Copper: Can it go up over the next 5-10 years and how can I take advantage?

Nick Sundich, July 10, 2023

Copper is one of the most in-demand metals on the planet and has amongst the best prospects of any metal for growth over the medium and long terms.

In this article, we look at why it is so important and what are its growth prospects over the next 5-10 years?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Why is copper so important?

Copper is an essential element that plays a vital role in the global economy. This metal is a ductile, reddish-orange metal with excellent electrical and thermal conductivity. It is used in many industries due to its malleability and low cost. It can be found in a wide variety of products, from electrical wiring, to coins, to plumbing fixtures, to electronics components.

Copper is also sought after for its superior anti-corrosive properties and durability. This makes it ideal for use in marine applications, such as pipes and coastal structures. In addition, copper is often used in the production of semiconductors and other electronic components due to its high levels of electrical conductivity.

Due to its numerous uses, copper has become indispensable for modern society; it’s an important material for industry and infrastructure projects around the world. The demand for it continues to grow as new technologies such as renewable energy sources are developed; these require large amounts of copper for manufacturing turbines and wiring materials.

The global market for copper has grown dramatically over the past two decades; major suppliers include Chile, Peru, China, Mexico and Indonesia. As demand increases so does the need for efficient mining operations that are committed to sustainable development practices; this helps ensure that resources are harvested responsibly while protecting local ecosystems from environmental damage.

Can copper go up in the medium to long term?

Yes, copper is a metal that can go up in the medium to long term (5-10 years). This is due to a variety of factors, including the increasing demand for copper in industrial applications around the world and its role as an essential component of renewable energy projects.

Copper has been identified as an important component in the growing trend of electrification, with electric vehicles and other forms of low-carbon transport increasingly being adopted around the world. Indeed, electric vehicles need twice as much copper as internal combustion vehicles.

Copper is also an essential part of many renewable energy technologies such as solar panels and wind turbines, which are becoming increasingly popular sources of energy globally. The growing demand for these technologies has led to increased demand for copper, driving up prices.

Furthermore, many countries are investing in infrastructure projects, from roads to railways and power grids. Copper plays a major role in these projects too since it is ideal for conducting electricity and heat, making it integral for both residential as well as industry applications. This increased demand has further driven up prices of copper over time.

This point is particularly the case in emerging markets which contribute to over 55% of global copper demand.

Finally, the global economy continues to expand and grow which means that there is more money available for investment into commodities like copper, which has also contributed to increasing prices over time. In sum, all these factors have created an environment where the price of copper can continue to rise over a medium-to-long term period.

But by how much?

Well, it is anyone’s guess. One of the most radical came from billionaire miner Robert Friefdland who told Bloomberg in June 2023 that demand could go up ten times ‘when push finally comes to shove’.

What does he mean there? Well, when investors and governments realise how important it is. And he thinks it is coming because not enough mines are being built to satisfy future demand.

There are other estimates too. S&P predicts demand will reach 50 million metric tonnes by 2035, which would be more than all consumption worldwide between 1900 and 2021.

The Australian government’s Department of Industry, Science Energy and Resources (DISER) predicts that it will reach 30 million tonnes in 2028 – only five years away. This would represent a 2.7% average annual rate, but a rate that would exceed production growth (forecast to be 2%).

DISER tips 2026 will be the tipping point where supply outstrips demand.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

So why is it down in the short term?

Because of fears of a global recession, or perhaps just in major market economies.

