Ross Stores (NDQ:ROST): US$20bn in revenues from serving America’s depraved working class

![]() Nick Sundich, July 19, 2024

Nick Sundich, July 19, 2024

Ross Stores (NDQ:ROST) is an S&P 500 company that is well and truly for the working class, being America’s largest discount apparel retailer.

Even though the US economy is going strong and inflation is coming under control, this is not necessarily being felt across the country. This has been reflected in the company’s sales (surpassing US$20bn in 2023) and in its share price growth in the last 12 months (over 35%).

Ross Stores (NDQ:ROST) share price chart, log scale (Source: TradingView)

The history of Ross Stores (NDQ:ROST)

The company is headquartered in Dublin, California. From San Francisco, you cross the Bay and you drive through a valley that is half-way between Oakland and Fremont. That broader region is called the ‘Tri-Valley’. How did Ross end up there you might ask? It has always had roots in the San Francisco Bay Area and has shifted its headquarters a number of times. It has been in the ‘Tri-Valley’ area since moving from Newark (not Newark in New Jersey but in California adjacent to Oakland) in 2003, initially to Pleasanton and then to Dublin which neighbours Pleasanton. Of course, as is the case with many US corporations, it is incorporated in Delaware.

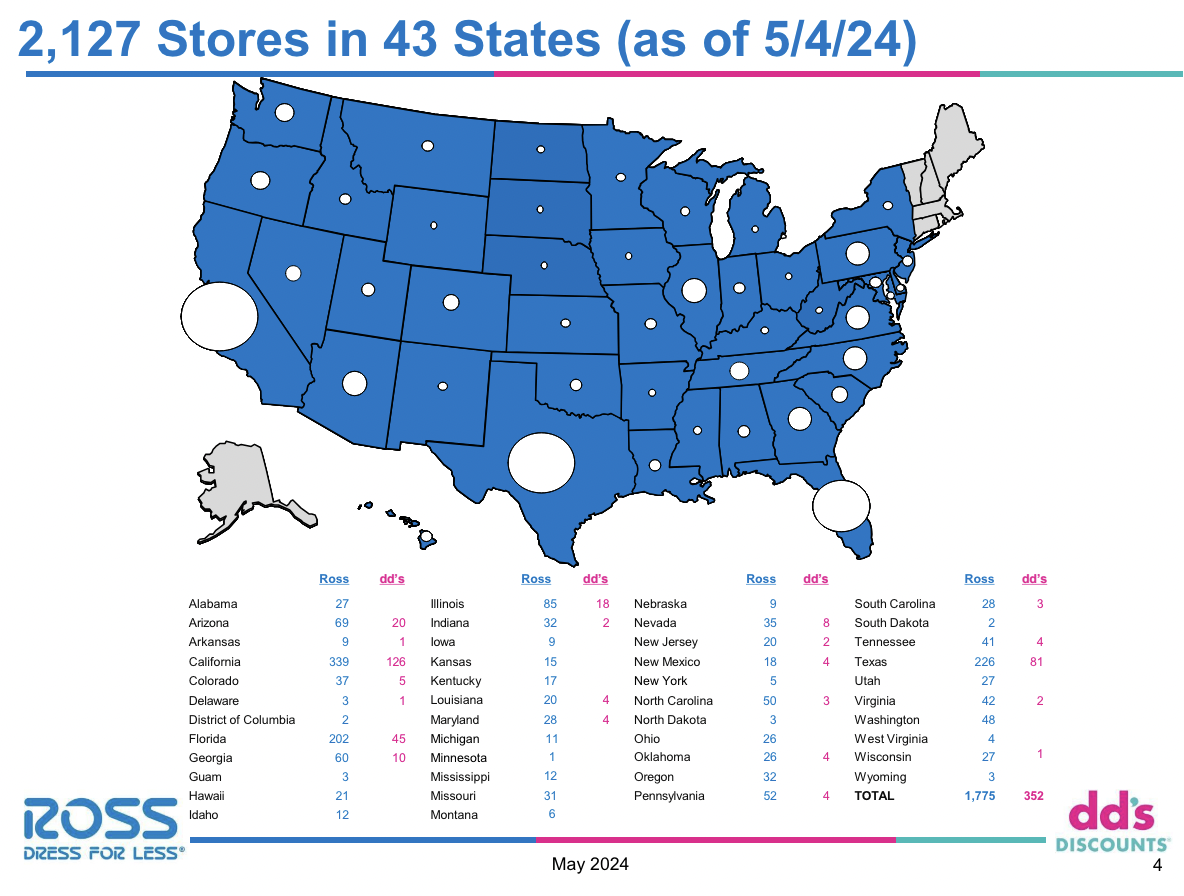

The first store was opened in 1950 by Morris ‘Morrie’ Ross, who the company remains named after. Between 1958 and 1982, the company was owned by William Isackson, and then it was sold to a group of investors led by Mervin Morris, the founder of Mervyn’s. By this point it had 6 stores, but this rapidly expanded – reaching nearly 300 stores by the end of 1995. Today, it has nearly 1,800 stores in its own right and roughly 350 stores operating under the dd DISCOUNTS brand. The two chains share some corporate and support services, but have distinct merchant, store field and distribution operations.

Source: Company

Ross’ Business model

The company aims to provide apparel at 20-60% below department and specialty store prices at Ross and 20-70% at Discounts. Stores receive merchandise 3-6 times a week and they are designed to be a ‘treasure-hunt’-like shopping experience. Brand name labels are left on so that shoppers will identify with particular brand.

Ross Stores has a large network of merchandise and vendors from whom the company buys directly, typically later in the merchandising buying cycle than department or specialty stores. They sell to Ross to sell something they otherwise would not have, and in return Ross does not require the conditions other stores do (such as requiring allowances or shipments to be dropped directly to stores rather than distribution centre).

