Auswide and MyState are merging, will the Big 4 Banks be watching closely?

![]() Nick Sundich, August 19, 2024

Nick Sundich, August 19, 2024

The biggest market news on August 19, 2024 was that Auswide and MyState are merging. The two small cap bank stocks, the former of which hails from Tasmania while the latter from the Queensland town of Bundaberg, may seem like an unlikely match at first glance, but the merger makes sense for both companies.

Why Auswide and MyState are merging

Auswide and MyState are keen to expand beyond their original territories, and strengthen up in what is a difficult market. There are the Big 4 Banks, Macquarie and then several smaller institutions in an intensely competitive market. Brand marketing aside, there is little scope for the companies to stand out from the others.

Smaller institutions tend to attract lower quality lenders and make lower profits – or more specifically, lower margins. This is because they have lower interest rates for borrowers, but need to have higher interest rates for deposit holders as well as when accessing wholesale funding. This isn’t necessarily the case with all of them, but it generally is. Investors may remember the regional banking crisis in early 2023 where no less than 3 regional banks collapsed. Although the fear of another GFC was unfounded, investor confidence in smaller banks has remained shaky ever since.

This deal won’t make the companies into a ‘Big 4 Bank’ anytime soon, but it will strengthen their market position. The pair of companies, or one company as it will then be, will have $12.5bn in lending assets and $9.6bn in customer deposits. The brokers coordinating the deal have told investors that it will be over 20% EPS accretive in FY25. There will be over 270,000 customers across Australia.

Auswide shareholders will receive 1.11 MyState shares for each Auswide share, implying approximately 34% ownership of the new company, with MyState shareholders owning the balance. This only represents a 2.5% to the 1-month VWAPs, but the companies’ boards are going ahead with the deal nonetheless. The board of the new company will comprise of 3 directors from AusWide with 4 from Mystate – Sandra Birkensleigh from the former company will be Chair. It is expected that a meeting to vote on the deal will occur in November or December of 2024.

FY24 was…average at best

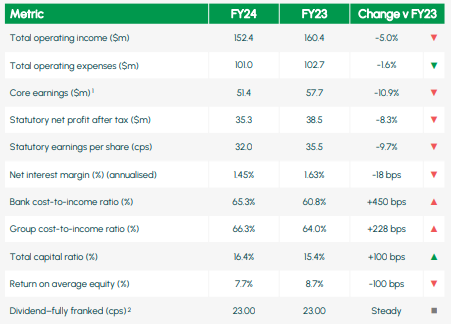

Both companies unveiled their FY24 results today. MyState announced a $35.3m profit after-tax – down 8% from the year before – as well as 14,000 new customers and a total loan book surpassing $8bn. Its Net Promoter Score was +58 (up 23 points) and Net Interest Margin was 1.45%. The total dividend was 23 cents per share, representing a 72% payout ratio and a 5.7% yield from its $4.06 share price today.

Source: Company

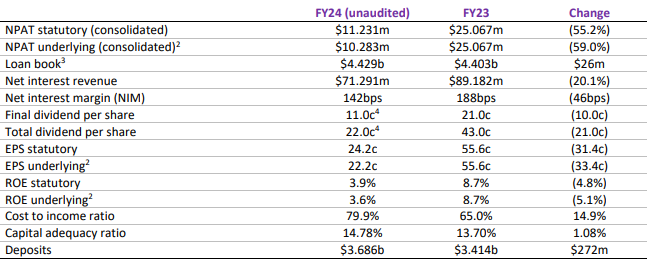

Turning to Auswide, it reported a $11.2m profit – not even half of what it had been the year before, down 55% to be more specific. Its Net Interest Margin was 1.42%, down 46 basis points, and its ROE was 3.9% – down from 8.7% a year ago. Customer deposits grew 8% to $3.7bn, but its loan book only rose 0.6% to $4.4bn. Investors were told to expect a dividend of 11c per share, representing a 96% payout and

Source: Company

Separate to the merger, Auswide unveiled a deal of its own. It is buying non-bank SME blended Selfco for $6.5m. To fund the deal, as well as to fund CET1 capital requirements, Auswide is raising $15m, $12m through a Placement and $3m in a Share Purchase Plan. This capital raising is being done at a discount, 8.05% to Friday’s closing price.

Should the Big 4 Banks be worried?

Probably not. Their marketing departments may be irritated by certain marketing tactics that will be made to try and take customers, just as occurred with the neobanks. But we don’t think the new company will be a substantial competitive threat to the Big 4, unless it starts bulking up and taking out other competitors. In many ways, this deal just shows how dominant the Big 4 are, that other banks feel the only way they can realistically be competitive in the longer-term is to join forces with each other.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

There’s Gold in Them Hills: Why Some ASX Gold Miners May Still Be Undervalued

Why Some ASX Gold Miners May Still Be Undervalued “Gold is money. Everything else is credit.” – J.P. Morgan…

So your stock will release shares in escrow? What’s going to happen to the share price?

Just what are shares in escrow? And what happens when they are released? Essentially, escrow arrangements ensure that existing investors who…

What is the best trading platform for ASX stocks in 2024?

If you want to trade stocks on ASX, what’s the best trading platform for ASX shares? Unfortunately, there is no…