Can Westpac (ASX: WBC) make a strong comeback in 2022?

![]() Nick Sundich, April 22, 2022

Nick Sundich, April 22, 2022

Westpac is Australia’s oldest bank, but not its most agile

Westpac (ASX: WBC) is one of Australia’s so-called “Big Four” Banks – the oldest, having begun in 1817, and the third largest of the Big Four by market capitalisation. This company provides banking services, particularly deposit accounts and loans to customers in Australia and overseas.

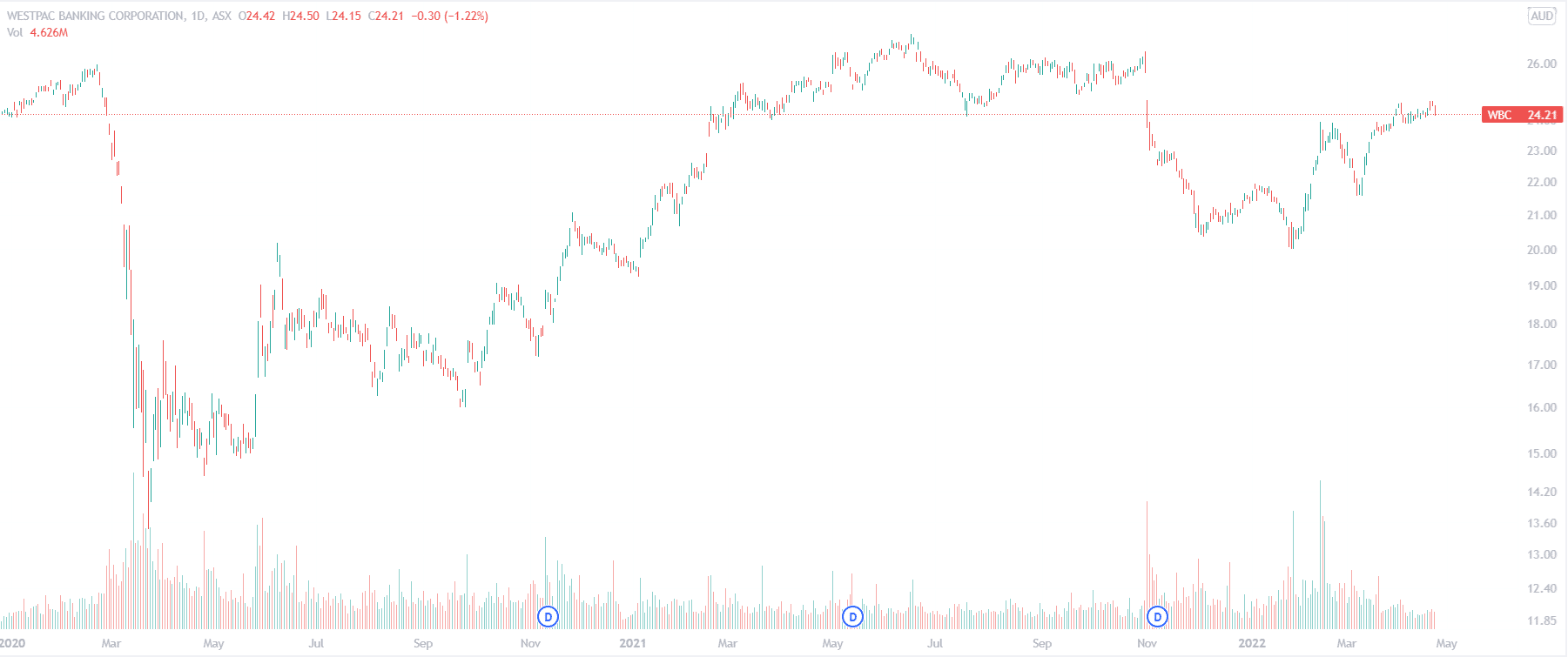

It is the only bank of the Big Four to still trade below its pre-Corona Crash highs. It has continued to be plagued by the fallout from AML/CTF breaches, which led to a $1.3bn fine, which was the largest in Australian corporate history.

GET A 30-DAY FREE TRIAL TO STOCKS DOWN UNDER

Westpac is recovering from tough times

WBC’s share price decline began in the December quarter of 2019 when AUSTRAC first launched actions against the bank. The pandemic couldn’t have come at a worse time for the bank, having to take a $1.6bn impairment charge to brace itself for a longer-term impact. Ultimately, the impact of COVID-19 was not as bad as the bank feared with record low interest rates triggering a surge in lending. Still, its $2.3bn FY20 profit was only a third of FY19 levels.

In FY21, WBC made $5.5bn, but it was still below pre-pandemic highs and was propped up by a swing in provisions. And more concerningly, its pledge to cut costs to $8bn by 2024 appeared to be off-track with costs actually rising by ~$600m. Admittedly, these costs included one-off expenses, such as fixing its compliance systems, compensating customers and expenses related to selling assets. In its most recent quarterly update, Westpac showed some progress in cutting costs.

But investors are also concerned about its Net Interest Margin (NIM), which has felt the pinch from record low interest rates. Although investors disregarded the NIM for roughly 18 months because of the lending boom, the bank’s mortgage book growth trailed its peers. Investors hope that interest rates rising will ease the squeeze, but it will depend on the extent to which WBC follows the RBA.

Westpac Banking Corporation (ASX:WBC), log scale (Source: Tradingview)

Is Westpac a buy?

In short, we don’t think WBC is a buy right now. We do like the effort management has made to cut costs while implementing the AUSTRAC reforms, but it’s still too early to definitively say progress is being made.

This stock could be a buy when interest rates start to rise before we can see progress borne out in its financials – in the form of reduced costs and a return to regular profits at pre-COVID levels. However, it lacks the market momentum that CBA (ASX: CBA) and NAB (ASX: NAB) have shown in the past couple of years.

And on a forward P/E basis, at 16.0x WBC is only narrowly cheaper than NAB at 16.5x. CBA is trading at 20.6x and ANZ at 13.4x. Westpac is more reasonably priced on a P/BV multiple, though, at just 1.2x while NAB is valued at 1.7x, CBA at 2.4x and ANZ at 1.2x.

Still, our pick of the Big Four banks is NAB (ASX: NAB) although Westpac’s turnaround from the Banking and Finance Royal Commission does provide hope for long-suffering shareholders.

Recent Company Announcements

- Westpac completes the sale of New Zealand Life Insurance Business.

- Q1 FY22 trading update

- Executive team changes

- Westpac sells its wholesale auto loan book

Stay up-to-date on ASX-listed Banking stocks!

Make sure you subscribe to Stocks Down Under today

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Westpac

- Does WBC pay a dividend?

Yes, it typically pays a dividend. It paid $1.18 in FY21, fully franked and representing a yield of 4.8%.

- Is Westpac an Australian company?

WBC is an Australian company and has Australian shareholders, but some foreign shareholders too.

- Are Westpac and St. George the same?

Although WBC and St. George are different brands, St. George has been owned by WBC since December 2008.

- Is Westpac an ethical bank?

This is a difficult question to answer and will depend on an investor’s individual definition. One might argue WBC aren’t given its AML/CTF breaches. But the bank has made efforts to change its ways, hiring new risk-based staff and implementing new systems. The bank has also made efforts to reduce the exposure of its lending portfolio to high emissions intensive industries.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…