70% of its customers are females, who shop for themselves and other family members. They tend to visit two to three times a month and while they engage with digital channels to find them, they go in store to shop. This is why Ross has held back on embracing eCommerce to the extent many of its peers have. This hurt the company during the pandemic in a way that many of its competitors (with online shopping options) did not. Nonetheless, eCommerce is far lower margin than in-store, which is why Amazon has tended low single digit margins, while Ross’ operating margin is just above 10%.

Will momentum continue for Ross Stores?

This will all depend on whether or not Ross Stores can maintain its margins and bottom line growth. Consensus estimate suggest it well. For the next fiscal year (FY25, the 12 months to January 31, 2025), analysts call for 4% revenue growth and 8% profit growth. For both FY26 and FY27, 6% revenue growth and 10% profit growth is expected.

Nonetheless, the stock is only trading at a modest discount (7%) to the mean target price which is US$161.49. Our DCF model suggests modest growth too, with US$160.68, using consensus estimates and an 8.73% WACC. It is trading at a 17.5x EV/EBITDA and 25.1x P/E, which is cheaper than its closest peer Burlington which is at 19.1x EV/EBITDA and 32.9x P/E.

One thing to worry about is the company’s succession. Its current CEO Barbara Rentler will stay down on January 31, 2026, by which time she will have been with the company since 1986 and CEO since 2014. The board hopes to have chosen its new CEO by that time. The reason this is an issue is because much of the board have been long-serving as well and it will be interesting to see if the board view generational change as necessary, or puts it in the ‘too-hard’ basket by appointing another board member as CEO.

Ross Stores is a company to buy and hold for the long-term, not necessarily to grow over 12-24 months. We don’t expect the strong growth seen in the share price in the last 12 months to be repeated unless sales grow exceptionally stronger than anticipated.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Apple’s iPhone Production in Focus: Is the Tariff Pause Enough to Ease the Pressure?

Apple, one of the largest and most influential tech companies in the world, is no stranger to the fluctuations of…

Why travel shares are getting slammed…and it is not for the reasons you may think

Just when ASX travel shares were out of the COVID-19 doldrums (in that some surpassed their pre-COVID highs), 2025 looks…

Capital Gains Tax on Stocks: Here’s what you need to know

Investors may be liable to pay Capital Gains Tax on Stocks, but may not know the nuances of how it…