Cyclopharm (ASX:CYC): Meet the latest ASX health stock making money from the USA!

Nick Sundich, August 28, 2024

Cyclopharm (ASX:CYC) is a rare species – an ASX stock that has just cracked the US market, but where the share price has not matched its sales. Granted, it is early days, and perhaps Cyclopharm has not had the uplift other companies have had, given it only just sold on US$250,000 generator and made over A$30m in sales last year from over 60 countries. But there is a very bright future ahead.

Who is Cyclopharm? And what is Technegas?

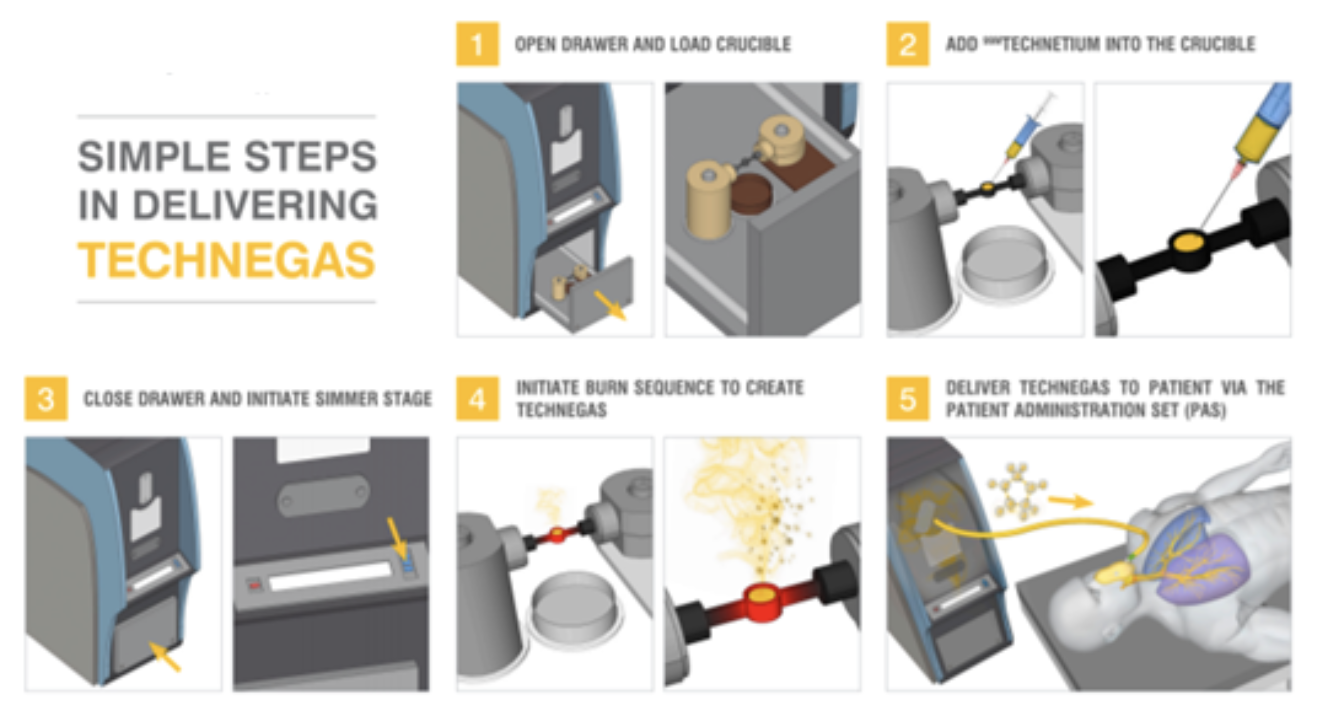

Cyclopharm is an ASX-listed medtech company that sells Technegas in over 60 countries. Technegas is a gas that patients inhale in via a breathing apparatus that makes the lungs easier to see via a special type of nuclear medical scan taken of the lungs – a Ventilation-Perfusion (VQ) scan. The company has multiple revenue streams being not only a supplier of the generator and consumables, but a provider after-sales services of the devices.

Source: Company

Technegas has several advantages including that it:

- Is more diagnostically accurate, being able to reach parts of the lungs that other types of images cannot

- Uses less radiation, and thus administers a lower dosage to patient

- Works quickly and simply enabling a rapid diagnosis, and

- Can be administered to almost all patients.

