IGO shares shed 78% in less than 2 years, but are up 40% in 2025! Dead cat bounce or legitimate rebound?

For several years IGO shares reaped the benefits of growing demand for battery metals and the fact it was well managed to capitalise on it. The company has three nickel projects and exposure to two lithium projects. Not many ASX companies offer such diversified exposure. Unfortunately, the Battery Metals Bust of 2023-4 caused IGO shares to shed nearly 80% from July 2023 to April 2025. Since then, shares have recovered somewhat, and are set to finish 2025 roughly 40% higher. But is this a dead cat bounce, or a legitimate rebound?

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Who is IGO?

IGO (known as Independence Group until 2020) has been listed on the ASX since 2002 at just 20c per share. It grew into the giant it is through the acquisition and development of several major projects – both those it discovered in its own right and those it acquired and took to the next level. The Tropicana Gold Mine is a great example of this – it was discovered in 2005 and was offloaded to Regis Resources in 2021 for $903m as it sought to focus exclusively on battery metals.

It has four projects, all in WA. There are three nickel projects: Cosmos, Nova and Forrestania. Nova (formerly known as Nova-Bollinger) was acquired in 2015 when Sirius Resources was snapped up while the other two were only bought in June 2022 after the acquisition of Western Areas. Spoiler alert for later in the article: This deal has not turned out so good for reasons which we will come to. We won’t mention the JORC Resource because they have been de-classified as JORC-Reportable. Nova still is, but the most recent resource is just 45kt nickel, 17.8kt copper and 1.5kt cobalt.

Then, IGO is in lithium with a 25% stake in the Greenbushes and a 49% stake in Kwinana, buying these stakes in 2020 from China’s Tianqi. Greenbushes lies just 90km from Bunbury and is the world’s largest and highest-grade hard lock lithium operation. It has 440Mt grading 1.5% lithium and produces 1.5Mt annually.

IGO thinks it can support another ~20 years of mine life with an average of 9.5Mtpa (million tonnes per annum). It is spectacularly low cost compared to many of its peers such a Mineral Resources (ASX:MIN) and Pilbara Minerals (ASX:PLS). As we’ll go on to elaborate on later, Kwinana was fully written down earlier in 2025.

Why did IGO shares surge so much?

IGO shares quadrupled in 2 and a half years from the Corona Crash to late 2022. This was because the company was reaping a significant benefit from the battery metals boom.

In FY22, IGO made $903m in revenue (up 35%) and a $331m NPAT (down 40% although FY21 was inflated by the sale of Tropicana). In FY23, $1.02bn in revenue and a $549m NPAT (up 66%). This was achieved despite the impairment charges at Forrestania and Cosmos, all due to spectacular spodumene production and sales remaining strong.

So why have IGO shares gone down?

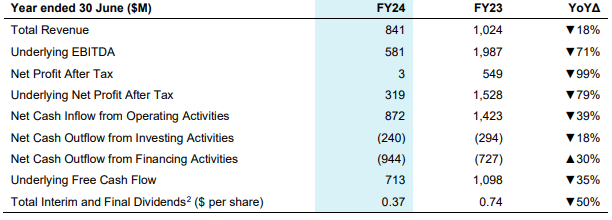

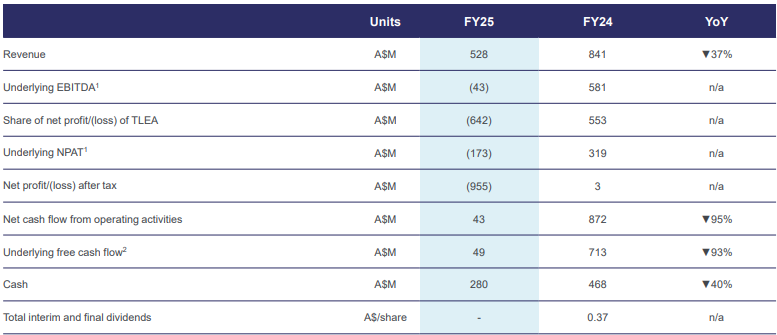

The answer here is also simple. Because the battery metals market has undergone a significant correction. This showed in IGO’s FY24 and FY25 results.

Source: Company

Unlike Mineral Resources, it still paid a dividend in FY24, albeit 50% below the year before. But it did not in FY25.

