Can Gold Hit $4,000 in 2025? These 5 ASX Stocks Could Soar if It Does

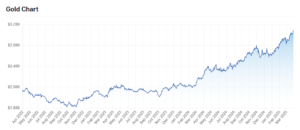

In our view, the question isn’t just whether gold can hit $4,000 an ounce in 2025; it’s about what happens if it does. Gold has long served as a barometer for global economic conditions, reflecting inflation expectations, central bank policies, and investor sentiment towards financial stability. If a perfect storm of macroeconomic forces drives gold to new heights, certain ASX-listed gold stocks could experience massive upside potential.

We’re not talking about moderate, inflation-adjusted gains here. We’re looking at a structural bull market that could redefine how investors view gold and gold mining companies. If gold reaches $4,000 per ounce, the implications could be profound for gold miners, pushing their margins, valuations, and stock prices to unprecedented levels.

So, what factors could propel gold to these record highs? Which ASX-listed gold stocks stand to benefit the most from such a move? Let’s dive in.

Could Gold Hit $4,000 in 2025?

At first glance, a $4,000 gold price may seem extreme. However, several credible macroeconomic forces suggest that it’s a real possibility:

- Sticky Inflation: While inflation has cooled from its post-pandemic highs, it remains persistently above central bank targets. Many economists believe central banks will be forced to tolerate structurally higher inflation in the coming years, making gold an attractive hedge.

- Weakening Fiat Confidence: According to the World Gold Council, central banks purchased over 1,000 tonnes of gold in 2023, the second-highest on record. This aggressive accumulation suggests that central banks are hedging against a weakening U.S. dollar and rising geopolitical risks.

- Recession Risk: In times of economic downturn, gold has historically outperformed other asset classes. If the global economy contracts, demand for defensive assets like gold could surge, pushing prices higher.

- Geopolitical Instability: Rising tensions between major economies, wars, and uncertainty around global trade could drive investors toward gold as a safe-haven asset.

- U.S. Fiscal Policy: The U.S. government’s massive debt levels and the potential for aggressive fiscal stimulus could weaken the dollar, making gold more attractive.

Some analysts, including Ole Hansen from Saxo Bank, have suggested that gold could reach $4,000 in a period of economic chaos or aggressive monetary easing. While this isn’t the base case for most analysts, it’s far from implausible, given current global trends.

What Would $4,000 Gold Mean for ASX Stocks?

If gold prices surge to $4,000 per ounce, it will be a game-changer for gold miners. The key beneficiaries would be companies with:

- Low-cost production: Miners with low all-in sustaining costs (AISC) would see their profit margins expand dramatically.

- Strong balance sheets: Companies with minimal debt would be better positioned to capitalise on rising prices.

- Near-term production growth: Companies on the verge of ramping up production could see their valuations explode as they transition into revenue-generating operations.

- Large resource bases: Companies with substantial gold reserves would see their asset values surge, making them attractive to investors and potential acquirers.

With that in mind, here are five ASX-listed gold stocks that could soar if gold reaches $4,000 per ounce.

Evolution Mining (ASX: EVN)

One of Australia’s largest gold miners, Evolution has spent the past few years streamlining operations and acquiring tier-one assets. Its flagship Cowal and Ernest Henry mines boast all-in sustaining costs (AISC) well below $1,400 per ounce, meaning even at today’s prices, it’s printing cash.

If gold breaks above $3,000, let alone $4,000, we believe Evolution’s operating leverage will become extremely attractive. Its recent acquisition of Northparkes also adds copper exposure, a useful hedge in an inflationary environment.

From a financial perspective, Evolution had a net debt of >$1bn in FY24, but this is well-covered by strong free cash flow generation.

Key reasons EVN could benefit:

- Low AISC = high profit leverage

- Clear growth pipeline

- Strong liquidity and operational execution

Perseus Mining (ASX: PRU)

Perseus is one of the few miners (in any commodity) to have made it in Africa. Its projects include the Edikan mine in Ghana as well as the Sissingue and Yaoure mines in Cote d’Ivoire.

In the 6 months to December 31, 2024, the company produced over 250,000/oz gold at an AISC of US$1,162/oz and had an average sale price of US$2,350/oz. This generated over US$580m in revenue and a profit of US$201m. This left it with a cash and bullion balance of over US$700m.