From a business model perspective, Cyclopharm is a good business because it has a multi-faceted revenue model, including a one-off installation and training fee, ongoing recurring revenues from access fees and annuity sales revenues for per-patient consumables.

Technegas is used to diagnose a lung condition called Pulmonary embolism (PE) which is a condition occuring when a blood clot (thrombus) becomes lodged in an artery in the lung and blocks blood flow to the lung.

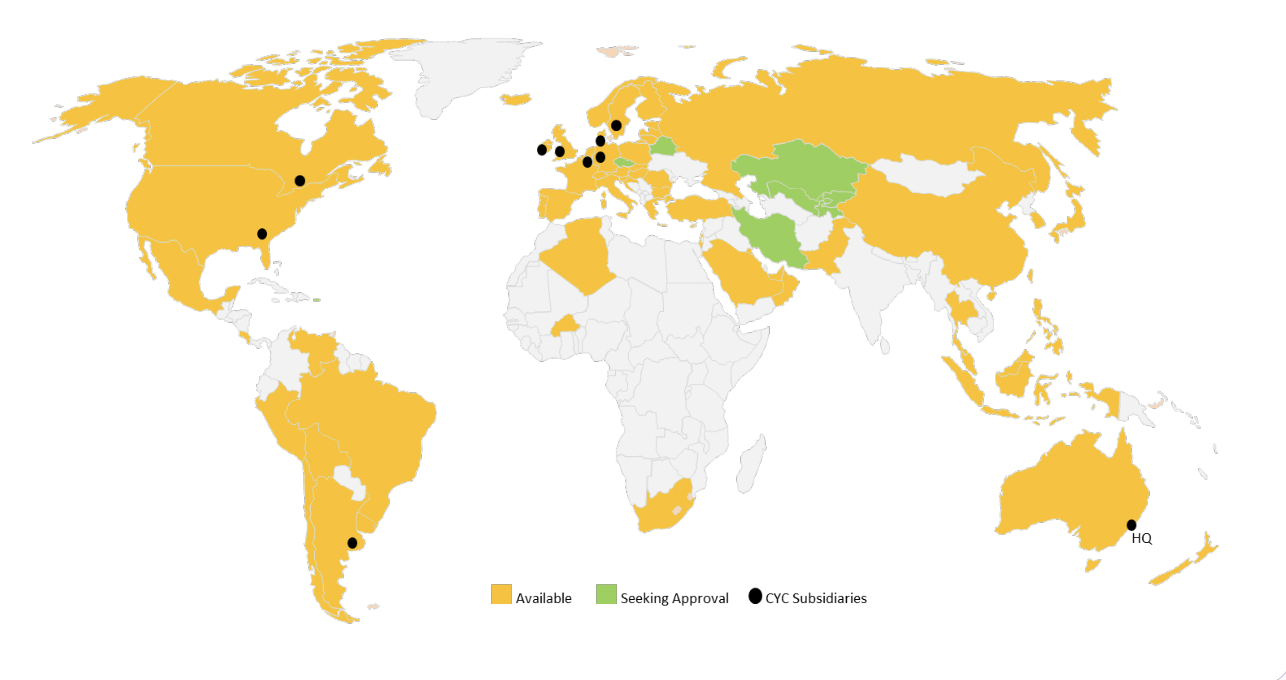

Technegas is sold in over 60 countries, but only recently to the US

Technegas was first registered as a drug in Europe in 1996, and in Canada in 2003. In the latter market, it has essentially captured the entire opportunity over the last 20 years, now being used on over 45,000 patients per annum. Cyclopharm picked up Technegas from Vita Life in 2006 via a share exchange, and listed on the ASX in the following year. It is present in over 60 countries, including the USA, which only joined the list last year.

Source: Company

The USA is the world’s largest healthcare market generally, as well as for nuclear medicine. But it also has the world’s most stringiest regulator and it has taken nearly 2 decades to obtain approval. The FDA has been convinced of Technegas’ efficacy for years, but still declined to approve it for other reasons such as certain aspects of the manufacturing of the crucibles and the dosimetry in adults and children. It is also important to note that none of these issues have been raised in other jurisdictions where Technegas is delivered.

Throughout the pandemic, the company went to great lengths to obtain the long awaited green light, going so far as to hire ex-consultants from the FDA to review its submission and checking the FDA’s queries with regulators that had already approved Technegas several years ago. But one positive sign was that FDA officials went to the trouble and expense of a fortnight’s stint in hotel quarantine in order to visit the site. In October 2023, approval was finally obtained.

