The ANZ Suncorp deal was finally approved! Can this deal propel ANZ Bank’s growth over the next 2 years?

![]() Nick Sundich, February 20, 2024

Nick Sundich, February 20, 2024

Yesterday, ASX investors awoke to news that the proposed tie up between ANZ Suncorp deal (specifically Suncorp’s retail banking arm) – the biggest Australian banking deal in a decade – will be going ahead after all.

The deal, first proposed in July 2022, provided for ANZ to pay pay $4.9bn for Suncorp’s retail bank, $3.5bn of which will be funded by new investor capital – representing a P/E of 13.8x before synergies, 9.3x after synergies and a 1.3x P/B. On the very same day, announced it had decided not to proceed with plans to acquire MYOB.

At face value, it appeared to be a good deal for both companies. Suncorp had been looking to offload its banking operations for some time, while ANZ Bank has been lagging its other Big 4 peers in retail banking. But why did the deal take so long to go through, why did ANZ seek the deal and refuse to take no for an answer, and most important of all, will the deal deliver for shareholders?

ANZ Suncorp deal is an attempt for ANZ to catch up to its peers

Cast your mind back to mid-2022. At the time, ANZ Bank has lagged its Big 4 peers with the worst one-year and five-year share price performances of -/-0.3% and -/-28.1% respectively. ANZ had endured many problems experienced by its Big 4 peers as well. Namely, the Corona Crash, the economic downturn with lockdowns, the squeeze on Net Interest Margins given record low interest rates and consequently downgraded profits and dividends.

But ANZ Bank fared worse than its peers because it has lagged its competitors in technology by several years and having a smaller market share in the retail segment. In fact, ANZ was the only Big 4 bank to have shrunk its mortgage book in 2021. Although the Big 4 combined have 75.2% of the residential mortgage market in Australia, ANZ only has 13.1%. By acquiring Suncorp’s retail banking arm, ANZ Bank wanted to turn things around, particularly in the Sunshine State.

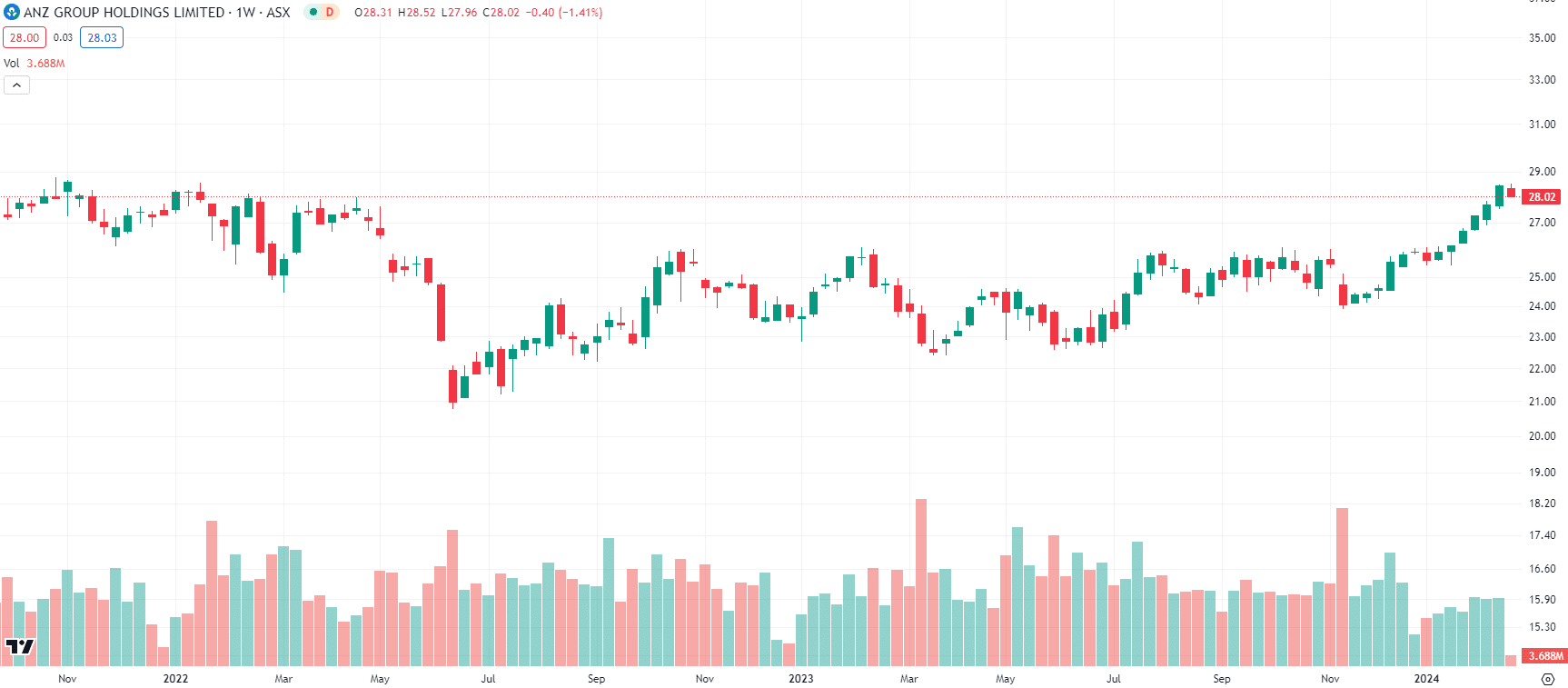

Things have turned around in the last 18 months, however. ANZ actually has the biggest percentage gain of its Big 4 peers with over 30% since mid-July 2022. Why? Putting this saga to one side for a moment, it finally caught up to its peers in launching its ANZ Plus Platform. It has around 500,000 customers, roughly 40% of which are new to ANZ.

