Liontown Resources (ASX:LTR): From riches to rags, now back to riches again? Here’s what 2026 holds

We’ve all heard the saying ‘rags to riches’ and when Liontown (ASX:LTR) found Kathleen Valley, it was the perfect illustration of what it means. Liontown (now known just as Liontown after dropping the ‘Resources’ part of its name) was just another small cap explorer, hoping to stumble across a major deposit and turning it into a mine – but of course, with little hope.

Unfortunately, you could argue 2023-24 was might be the opposite – riches to rags. It shed roughly two thirds of its market value from over $6bn to <$2bn, had a takeover deal fall through, not to mention a major financing deal that would’ve helped it bring Kathleen Valley into production also falling through. The latter deal was signed on the dotted line, but lenders walked away. Why? Falling lithium prices. But does this mean the long-term story is no longer in tact?

Well, not necessarily, because the company entered production as it had promised and it shipped over 360,000 dry metric tonnes of spodumene concentrate. Now, in early 2026, there is hope that the future envisioned is closer than investors think. Liontown is now capped above $6bn again having more than tripled in 2025.

There is hope that this is a true dawn for lithium prices rather than another false one. And Kathleen Valley is going underground – making it the first lithium mine of its kind in Australia.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Who is Liontown Resources (ASX:LTR)?

Liontown is an ASX resources company responsible for the Kathleen Valley lithium project. The project, which Liontown made the Final Investment Decision on in 2022, is one of the most significant new, long-life lithium projects being constructed anywhere in the world.

Liontown was founded in 2011 and for several years was just another small cap explorer. Initially focused on gold exploration in Western Australia, the company shifted its focus to lithium exploration by 2014, and picked up Kathleen Valley project in 2016. The rest is history.

Great project metrics

As of the end of September 2025, Kathleen Valley has a current Mineral Resource Estimate of 150Mt @ 1.34% lithium and an Ore Reserve of 71.7Mt @ 1.32% lithium. Of this, 106Mt is Indicated and 15Mt is Measured with 26Mt being Inferred and the balance being Stockpiles.

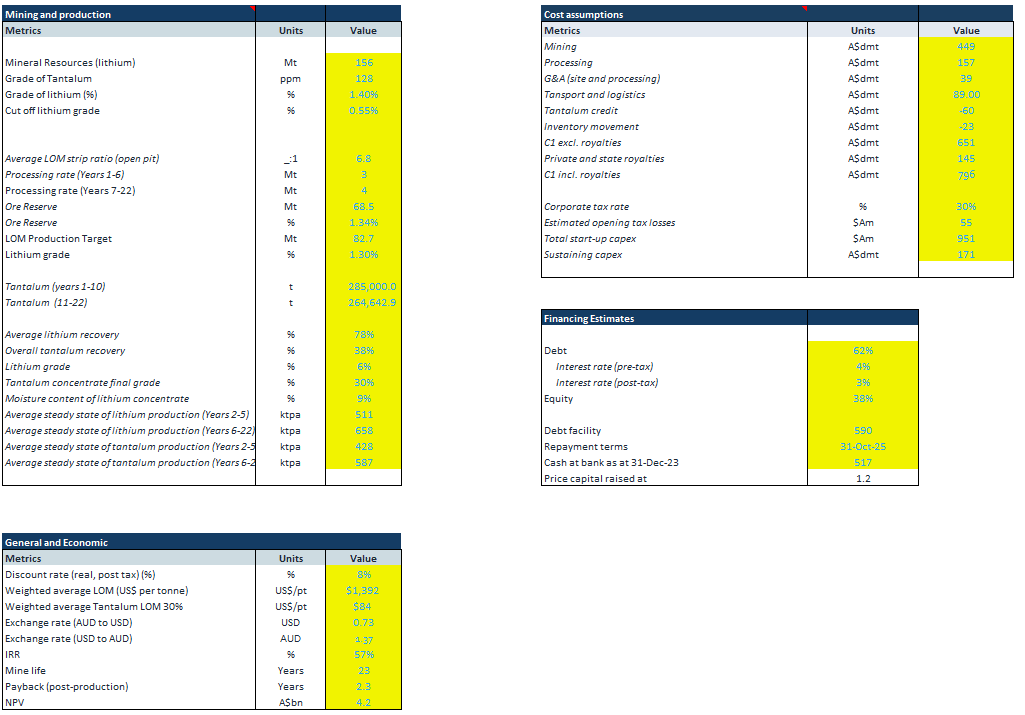

The project’s economics, outlined in the 2021 DFS include an NPV of A$4.2bn and a 57% IRR after tax. There is also a tantalum by product that will generate further revenues, and a strong ESG focus with significant renewable energy use at the project – >60% at the project start up.