Source: Company

The nickel and lithium bear markets are key

Let’s look at nickel specifically. At its all time high, the benchmark price for nickel on the London Metals Exchange (LME) was US$30,000 per tonne. It nearly halved form there and spent months in the doldrums. There is a general oversupply of nickel in the world as EV sales are weaker than expected. Also hurting matters was rapid growth from nickel producers in Indonesia, many of which are backed by Beijing. Indonesia has more than half the world’s production, and it could have 66% by 2032 if forecasts from Benchmark Minerals turn out right.

As noted above, IGO has recorded a ~$900m impairment against Western Areas and may have to write-off that entire amount but it has not yet. Forrestania specifically looks likely to be sold to Medallion Metals (ASX:MM8). The Cosmos project was put into care and maintenance in light of the costs. Kwinana was initially spared from impairment as work initially went on, but it stopped in early 2025, and it was written down to zero by July that year. This was not so much due to prices, but because it was poorly built and did not produce lithium in the volumes it was meant to. As for Nova – what’ll happen to it is anyone’s guess. This leaves Greenbushes as its own productive asset.

Turning to lithium and spodumene prices fetched consistently below US$1,000 per tonne for more than 18 months. Price languished in the were US$700-900 per tonne for many months, down from US$8000 per tonne at the end of 2022. Ouch. So as it goes without saying, it means that lithium production is a lot less profitable, maybe not even viable for some companies.

Now prices have begun to move in recent months and have exceeded US$1,000/t, but are still behind their all time highs. Beyond prices, other concerns include that certain Australian miners, such as IGO, may not be able to access US government subsidies due to joint-Chinese ownership of its projects. This makes it all the more critical for projects to be low-cost.

Other problems

There have been a few other matters that haven’t helped IGO. Long-time boss Peter Braford died in October 2022, a big blow to the company given how long he successfully led the company. A permanent replacement was only found in January 2024 in former Rio Tinto executive Ivan Vella. It was always going to take some time for him to prove himself in the role in the eyes of investors. He has ambitions to diversify the company away from nickel and build a copper division.

Investors are also remembering that IGO is only in Greenbushes as a minority JV-partner. It has to pay royalties on the agreed mechanism when other industry players not in JVs do not, has no marketing rights and is at the mercy of Tianqi’s discretion as to whether or not it gets dividends – a fact highlighted when IGO didn’t even get a dividend for the December quarter of 2023. It is essentially a passenger. A passenger on the train that is the best hard rock lithium project in the world…but it is a passenger nonetheless.

But hey, the company will bounce back when lithium prices do, right?

It’s arguable. And investors have gotten excited at any hint, most notable the (ultimately temporary) closure of a Chinese mine responsible for 5% of global supply. But we’d say not so fast. Now, Greenbushes is operating with a 66% EBIT margin and it made 1.48Mt in spodumene production and ~6,782t of lithium hydroxide.

Yet, the worst thing about the JV deal the company is stuck in with Greenbushes is that selling pricing is based on backward-looking benchmark prices. So even when lithium prices recover, it’ll take even more time for this to be seen in IGO’s revenues. Tianqi can buy spot volumes for lower so Greenbushes will sell 25% less than it produces.

You also have to wonder how US foreign entity of concern rules impact it considering IGOis in a JV with a Chinese company. The US is a lucrative market for battery metals, but IGO may be missing out on that market when many of its ASX peers ultimately will not.

Greenbushes has been continuing and there have been good signs, although prices have remained at US$730/t due to the backended deals ignoring the current highs in prices. The EBITDA margin was 57% and 320t was produced, but sales fell 27% to 301/t. Of course, this is all on a 100% basis. Nova is operating but is eventually expected to close – nickel production fell 33% and copper production 41% and sales for these fell 5% and 50%. Ultimately, group revenue was $105m (down 17%). It has A$287m cash.

Consensus estimates for IGO forecast continued decline in revenues as Nova comes offline and uncertainty remains over Greenbushes revenues. The target price is A$5.64, down 19% from the current price. The estimates vary from a high of $7.50 to a low of $4, but even the former figure is well below the company’s all time high and little above the current price.

IGO’s copper ambitions are admirable, although it’ll be a long game. The company will either have to find projects via M&A – which is quick but expensive – or exploration, which is a cheaper but ardeous and painstaking process.

Should I buy IGO shares?

Given all of the above, no. We would still avoid the battery metals sector for the time being, or at least companies that are only exposed to it. Even if you believe there’s upside, it is better to look at companies like Core Lithium and Liontown that own assets outright and have pricing as the only operational uncertainty facing them.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…