Under ANZ Plus, would-be mortgagees can apply through their phones and finalise within 45 minutes. The platform is also attracting a significant proportion of savers, obtaining $10bn in deposits. Both metrics ahead of expectations and even some peers. CEO Shayne Elliott singled out NAB’s digital bank UBank, saying its entire balance sheet was $18bn despite being in business for 15 years while ANZ made 60% of that in 18 months.

This momentum has flowed through to ANZ’s share price.

ANZ Bank (ASX:ANZ) share price chart (Graph: TradingView)

A long time coming, but the deal is finally through

It was only natural that the ACCC would have something to say on the deal, although the bank was confident it would finally get the deal through. The deal was first put to the ACCC just prior to Christmas 2022, and first released its views in early-April, before knocking it back in August. The ACCC found it would substantially lessen competition.

ANZ appealed it on the basis that it was based on hypotheticals, rather than facts – the idea that the biggest firms in a market tacitly collude all the time. Even in absence of formal evidence (such as communication) that this was the case, it was theory that this was the case. The ACCC was so against it, that it proposed an alternative deal – Suncorp merging with Bendigo and Adelaide Bank.

But yesterday, the Australian Competition Tribunal overturned the hearing, finding that it would not lessen competition. It found that there would only be a small increase in ANZ’s market share and it would not change the likelihood of the major banks coordinating. It also noted the intense degree of competition in the mortgage market, especially since Macquarie entered the market.

Keep in mind that ANZ has just a 2.3% market share. In home deposits, Suncorp has just 1.7% and ANZ has 13.3% – even a combined Suncorp/ANZ retail bank would trail the other Big 4 banks.

The decision was hailed not just by ANZ and Suncorp, but by the Queensland government too. Treasurer Cameron Dick noted the banks’ promises for a new tech hub in Brisbane and insurance centre in Townsville.

What will Suncorp bring to ANZ Bank?

Most obviously, ANZ Bank will obtain a greater market share in Queensland. ANZ is present in Queensland, but it derives more of its home loan book from the southern states – Victoria and Tasmania collectively make up more than a third of ANZ’s loan book.

Queensland has recorded better economic growth, better workforce participation and more interstate migration than any other Australian state or territory. Suncorp’s retail banking arm will continue to operate under its own brand, with current CEO Clive van Horen and the promise of no net job losses in Queensland for at least three years.

ANZ is still not the best bank to invest in

We think even if the deal is approved, banking is not the best place for investors to be in right now. And even if it was, ANZ is not the best bank to be in, even with today’s deal. It may look cheap, with a P/E of just 13x for the next 3 years, a P/B of just 1.2x (barely half of CBA), the lowest market cap amongst the Big 4 and although the mean consensus share price is below the current price, it is the lowest discount of its peers.

However, we think it has too low a market share to derive a meaningful impact, even with this deal. We remain worried about what falling interest rates could do, considering 13 rate hikes in less than 18 months barely budged its NIM. We also note that ANZ has the largest exposure to New Zealand of its peers and the economy there is not doing as well as Australia. And although management do not have the egg on their faces as they would if the deal was also blocked on appeal, you have to wonder why it took so long to go through and how much more money was spent on the lawyers – it meant that the bank only partially franked its dividend at 56%. Of course, what happens from here is anyone’s guess.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Frequently Asked Questions about ANZ

- Is ANZ an Australian bank?

ANZ is an Australian bank and most (but not all) of its operations are in Australia

- Is ANZ buying Suncorp?

ANZ has proposed to buy Suncorp’s retail arm, but not its insurance segment. The companies have agreed to the deal, but it still has to obtain permission from the ACCC.

- Is ANZ a good buy?

We don’t think so given it trails its peers in home loan market share and in technological capabilities.

- Is ANZ ethical?

Ultimately this question is up to individual investors, but we think ESG investors should be wary of the banking sector generally given the higher risk of falling short of the law and how it often funds sectors that ESG investors may perceive as unethical, such as resources.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

EBR Systems (ASX:EBR): Another heart-focused medtech that has gained FDA approval

Mere days after Artrya (ASX:AYA) obtained FDA approval for its heart-health technology, EBR Systems (ASX:EBR) has achieved that same feat.…

ASX 200 Winners: Here are 6 that have slipped under the radar

A quick glance of the list of ASX 200 Winners in 2025 would throw up many obvious candidates. The majority…

Will Trump Make Uranium Great Again? And either way, what’s next for uranium stocks

Uranium investors hoping the Trump administration would ‘Make Uranium Great Again’ have been disappointed so far, but should investors give…