1 year since Redox (ASX:RDX) listed, it has gained nearly 20%. But what’s next for Australia’s largest chemicals importer?

![]() Nick Sundich, July 1, 2024

Nick Sundich, July 1, 2024

It has been nearly a year since chemical importer Redox (ASX:RDX) listed on the ASX. It has raised $402m for a $1.34bn valuation, making it the biggest IPO in 18 months at the time, although it has since been surpassed by Guzman y Gomez (ASX:GYG).

At the time Redox listed, the IPO market was all but dead, at least in respect of non-resources companies, and it was hoped the listing would perform well and the IPO market would revive. Initially, Redox shares underperformed and while they have performed decently since February 2024, not many are talking about this company. But could this be a chance to buy a hidden gem of a company?

Redox (ASX:RDX) share price chart, log scale (Source: TradingView)

Meet Redox

Redox is a chemicals importer based near Campbelltown in South Western Sydney. This company sells chemicals, ingredients and other raw materials to over 6,000 manufacturers. These include food ingredients, pharmaceuticals, flavours, specialty chemicals, fertilisers, pigments, plastic polymers and many more, totalling over 500,000Mt sold per annum.

The company is not a manufacturer, but a distributor, so it is essentially a middle-man, although in the era of supply chain issues, this isn’t the worst space to be in. But it does not just transport and deliver the goods, but also performs any necessary mixing and blending as well as technical support, so it can create value beyond the original manufacturers.

A typical Redox customer makes end products like detergents, shampoo or even food. They lack forecasting abilities and an R&D or storage budget necessary to do much other than manufacture. They need storage, technical help to use products and need just in time delivery. Meanwhile, a typical supplier makes several products which, are used in many disparate industries, has many competitors and is hence unwilling to give credit to buyers. They too experience costs too high (and a logistics capacity too low) to serve customers in their own right.

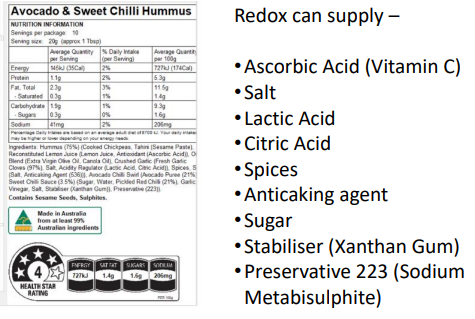

Although costs are a risk, Redox is better able to absorb costs and negotiate good prices with suppliers because it is a market leader. And, as the company shared in a recent presentation, it could supply most of the ingredients in a typical Hummus.

Source: Company

Redox was founded in 1965 by Roland Coneliano and it has stayed in the family to this very day – the family still owns over two thirds of the business. On a CAGR basis, it has grown sales at 11.9% annually over the last 30 years. Redox is the largest company of its kind in Australia with eight warehouses in Australia and operations in New Zealand, the USA, Malaysia and (from 2024 onwards) Canada, although 85% of its revenue came from Australia in FY23.

Redox’s financial performance

At the time of its IPO, the company has told investors to expect $1.33bn in revenue and a $97.4m profit for FY24 which would have been 9% and 20% higher than FY23. It also told investors to expect potential M&A going forward given that the industry is highly fragmented as well as its first dividend in March next year from its 1HY24 profit. The plan was to pay 70% of its profit.

Let’s look at 1HY24. Redox revenue came in at $582m, 8% down from 1HY23, and its profit (excluding the impact of forex movements) was $48m (the company did not provide a comparison for 1HY24). It revised its revenue guidance to $1.18-1.24bn, which would be lower than FY23 – 1.2% on one extreme and 6% on the other. However, its profit guidance was upgraded to $94-102m, which was ahead of prospectus. It held true to its promise of paying a dividend, opting to pay 6c per share (80% of its net profit).

Growth at a Reasonable Price

For FY25, consensus estimates call for $1.37bn in revenue and a $105m profit, up 13% and 7% from the mid-way point of the above guidance. For FY26, $1.53bn in revenue and a $116m profit, both 11% higher than FY25. These place the company at a P/E of 15.5x P/E and a 1.2x PEG multiple, which we think is very reasonable.

The company hopes to grow both in Australia and in North America, but it is the latter that presents a bigger opportunity, with chemicals being an A$191bn market and ingredients a further A$31bn in the US alone, compared to A$28bn and A$8bn in Australia respectively. The company is active in 35 states with 16 sales representatives across 5 cities and 12 warehouses in the lower 48 states (all the states except for Hawaii and Alaska). It can also use these as a springboard into Canada with established customers in 4 major provinces.

Who knew chemical companies did ESG

Chemicals distribution can be a dangerous business with extreme environmental consequences. But Redox boasts a strong ESG profile with a Silver Medal for Custainability from Ecovadis in 2023.

It makes regular donations to the Chemical Educational Foundation (CEF) in the US which provides STEM education to children across America. It also gives employees 1 extra day of leave per year to engage in paid volunteering.

Should I buy Redox?

Some investors might be weary of this company given what happened to peer chemicals company DGL (ASX:DGL) that crashed back to earth after a strong debut. The issues with DGL were that margins were decimated and that the company was only growing through M&A. We believe the polar opposite is the case with Redox, and so we will be watching this one with close interest.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…