Why Perseus Stands Out:

- Its ‘war chest’, in other words cash balance to acquire new projects and low debt

- Its discount compared to many of its peers

- Major leverage to rising gold prices

Northern Star Resources (ASX: NST)

Northern Star is the heavyweight of ASX gold stocks. With assets like the Kalgoorlie Super Pit and Pogo Mine in Alaska, it’s built a diversified production portfolio across Australia and North America.

We’re not just talking ounces, Northern Star produced over 1.6 million ounces in FY23. At scale, every $100/oz increase in gold price adds substantial EBITDA. A surge to $4,000/oz? That’s game-changing.

The company is known for disciplined M&A, and it maintains strong margins thanks to efficient operations and a keen focus on shareholder returns.

What we like:

- Large-scale, low-cost production

- Strong balance sheet

- Management with a proven track record

Bellevue Gold (ASX: BGL)

Bellevue is one of the newest producers the ASX. Its namesake project in WA has just commenced production and is a brownfields development. In other words, it is a former mine that former operators thought had run out of life but wrongly so as the current management team has found Total Mineral Resources of 9.8Mt at 9.9 g/t for 3.1Moz of gold.

We believe Bellevue offers a unique risk/reward profile. It has high-grade resources and ESG credentials (it’s targeting net zero), and sits in a safe jurisdiction. But more importantly, it offers outsized torque to the gold price.

At $4,000/oz, the margins here could be absurd, and investors are already starting to take notice.

Reasons to watch BGL:

- High-grade orebody

- Low-cost profile

- Near-term production catalyst.

Capricorn Metals (ASX: CMM)

Capricorn has quietly built a reputation for disciplined project delivery. Its Karlawinda project is now producing over 100,000 ounces annually at impressive margins.

What’s different about Capricorn is its focus on returns. It has no debt, consistent dividends, and prioritises shareholder value, a rarity in the junior mining space.

Its development pipeline also includes the Mt Gibson project, which could double group production. At higher gold prices, we believe CMM will become a cash-flow machine.

Why Capricorn could shine:

- Clean balance sheet

- Growing production base

- Consistent delivery and capital returns

What Could Go Wrong?

It’s important to note that a $4,000 gold price is not the consensus forecast. Major risks include:

- Central banks successfully taming inflation

- Rising real interest rates

- A strengthening US dollar

- Recession-induced demand destruction

Still, in our view, the risk-reward skew for gold exposure remains attractive, especially through well-managed ASX stocks with margin resilience.

Final Thoughts

If gold climbs to $4,000 in 2025, the impact on ASX-listed gold miners could be nothing short of extraordinary. But it’s not just about picking any miner; it’s about identifying those with the right mix of margin leverage, production visibility, and investor-friendly strategies to capitalise on the opportunity.

The five stocks we’ve highlighted—Evolution Mining, Perseus Mining, Northern Star Resources, Bellevue Gold, and Capricorn Metals—stand out as strong candidates in this scenario. Each of these companies has the potential to benefit from a higher gold price due to their low production costs, strong balance sheets, and well-defined growth strategies.

Of course, predicting gold’s future price is never an exact science. A surge to $4,000 would likely require a combination of persistent inflation, global economic uncertainty, and rising central bank demand, all of which are plausible given current market trends.

Could gold hit $4,000? Only time will tell. But if it does, the upside for these companies and their shareholders could be truly golden.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

FAQs

- What would drive gold to $4,000 in 2025?

Several factors could converge to push gold higher: persistent inflation, geopolitical instability, central bank demand, and a weaker US dollar. A recession could also spark a flight to safety, boosting gold’s appeal.

- Is now a good time to invest in ASX gold stocks?

If you believe gold prices are headed higher in 2025, many ASX gold miners are trading below historical valuation multiples, which could represent an opportunity. As always, do your research.

- Are explorers or producers better in a gold bull market?

Producers benefit from rising gold prices via higher margins. Explorers, however, can see speculative interest spike. We believe near-term producers with strong assets strike the right balance.

- What’s the risk if gold doesn’t rise?

If gold remains flat or drops, higher-cost miners may struggle. Low-AISC producers with strong balance sheets are best placed to weather that scenario.

- How do I choose the best ASX gold stock?

Look at cost structure, management track record, jurisdiction risk, and production outlook. Also, consider how much exposure the company has to exploration upside or M&A.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…