Ramping up in the USA

While awaiting FDA approval, CYC management has been doing the groundwork to ensure a hassle-free entry and rapid expansion post Technegas’ approval. Management has ensured that Technegas will be reimbursable by health insurers from day one making its adoption easier by patients and hospitals. It plans to supply Technegas generators to US hospitals through a service model rather than an upfront sale of generators.

Through this model, the company will retain ownership of the generators over their lifecycle and charge an ongoing annual fee attributed to preventative maintenance, raining and product support. This approach will result in accelerated consumables revenue and provide a more predictable revenue base over the generators’ lifecycle.

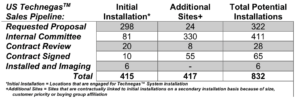

CYC obtained over 400 expressions of interest from US hospitals for Technegas. Furthermore, it had several dozen generators stocked up at its Sydney headquarters, all ready to be shipped to the US. The company rationalised its supply chain pre-COVID so it has been unaffected by supply chain issues post-pandemic. Technegas has been awarded a ‘Transitional Pass-Through’ (TPT) status by the Center for Medicare and Medicaid Services (CMS), providing for Technegas to be fully reimbursable for a maximum of 3 years.

It has a target of 300 generators in place by December 2025, and reiterated this target earlier this week. And this isn’t even its entire sales pipeline.

Source: Company

Why the US is so important

US market is a major opportunity for CYC, not just because it is the world’s largest healthcare market generally. It is also a market where Pulmonary Embolism (PE) is a major burden. The American Lung Association estimates that PE impacts around 900,000 people annually and that it 10-30% of individuals die within one month of diagnosis. Pulmonary Embolism occurs when an artery in the lungs gets blocked by a blood clot. In many cases, this blocks the flow of blood to the lung and this makes it life threatening.

In the US, about four million diagnostic procedures are conducted each year on PE patients. Out of all these diagnostics tests being conducted, 15% are based on nuclear medicine imaging and 85% of them are CTPA. These 600,000 nuclear medicine ventilation procedures being conducted every year represent a market opportunity of ~US$90m. However, CYC believes it can double the number of scans sent to nuclear medicine imaging, thereby increasing the PE market to US$180m.

The bigger opportunity for Cyclopharm in the long term will be applications of Technegas beyond PE. CYC is targeting new applications through clinical studies that are focussing on diagnosis of Chronic Obstructive Pulmonary Disease (COPD), asthma and other respiratory diseases, like Long-Covid. For now, we will not consider these indications in our valuation for conservatism’s sake but may in the future.

Cyclopharm is undervalued

With a market capitalisation of $157.3m as of August 27, 2024, we think Cyclopharm is way undervalued. There are companies that are still at the clinical stage that have higher market capitalisations like Immutep (ASX:IMM) and Imugene (ASX:IMU). As for companies that have recently commercialised drugs in the US, there are some with capitalisations in the multi-billions of dollars like Telix (ASX:TLX) and Neuren (ASX:NEU).

Telix has annualised sales of $727.9m (having generate half of that in the first half of CY24) and is trading at 9x EV/Sales, whilst Cyclopharm is at 5.6x EV/Sales with annualised sales of $26.6m. Applying a 9x EV/Sales to Cyclopharm generates a share price of $2.22 per share, a 60% premium to the current price. Our friends at Pitt Street Research last year valued the company at A$429.1m in a base case and $600.7m in an optimistic case, equating to $3.86 and $5.41 per share respectively, accounting for the current number of shares on issue. If Cyclopharm can reach the target it has set for itself, we cannot imagine the company will stay this cheap for too long.

Pitt Street Research/Stocks Down Under staff and directors own shares in Cyclopharm

What are the Best ASX stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Directors duties: Here’s what ASX company directors owe their investors

Some investors may think the only Directors duties are to ‘create shareholder value’. Maybe in their eyes, but not the…

Gorilla Gold Mines (ASX:GG8): Its skyrocketed from a minnow to a $300m company

Gorilla Gold Mines (ASX:GG8) has had a run in 12 months that its shareholders could only have dreamed of. The…

Alvo Minerals finds itself a new Brazilian target

Every now and then in the mining game you meet people with a knack of finding more than one good…