Peninsula Energy (ASX:PEN): Our favourite ASX uranium play for 2023!

![]() Nick Sundich, June 19, 2023

Nick Sundich, June 19, 2023

This week we are taking an in-depth look at Peninsula Energy (ASX:PEN). It is one of a handful of uranium stocks that are re-starting mothballed projects after a prolonged period of downward prices. And for reasons we will address in this article, Peninsula Energy might have the most upside of all of them.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

Get a 14-day FREE TRIAL to CONCIERGE now

Peninsula Energy and the Lance Project

The reason Peninsula Energy has the most upside because it is re-starting production in just a manner of months. Its flagship Lance project lies in Wyoming, USA and it is undergoing final construction before production starts again.

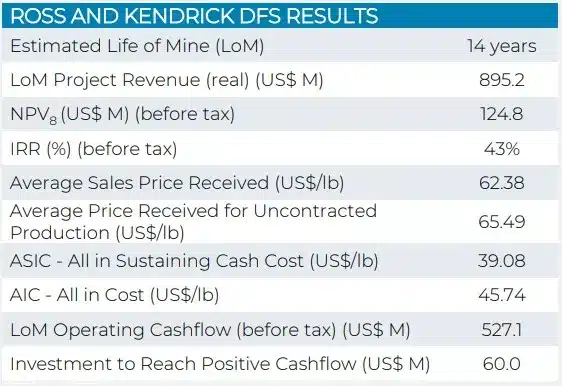

Lance is one of the largest US uranium projects with 53.7Mlb of JORC Resources. The conservative DFS, completed in August 2022, estimated a 14-year mine life generating 14.4Mlb, deriving a 43% pre-tax IRR, US$895.2 project revenue across the life of the project and a US$124.8m pre-tax NPV.

Source: Company

Lance will kick start in 2 stages, Stage 1 will see 800,000/lb produced per annum while Stage 2 will see 2Mlb. The latter will occur within roughly 20 months after Stage 1.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

In case the economics were not compelling enough

What makes the Lance product further compelling are 3 factors.

First, Peninsula Energy will produce with the low-pH ISR method to produce. The method involves recovering minerals from a suitable orebody before dissolving them and pumping the solution to the surface where the minerals can be recovered, thereby generating no tailings or waste rock. This means the project, which is the only US project authorised to use this operation and it will be a low-cost operation.

Second, there is virtually no sovereign risk with this project, given it is in the USA. Investors in uranium shares have been made all too aware of the issue after the Namibian mining minister made to Bloomberg that ‘local ownership must start with the state’ and that there should be a minimum equity percentage that would be free-carried. This made investors worried that their stakes will be diluted – or worse, that companies wouldn’t be able to proceed with production.

There’ll be no such troubles here. This is not just because America’s regulations tolerate mining, but because uranium is needed by the country. After dominating the world’s uranium production in the 1980s, it has been reliant on Russia for is nuclear fuel (which accounts for 52% of its clean energy). Peninsula Energy itself delivers uranium to the country’s strategic uranium reserve.

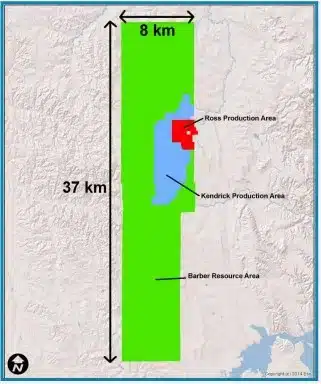

Third, there may be further upside in Peninsula Energy from exploration work conducted at the project. It is important to note that the DFS excluded the bulk of Peninsula’s total land holdings (specifically, all of the Barber Resource Area) and this accounts for over 30Mlb of Inferred Resources. If further exploration work can convert that resource to Indicated and/or Measured, it may be accounted for in the project’s economics and further enhance it.

Lance project area (Source: Company)

Re-starting at the right time

Uranium is a non-renewable resource with low carbon emissions, making it an attractive alternative to traditional fossil fuels. It has a wide range of applications in nuclear power plants and can be used for medical research and other industrial processes. The uranium market has never reached its pre-GFC highs (of over US$140 per pound), being hit by that crisis along with the Fukushima nuclear tragedy.

But as the push for decarbonisation grows, uranium has become increasingly sought after as an effective fuel source with minimal environmental impact. And prices have rallied to levels that will enable several mothballed projects (including Lance) to restart and deposits with potential to grow into operating mines suddenly become appealing to explore at.

Uranium spot price, log scale (Source: Trading Economics)

Peninsula Energy will re-start Lance in the middle of 2023, being in the final stages of construction right now. But it is already selling uranium thanks to stockpiled reserves. It has sold 500,000lbs in the March quarter alone, 60% of which was to the US Department of Energy. The balance 210,000lbs remains in reserves and this could provide a bonus for its customers, be a working capital option or it could potentially be sold.

What is it worth and what are the risks?

Using a DCF using Free Cash Flows projected from the project (and a 10% WAAC), we think Peninsula Energy is worth A$0.42c per share in our base case and A$0.55c in an optimistic case scenario where we assume a 5% premium to the prices the company has assumed in its DFS. Namely, US$65.49 for uncontracted production and US$63.28 for production that is contracted.

The key risks with Peninsula Energy are financing, operational and commodity price risks. The company will need ongoing capital to bring the project back into full swing.

The company is mostly set for Stage 1 with US$24.7m required, but US$265.9m will be needed for Stage 2. Some of this could forseaably be funded with free cash flows from Stage 1, but it will inevitably need to go to market at some point in the next couple of years to bring it online.

The very reason Peninsula Energy mothballed Lance in the first place is because of low uranium prices and another downturn would be a gut punch to the company and its peers. Nonetheless, we think the risk is lower than a decade ago given how important nuclear energy will be to the world’s decarbonisation push.

In summary, investors should watch Peninsula Energy closely in the coming months as there is a lot of upside left in this one. And there won’t be too long to wait before it will be realised!

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

Get a 14-day FREE TRIAL to CONCIERGE now

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…