Investing in Bitcoin in 2024: Here’s the ultimate investor’s guide!

![]() Nick Sundich, April 11, 2024

Nick Sundich, April 11, 2024

We’ve compiled the ultimate guide to Investing in Bitcoin in 2024! Should you consider investing in it? What is the best way to go about it? What are the key risks? And what is this so-called ‘halving event’ that everyone is talking about?

What is bitcoin?

Bitcoin is a decentralized digital currency (or a cryptocurrency), without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin has garnered attention for its use in transactions where anonymity and security are valued, as well as for investment opportunities, leading to widespread discussions about its potential impacts on the global financial system.

What is the history of bitcoin?

Bitcoin, conceived by an anonymous person or group of people under the pseudonym Satoshi Nakamoto, has its origin marked by the publication of a white paper in 2008, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This revolutionary document outlined a decentralized digital currency system, intended to eliminate the need for intermediaries like banks. The first software was released in January 2009, and Nakamoto mined the inaugural block of bitcoins, famously known as the Genesis Block, embedding a timestamp and a commentary on banking bailouts.

Over the years, the cryptocurrency transitioned from an obscure digital novelty to a significant player in financial markets, challenging traditional economic structures. Its history has been characterized by volatile price swings, regulatory scrutiny, and a growing acceptance among both consumers and businesses as a means of payment and investment.

Bitcoin has also paved the way for the development of other cryptocurrencies, known as altcoins, which utilize similar blockchain technology but with different features and goals. Some notable examples include Ethereum, Litecoin, and Ripple.

Spectacular returns

Despite its initial purpose as a peer-to-peer electronic cash system, use cases have expanded beyond just being a currency. It has also been utilised as a store of value, similar to gold, and has even been integrated into traditional financial systems through the creation of futures contracts. Additionally, the underlying technology behind cryptocurrencies, known as blockchain, has shown potential for various applications in industries, such as supply chain management and voting systems.