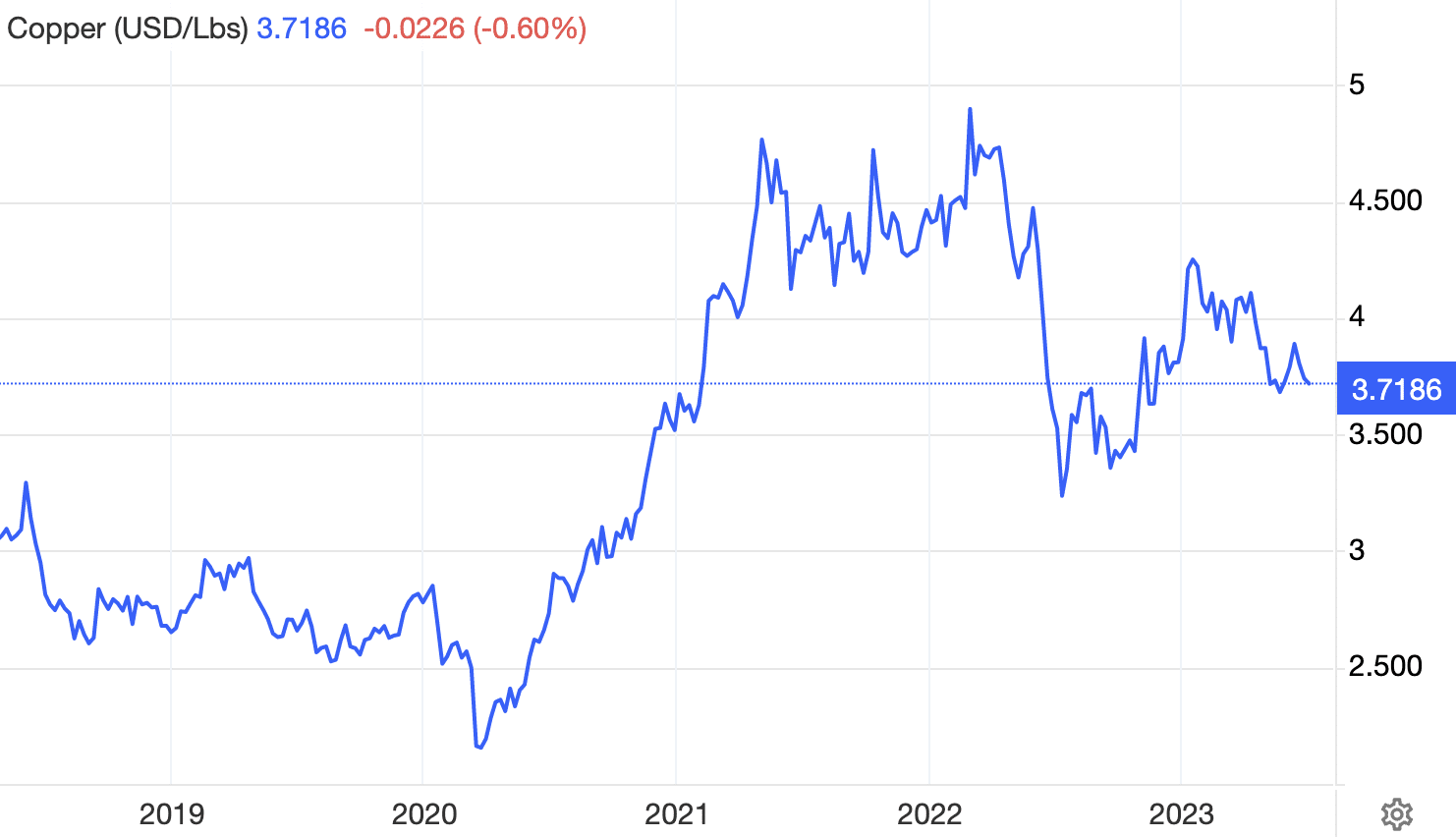

Spot prices are down some way from all time highs in 2021 as economies re-opened in the aftermath of COVID lockdowns.

Indeed, individual releases of weak manufacturing data often cause sharp intraday declines.

Investors should consider that 46% of supply is used in building construction right now. This industry has been on shaky feet even in the absence of a recession due to inflation and supply chain issue.

Copper prices (Source: TradingEconomics)

It may be accepted that prices may not enter an uptrend until the end of 2023. But the ‘supply crunch’ could occur as early as next year and most likely within the 2024-26 timespan.

So how can I take advantage of the rise in copper?

Investors can take advantage of the rise in importance of copper by investing in copper-related stocks (particularly producers and explorers), mutual funds, or ETFs.

These types of investments enable investors to capitalise on the increasing demand and benefit from its growing price.

By investing in a mutual fund or ETF that specialises in copper stocks, investors can gain exposure to a variety of companies involved with production, processing, and distribution. One example is the Global X Copper Miners ETF (ASX:WIRE).

This type of diversification helps reduce risk while still allowing investors to reap the potential rewards associated with increased copper prices. Additionally, investors may want to research companies that offer new technologies and services related to copper exploration and production as these could prove to be particularly lucrative over the long-term due to their higher growth potential.

There’s no shortage of copper explorers on the ASX, but these are high-risk stocks that may not pay off – although they may well and handsomely reward investors if they do.

There has been a dearth of producers on the ASX since Oz Minerals was acquired by BHP for nearly $10bn in May 2023. That may change in the near future as the IPO market exits the deep freeze it has been in for the last 18 months.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…