Even with the fall from all time highs, the company’s shares have never looked back as it unveiled the deposit, defined the resource and commenced construction on the project, aimed for first production in the second half of 2024 (a goal that was reached on schedule), as well as securing the initial offtake agreements.

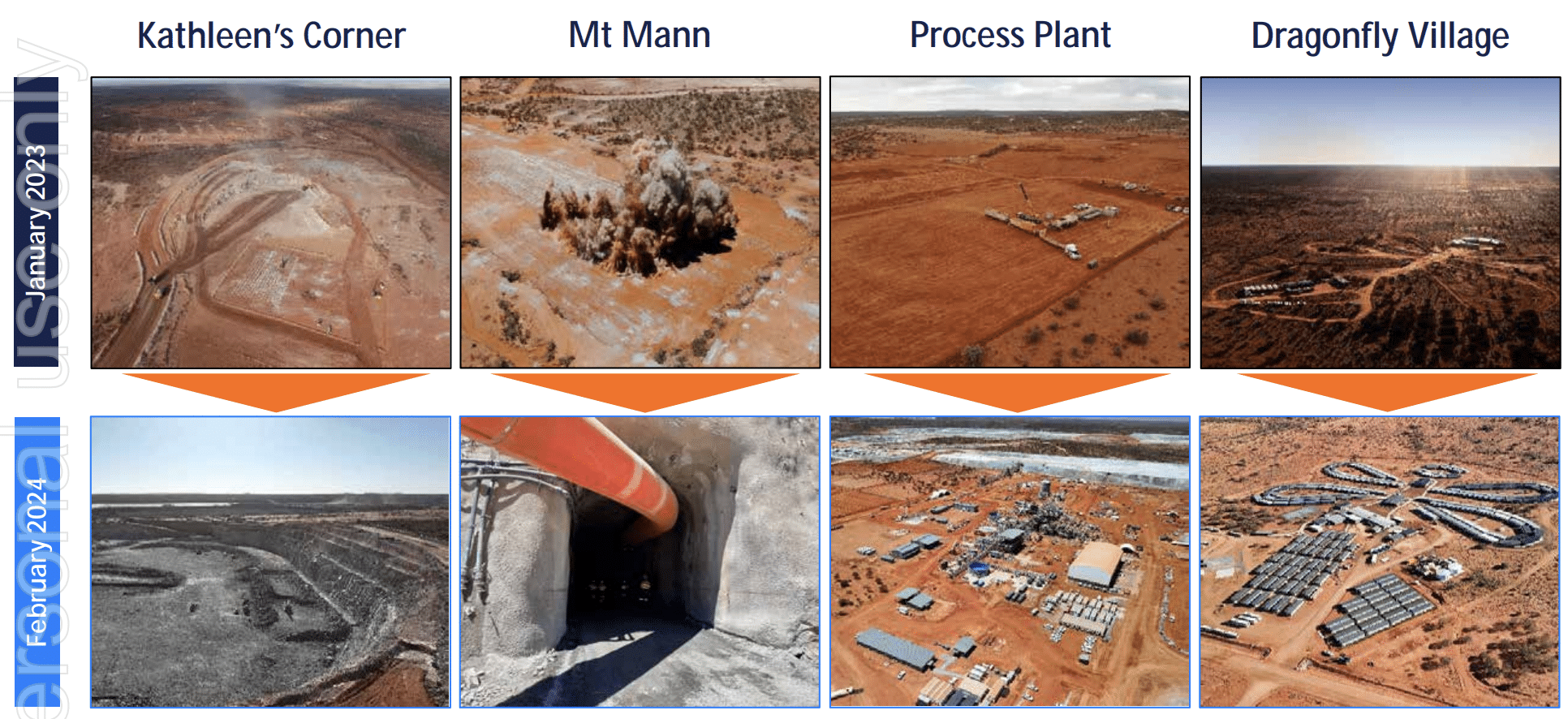

Source: Company

From rags to riches, to rags again?

Obviously, it is all well and good to have a big lithium deposit, but pointless if it cannot be extracted economically and if there are no customers. Liontown has customers including Tesla, Ford, LG and Canmax. The latter of these signed on the bottom line in early December for 150,000 wet metric tonnes in 2027 and 2028. The 2021 DFS had low operating costs of US$314/dmt. And it was ideally located in Western Australia, a jurisdiction with practically zero sovereign risk. All the boxes seemed ticked.

Unfortunately, it has been a poor run for lithium prices. The growth in electric vehicles slowed in 2022/3 and demand for lithium has followed suit. In China for instance, EV sales grew 84% in 2022 but only 25% in 2023. In January 2024, spodumene concentrate was US$955, down 90% from 12 months earlier. Ouch.