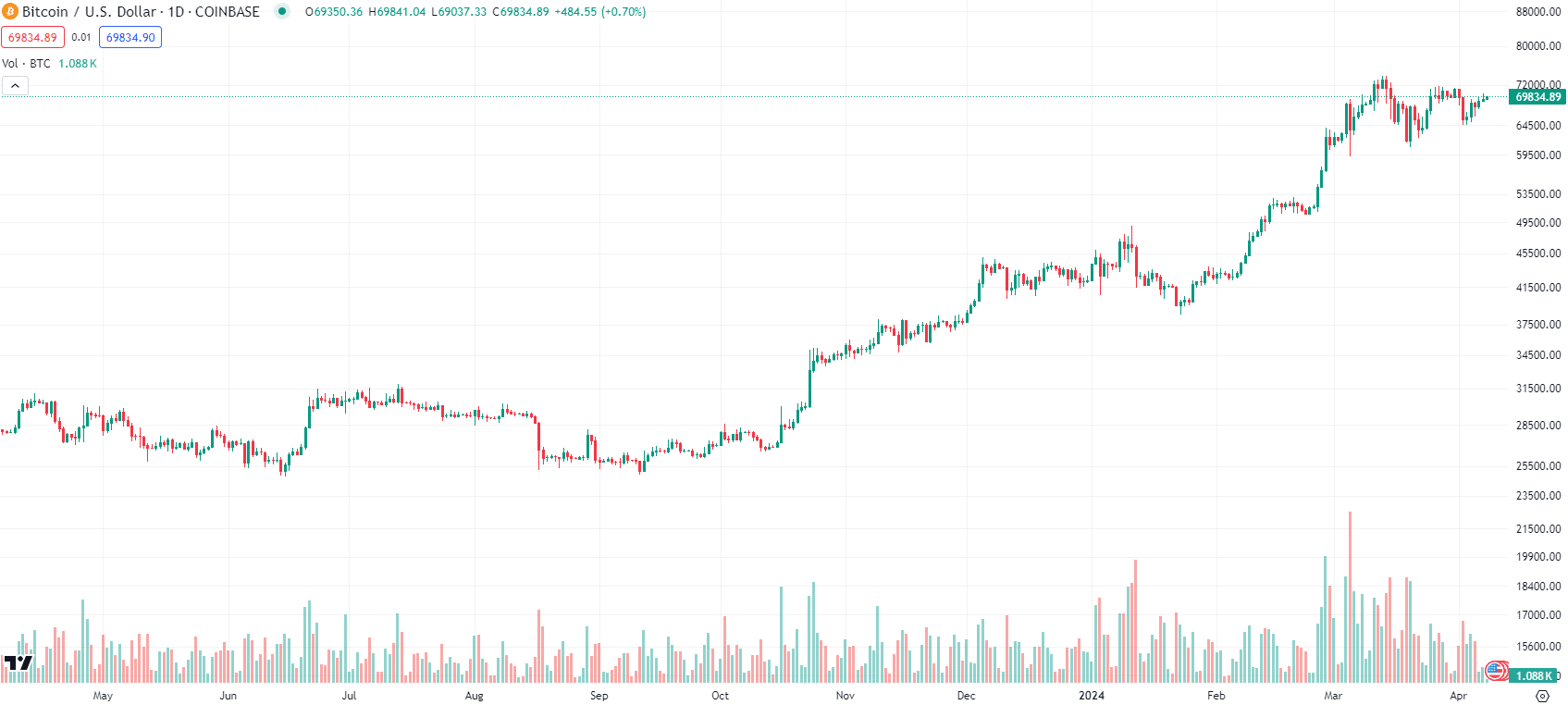

Those who have invested in this cryptocurrency have made spectacular returns over the past several years. Even in the past 12 months, it has more than doubled.

Bitcoin chart, log scale (Source: TradingView)

Why might you invest in bitcoin?

There are several compelling reasons. First, its position as the first and most well-known cryptocurrency has granted it a level of credibility and value recognition in the eyes of many investors. Its limited supply, capped at 21 million coins, creates a scarcity that could drive up its value over time as demand increases.

Secondly, Bitcoin offers a level of financial autonomy and privacy not always available with traditional banking systems, allowing users more control over their own money. Its global acceptance as a means of payment is also expanding, enhancing its utility and potential for long-term growth.

Thirdly, its historical performance has shown significant returns for early adopters. Nonetheless it is essential to remember that past performance is not always indicative of future results, and of course even those early adopters have seen volatility along the way. Investing in all cryptocurrencies comes with its own set of risks, including some not shared with any other asset class

In addition to these reasons, the overall excitement and hype surrounding the cryptocurrency cannot be ignored. This can create a sense of FOMO (fear of missing out) among potential investors, driving up demand and potentially increasing its value.

How to Invest in bitcoin

Investing in Bitcoin and other cryptocurrencies has become increasingly popular as these digital assets have shown substantial growth over recent years. For those looking to invest, several options are available:

1. Cryptocurrency Exchanges:

Platforms like Coinbase, Binance, and Kraken allow users to buy, sell, and hold cryptocurrencies. These exchanges offer various features, including wallet services, making them a convenient option for beginners and experienced traders alike.

2. ATMs

Such ATMs enable users to purchase Bitcoin using fiat currency. However, these machines often charge higher transaction fees compared to online exchanges.

3. Peer-to-Peer (P2P) Platforms

Websites like LocalBitcoins and Paxful connect buyers and sellers directly, allowing for a variety of payment methods. P2P platforms often offer more privacy but also require caution due to the higher risk of fraud.

4. Futures

For those interested in speculation rather than owning Bitcoin outright, futures are contracts that speculate on the future price of Bitcoin. These can be traded on certain financial exchanges.

5. ETFs and Funds

Although the availability varies by region, some financial institutions offer Bitcoin Exchange-Traded Funds (ETFs) or mutual funds. This option allows investors to gain exposure to Bitcoin’s price movements without directly handling the cryptocurrency.

Bitcoin halving? What is going on

The Bitcoin halving event, scheduled for May 2024, represents a significant milestone in the cryptocurrency world. This event occurs approximately every four years and is a process built into Bitcoin’s code to reduce the reward for mining new blocks by half. The halving aims to limit the new supply of the cryptocurrency, thus implementing a form of digital scarcity similar to precious metals. When the 2024 halving occurs, the reward for miners will decrease from the current 6.25 bitcoins per block to 3.125. This mechanism is critical for maintaining itsvalue over time, contributing to its deflationary nature and potentially impacting its market price.

The concept of digital scarcity has been a crucial factor in the rise of Bitcoin’s popularity and value. As more people become aware of the limited supply of Bitcoin, there is a greater demand for it, driving up its price. The halving event further enhances this notion by reducing the new supply even more, making each bitcoin more valuable.

In addition to impacting the market price, the halving event also has significant implications for miners. As the reward for mining decreases, it becomes more difficult and expensive to mine new bitcoins. This can lead to some miners dropping out of the network, resulting in a decrease in the overall hash rate (the computing power used to mine bitcoins). A lower hash rate can potentially slow down transaction processing times and increase fees. On the other hand, a lower hash rate could also make it easier for smaller miners to participate and earn rewards.

Halving may have more implications

The halving event also has implications for Bitcoin’s decentralisation and security. With fewer ‘coins’ being rewarded, there may be less incentive for miners to continue participating in the network and securing the blockchain. This could potentially lead to centralisation of mining power in the hands of a few large mining farms. However, the halving also serves as a built-in mechanism to prevent inflation and maintain the decentralisation which makes it so appealing.

