Cobalt: Why is it so important and what are its prospects over the next 5 years?

![]() Nick Sundich, July 14, 2023

Nick Sundich, July 14, 2023

Of all the resources used in electric vehicles, cobalt is the most under-rated. Compared to other battery minerals, it is more volatile and less abundant. But that doesn’t mean that it is not important and bound for growth in the long-term.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

What is cobalt?

Cobalt is a chemical element with the symbol Co and atomic number 27. It is a hard, lustrous, grey metal that is often used in alloys to increase strength and corrosion resistance. Cobalt is found naturally in the earth’s crust in only small amounts, and usually as part of complex ores. It has been used for centuries in glassmaking, pottery and jewellery production.

Today, it is used mainly in industrial applications, such as magnets, cutting tools and batteries. Cobalt compounds are also used extensively as catalysts for chemical reactions and pigments for paints and dyes.

But there’s one use that stands out above all others.

Cobalt is important for EVs

Cobalt is an essential component of lithium-ion batteries, which are the power source of electric vehicles. Cobalt helps to store and release energy in the battery more efficiently, making it a key element for the success of electric vehicle production.

It also increases the battery’s lifetime and helps to maintain its charge longer than other materials. Without cobalt, electric vehicle batteries wouldn’t be able to store enough power for long enough periods of time or be as efficient overall.

Furthermore, cobalt has higher thermal stability compared to other materials used in electric vehicle batteries. This means that it can handle increased temperatures without breaking down and losing its charge, helping to make electric vehicles more reliable and longer lasting. Additionally, it is more resistant to corrosion than other materials used in electric vehicles, making it a great choice for improving durability as well as performance.

For this reason, each EV battery needs ~9kg of cobalt and some need as much as 20kg, according to the International Energy Agency.

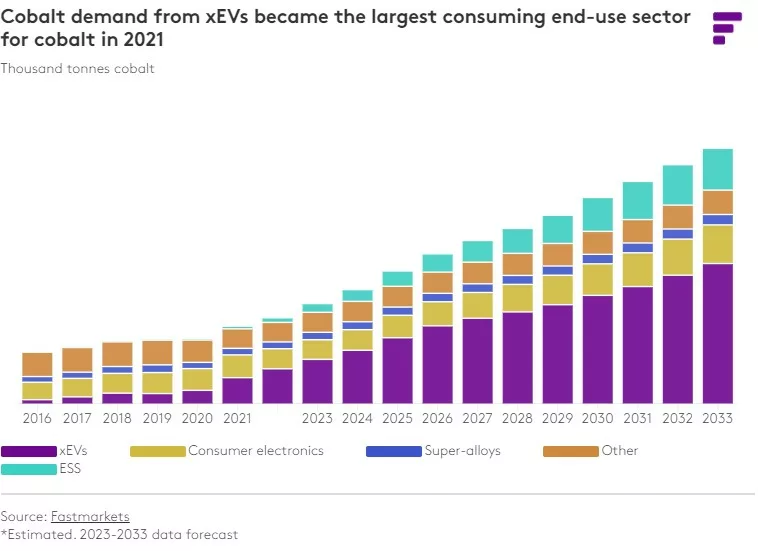

Just look at the forecast from FastMarkets below for the growth over the next decade. It estimates 14% CAGR growth over the next decade.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Benchmark Mineral Intelligence has its own forecasts, anticipating demand to reach 388kt by 2030, more than double what it is today. It is also anticipated by this point that there will be a supply deficit, even accounting for mines that are expected to be operational by then.

There is potential for Australia to grow its share of supplied cobalt to 6% by 2030 and for neighbouring Indonesia to reach 37%.

Can cobalt go up in the long term?

Yes, cobalt is a metal that can go up in the long term. As an element found in the earth’s crust, it is used to alloy or combine with other metals to increase strength and durability, as well as heat and corrosion resistance. This makes it essential for many industrial applications including electronics, aerospace, automotive components and medical applications, such as artificial joints.

Cobalt has become increasingly valuable over time due to its growing demand from various industries. Its finite supply on earth coupled with its increasing demand have helped fuel an upward trend in price over time.

From 2016-2019, the price of cobalt nearly doubled as global demand increased primarily due to rising demand from tech giants like Apple and Samsung for use in their lithium-ion batteries. The rise of electric vehicles has also increased demand for this material, which is integral to battery production. Experts anticipate continued growth in the price of cobalt in coming years as the need for traditional and newer technologies continues to increase worldwide.

Why then is it so volatile right now?

First of all we would like to note that despite short-term volatility, the longer-term has been nothing but exponential growth – consumption has tripled in the last decade! Notwithstanding, we acknowledge that cobalt is currently volatile due to a number of factors.

Firstly, the demand for cobalt is increasing rapidly as it is an essential element in many modern technologies, such as rechargeable batteries for electric vehicles and mobile phones. This has driven up prices for the metal and created a shortage in supply.

Furthermore, there are geopolitical considerations at play with regards to the main sources of cobalt – Congo and China. The former accounts of 70% of mined ore while the latter accounts for 70% of global processing.

We all know tensions between China and the West have been heightened since the pandemic. But also, Congo has recently passed laws which make it harder for foreign companies to operate within its borders, creating uncertainty regarding the future availability of all minerals from this region. At least most other minerals abundant in Congo and China are also abundant in other jurisdictions – to varying degrees.

Lastly, on top of these issues affecting short-term supply and demand levels, there is also a lack of transparency in the market which leads to additional volatility.

The long-term still looks promising

Despite these current issues, cobalt still holds exciting potential for the future due to its applications in new technologies such as electric vehicles. It is expected that further research and development will unlock new uses in other technologies, such as artificial intelligence and renewable energy solutions.

Additionally, advances in extraction techniques could help to improve extraction efficiencies which would then bring down costs associated with mining this element and make it more accessible overall. As such, despite its current volatility, there is great optimism about the long-term outlook of cobalt.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…