All companies developing mines would make contingencies for scenarios where prices fall 20-30% from their base case, but typically not where it falls below their cost curves. And for many lithium (and other battery metal) miners and developers, this is just what has happened.

Another victim of the lithium crash

Liontown is not the only battery metals stock to be impacted by falling prices. Core Lithium halted production at its mine, Albemarle cancelled the proposal to build a 4th processing facility at its own project and Panoramic Resources went into administration, sending the shutters slamming shut on its flagship nickel mine. Liontown has been hit.

As a result of these events, a $6.6bn takeover bid from Albemarle fell through and rumours Gina Rinehart would make a move of her own came to nothing. The rumours were legitimate because she was buying shares in the company but stopped right at 19.9%.

And barely 3 months after signing a commitment letter and credit approved term sheet for a $760m debt financing package, the company was sent back to the drawing board and eventually negotiated a smaller A$550m facility. This syndicate includes CBA, NAB, Societie Generale, Export Finance Australia and the Clean Energy Finance Corporation. HSBC, Westpac and ANZ were originally part of the syndicate but withdrew.

Liontown had also been impacted by rising inflation. A shortage of contractors and input shortages led to the capital costs blowing out. Kathleen Valley had been estimated to cost $240.5m in late 2019. This rose to $325m in 2020, $473m in November 2021 and then $545m in mid-2022. The final ‘upgrade’ was to $895m in January 2023. At the time, investors didn’t care that much because they believed it would pay for itself quickly given lithium prices at the time. Not so much now. CEO Tony Ottaviano openly called for government support in the form of royalty relief.

Production is underway and the first year went well

Notwithstanding all of the above, Liontown commenced production in mid-2024. In the first full year, the company produced 294,521dmt lithium and sold 283,443dmt (across 16 parcels).

The company made $298m revenue and $55m underlying EBITDA. The company made an underlying net loss of A$140m and a statutory loss of $193m due to non-cash impacts including depreciation of the newly commissioned plant, amortisation of open-pit deferred waste and a write-down of ore sorting potential stockpiles. The company claimed to be operational cash flow break even and after closing FY25 with $156m, raised over $300m in early FY26.

FY26 is the year that the Kathleen Valley project goes to underground mining and the company anticipates reaping the rewards from the second half of the year and into FY27. Assuming a targeted 5.2% lithium grade, it anticipates 365-450,000dmt concentrate with ASIC of A$1,060-1,295/dmt sold. It guided to $100-125m capex, of which $45-55m would be sustaining capex and $55-70m growth capital. Ultimately, it aims to produce 4Mtpa once mining has fully moved underground.

In case there are any ESG investors interested (that haven’t written off the entire mining sector), the company claimed to have 81% renewable power penetration, 22% female workforce participation, $22.7m spent with Indigenous businesses and laid the Foundations for its first Modern Slavery Statement.

Q1 of FY26 saw 87,172dmt produced and 77,474dmt sold with those figures up 1% and down 20% respectively. The average realised price was US$700/dmt.

But what about the lithium price?

Liontown cannot say when prices will return to levels seen in 2022 but is confident 2026 will be a better year. The company has launched a platform to run a spot sales auction via Metalshub and this allows buyers to bid for lithium. The first successful bid was US$1,254/dmt, a big premium to the current price.

Still, lithium prices have been on the up since June last year when supply chain issues became apparent. It has also stressed EV sales have always been growing strongly – 2m were sold in September 2025 alone. The market has been reinvigorated by the emergence of BYD and its fast-charging, lower-cost car models.

Of course, energy storage is becoming an increasingly important source of demand too and it could be up to 30% of the total lithium market in a few years. The reason for growing demand is to improve energy reliability as the world transitions to renewable sources.

But the catalyst that has led to Lionrown shares trending up in December 2025 was forecasts from investment banks for rapid lithium price growth in 2026. UBS reckons US$1,800/t and JP Morgan calls for US$2,000/t.

Our view

We’ve done our own modelling on Liontown, the assumptions are below. We used a lithium price of US$1,392/t and got a $3.2bn NPV – nearly half the current price.

Source: Stocks Down Under derived from 2021 DFS and 2023 cost updates

Now, if we increase that to US$1,800/t but keep all else equal, our NPV rises to $6.5bn which is an impressive IRR but not that much of a premium to the current share price. Hike the price to US$2,000/t and our NPV is $8.2bn. But of course, both assumptions are huge premiums to the current price.

Anyone investing into Liontown is obviously assuming lithium prices will rebound because it is already priced in.

Should I buy Liontown shares?

If investors reckon lithium prices will soar in 2026…it is a buy. But keep in mind a hike is already priced in, at least by our modelling.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…