It is important to note that while the halving event has historically had a positive impact on Bitcoin’s price, it does not guarantee an immediate increase. The market is unpredictable and other factors such as demand and adoption rates can also influence any cryptocurrency’s price. Nevertheless, the halving event remains a highly anticipated and closely monitored event in the cryptocurrency world.

How does investing in Bitcoin compare to investing in stocks?

Investing in Bitcoin as opposed stocks represents two fundamentally different approaches to growing wealth. Bitcoin, offers a digital, decentralized alternative to traditional currencies, characterized by high volatility and the potential for substantial returns. On the other hand, stock investments involve purchasing shares in a company, with returns dependent on the company’s performance and the broader economic environment. While stocks have been a proven avenue for long-term wealth accumulation, offering dividends in addition to price appreciation, Bitcoin’s allure lies in its potential for rapid growth. However, this comes with increased risk, as its value is influenced by factors such as regulatory changes, technological advancements, and market sentiment. Ultimately, the choice between investing in any cryptocurrency or stocks depends on an individual’s risk tolerance, investment goals, and belief in the future of digital currencies versus traditional equity markets.

What are the risks of investing in bitcoin in 2024?

Investing in Bitcoin carries several risks that potential investors must consider carefully. Volatility is perhaps the most well-known, with the price capable of dramatic fluctuations in a short period, making it a risky investment for those seeking stability. This volatility is attributed to several key factors. Firstly, the crypto’s limited supply, capped at 21 million coins, makes it highly susceptible to supply and demand dynamics. When demand spikes, prices can soar, but they can just as quickly plummet if investors sell off their holdings.

Secondly, Bitcoin’s relatively new market status means it lacks the established history of more traditional investments, leading to speculative trading based on news, rumors, and investor sentiment, further exacerbating price swings.

Additionally, regulatory news can have a pronounced effect on its value; announcements of stricter control or potential bans in various countries can cause immediate and significant fluctuations. Lastly, the still-evolving infrastructure and the entrance of institutional investors introduce elements of uncertainty and speculation, contributing to its volatility.

Regulation is still evolving

Furthermore, regulatory risk poses a significant concern, as the legal landscape surrounding cryptocurrency is still evolving, leaving Bitcoin susceptible to new laws and regulations that could affect its value. Regulatory risks are a significant concern for cryptocurrencies, as government policies around the world can greatly impact their adoption, value, and legal standing. Countries may enact laws that restrict the use of crypto, impose strict regulations on its trade, or even outright ban its possession and use, leading to fluctuations in its value.

Additionally, concerns over money laundering, tax evasion, and the financing of illegal activities can result in stringent compliance requirements for cryptocurrency exchanges, potentially stifling the market. Furthermore, the lack of a unified global regulatory framework adds to the uncertainty and volatility, as different countries may adopt disparate approaches to cryptocurrency regulation.

Cyber risks

There’s also the risk of theft from hacking as exchanges and digital wallets are prime targets for cybercriminals. Bitcoin, as a decentralised digital currency, leverages blockchain technology to ensure security and immutability. The underlying blockchain is a distributed ledger that records every transaction across a network of computers, making it extremely difficult for hackers to manipulate. While the network itself has remained secure, vulnerabilities can exist in peripheral areas, such as cryptocurrency exchanges and individual wallets.

These external platforms and devices, where users store their private keys, have been targets for hackers, leading to instances of theft. Thus, while the blockchain technology behind Bitcoin offers a high level of security, users must exercise caution and employ robust security measures for their wallets and the platforms they use to trade or store their Bitcoin.

Lastly, market risk cannot be ignored; being a relatively new market, cryptocurrencies can be affected by changes in technology, market demand, and investor sentiment, potentially leading to substantial losses.

Conclusion

As technology evolves and the world becomes increasingly digital, Bitcoin’s influence is likely to continue expanding. Its impact on traditional financial systems and the global economy remains to be seen, but one thing is certain: Bitcoin has already made its mark in history as a ground breaking innovation.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

RBA Interest Rate Decision: What It Means for Your Mortgage (or Savings)

The Reserve Bank of Australia (RBA) is the nation’s leading policy-making body, instilling confidence in its decisions on monetary policy…

Investors are overreacting to the $2.7bn Domain takeover bid: Here is why

The $2.7bn Domain takeover bid stole the headlines today. Shares in Domain (predictably) surged from their $3.13 close the day…

4 NZX stocks that should consider joining the ASX

NZX stocks typically are not on the radar of ASX investors (or any investors outside the Land of the Long…