2bn and $7.7bn. This is not just because CBA has the most customers and such a big loan book. But the bank has certain advantages over its peers such as its tech stack and lower reliance on mortgage brokers for leads. We don’t think investors should underestimate how important the latter point is. Upfront and trailing commissions eat into a bank’s margin on loans substantially. As a recent note from Macquarie pointed out, no other retail bank has grown its revenues in 5 years.

3. The company pays amongst the highest dividends per share among all stocks. In FY24, the company paid out $8bn in dividends and stock buybacks. Those who owned shares in their own right received an average of $3,618 a pop. And all up, 13m Australians benefited – even those who don’t own shares directly likely have a super fund with CBA shares.

4. As Warren Buffet said,’ Price is what you pay value is what you get’. It is easy to look at the bank’s market capitalisation and share price, but it is important to look at all the other factors, those mentioned above and others. One thing we’d add is that the bank is only 29x P/E for FY25. Not dirt cheap by any means, but it is far from the highest – WiseTech and Xero are well over that.

So are CBA shares overvalued?

On all the evidence, we think they are not. We think the bank is ‘fairly valued’. Of course, the question of how shares are valued, is a different question as to whether or not you should buy the company. While investors wanting dividends won’t be disappointed, we think growth investors have better opportunities elsewhere, particularly in the healthcare, tech and resources spaces – both among large caps and small caps.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…