Humm Group (ASX:HUM): Its no Big 4 Bank, but has defied the market in 2024

Humm Group (ASX:HUM) has not had the year you might expect to a financier that is not either a Big 4 Bank or Macquarie (ASX:MQG). Interest rates appear to have peaked, and many financiers have not benefited as much as you might expect due to intense industry competition, as well as expectation that rates are going down.

The saving grace with the largest 5 banks is having larger and higher-quality loan books, meaning loan books with lower proportions in arrears or default. This has not been the case with Humm, however. The company recorded impressive results in FY24, and this has shown in its share price.

Humm Group (ASX:HUM) share price chart, log scale (Source: TradingView)

Introduction to Humm Group

Many investors likely remember this company as a BNPL stock. Humm, which was known as FlexiGroup until mid-2020, was in the ‘payments by instalments’ space long before many of the other ASX plays. It was founded by Andrew Abercrombie in 1991, who remains with the business today. The company started with consumer leasing, before branding out into interest-free cards, commercial finance and payment solutions.

Things were going well for Humm until AfterPay came along. The company quickly lost market share to AfterPay and attempts to differentiate itself, both from a consumer and investor perspective, couldn’t slay the giant. In June 2020, Humm’s consumer business boasted 2.1 million customers and had added 380,000 during the preceding 12 months. This paled in comparison to AfterPay’s customers, which at that time numbered 3.2m in Australia alone. One reason was because Humm’s small ticket offering had a focus on the travel sector, which went into hibernation during the pandemic. And there was little incentive to use the offering for big ticket items (such as home improvement) instead of personal loans because interest rates were low.

Humm also has a commercial asset finance division, Flexicommercial. It has consistently been the second largest non-bank provider of asset finance, is profitable and currently possesses a growing loan book worth $2bn. Flexicommercial has been repositioned over the last five years and has a strategic position in the market, focused on sectors that commercial banks had stopped lending to, including agriculture and industrial sectors. Despite all of this, Flexicommercial was also disregarded by investors.

A fall and rise again

In CY22, Humm nearly sold its Consumer Finance division to Latitude (ASX:LFS). The deal appeared a win for both sides. Latitude would grow its Consumer Finance base, while Humm could focus on its Flexicommercial, with investor sentiment towards both companies theoretically improving as a consequence.

Ultimately the deal did not go ahead and consequently led to the shares of both companies suffering and a major board overhaul. This included the departure of notable investment banker John Wylie who had been on the board since early 2019 when he bought a 5% stake. We’ve already stated that both businesses are in good shape and we reiterate that view here. Flexicommercial is highly selective in which clients it lends to and it focuses on industries that tend to perform well irrespective of economic conditions. In many cases, Flexicommercial’s clients have a critical need for the items they are seeking finance for. Humm also has software that is better able to assess would-be customers’ creditworthiness. And this strategy is paying off given the low default rates.

Humm also rationalised its consumer business, getting out of small ticket financing and consolidating its various products into one brand. It will specialise in big ticket items (items between $1,000 and $30,000 such as car repair, solar panels and dental work), where consumers use the company’s products as a budgeting tool.

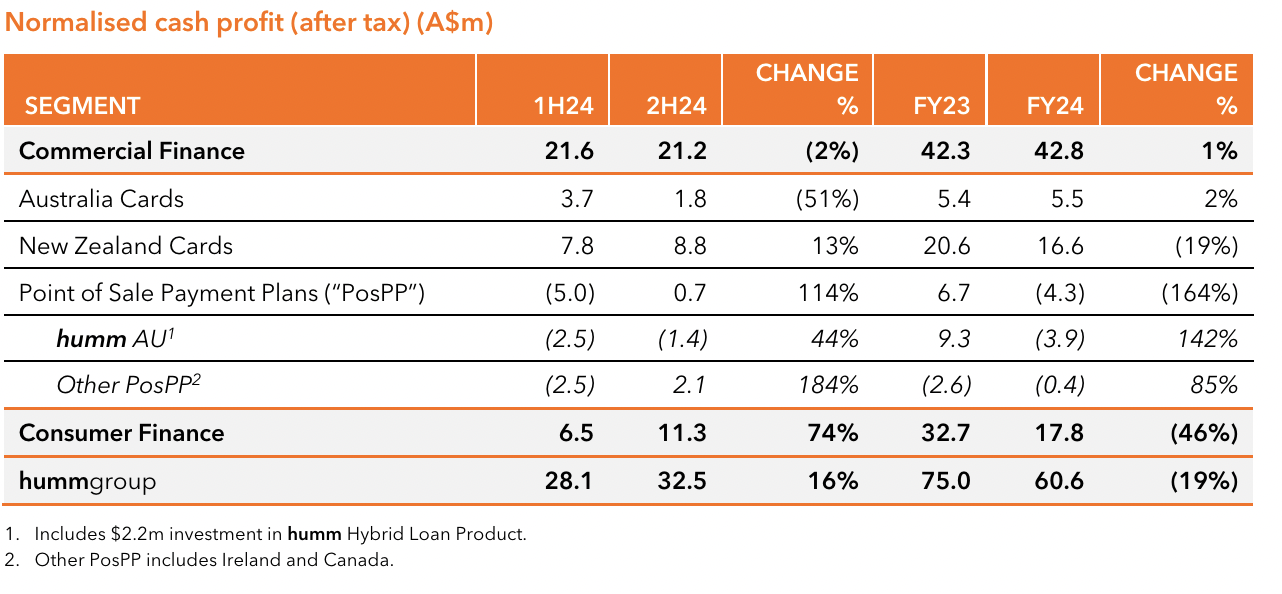

The actions taken by the company paid off. The company closed the period with a total loan book of $5bn, up 18%. 60% of the book was commercial receivables and this segment grew by 26%. The company made a total return to shareholders of 6.02% taking into account its 2c per share dividend. The NIM was 5.5% and its Net Credit Loss/Average Net Receivables was 1.8%. The bottom line was solid as well.

Source: Company

More of the same in FY25?

Humm has not given specific guidance for the year ahead. Nonetheless, it told shareholders it would ‘drive profitable growth across its operations, as it grows and expands’. Analysts covering the company expect a $64m profit on a statutory basis in FY25, or 12c per share. This places the company at just 6x P/E. On a backward looking P/B valuation, it is just 0.6x.

Investors will likely find these multiples compelling. We would urge caution for investors thinking of buying Humm shares on this basis alone. After all, the risk of an economic downturn and/or a hit to the company’s NIM as interest rates fall could hit its profit.

But all things considered, the company has undergone a remarkable transformation in the past couple of years and is in fair shape to handle whatever economic conditions may hold.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…