Should you really ‘Sell in May and go away’? Here’s why we think that theory is nonsense

![]() Nick Sundich, April 27, 2023

Nick Sundich, April 27, 2023

Have you ever heard of the saying ‘sell in May and go away’? It is probably better if you haven’t. We think this saying is nonsense.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

Get a 14-day FREE TRIAL to CONCIERGE now

What is the ‘Sell in May’ theory?

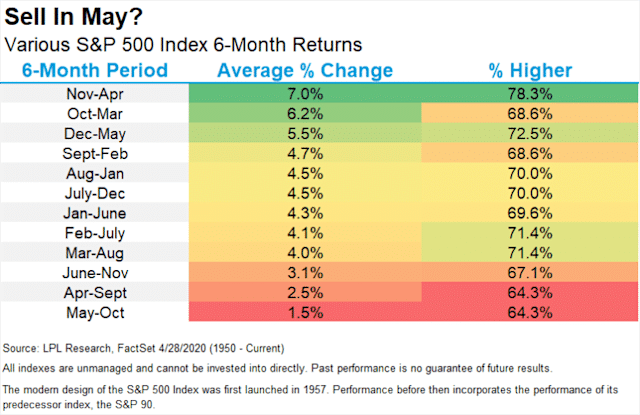

The Sell in May theory is an investment strategy that advises selling stocks in May and buying them back in November (or September, depending on who you listen to). The theory is based on historical data that suggests the market tends to perform poorly during the (Northern Hemisphere) summer months.

Indeed, according to data from the past hundred years, the stock market has performed significantly better during the winter months than during the summer months. So, the ‘Sell in May’ theory says you should sit on the sidelines during the summer.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Really?

Let’s delve more specifically into the data supporting the Sell in May theory.

A study conducted by the Wall Street Journal found that, on average, the Dow Jones Industrial Average tends to perform worse in the six months from May to October than in the six months from November to April. Specifically, the average annual return from May to October has been around 1%, while the average annual return from November to April has been around 7%.

In fact, the Dow has only posted a positive average return during the May-October period about half of the time over the past few decades.

Source: Yahoo Finance

It is important to note that this pattern has not held every individual year – most notably in 2020 when the market crashed in February-March and then recovered from May to October. But this pattern has been present more often than not in recent decades.

Why might traders sell in May?

Traders may sell in May as the Northern Hemisphere enters into the summer months and investors go on holidays. Therefore, even traders who aren’t going on holidays may choose to sell at this time in an effort to protect their investments. Additionally, by selling in May they can reinvest during times when stocks are historically cheaper during the winter months.

So should I believe this theory?

While this theory has some historical backing, it’s worth noting that past performance is not an indicator of future results. As we noted above, 2020 was a notable exemption to the rule. Additionally, the summer holiday theory does not hold in the southern hemisphere and there have been no studies to verify whether or not the ‘Sell in May’ theory holds in the ASX. The original theory was only conducted utilising the S&P 500 anyway.

Finally we note that, this strategy might not be suitable for all investors, as it depends on individual investment goals and risk tolerance. Individual companies may do well when the market is doing poorly and they might do poorly when the market is doing poorly.

Don’t sell in May

To put it simply, you should not ‘sell in May’, at least if you’re an ASX investor. Even though there is some historical data to support this strategy, it may not work for all investors and is not a guarantee of future performance.

Also, you should take the additional trading costs into account, i.e. when you sell and buy the stocks. There’s a good chance those costs will ruin any outperformance you may get from implementing this theory into practice.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

Get a 14-day FREE TRIAL to CONCIERGE now

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…