5 stocks that issued or upgraded their FY24 guidance in recent weeks!

We’re nearly at that time of year when companies upgrade or downgrade their FY24 guidance. It is called ‘confession season’. Why now? Because it is close to the end of the financial year, but also right before one of the most major equities conferences in Australia, run by Macquarie in early May.

A downgrade to guidance are typically received badly by the market, but an upgrade can be received well. We say ‘can be’ because companies do not always get the recognition they deserve when they’re going well. Sometimes, companies do not give guidance at all until later in the year, in which case issuing guidance may still quantify as an upgrade, especially if it is better than the year before.

Without any further ado, we recap a few companies that have upgraded their guidance (either from previous guidance or newly issued) – but you may have missed the good news.

5 stocks that recently upgraded their FY24 guidance

FOS Capital (ASX:FOS)

FOS Capital is a holding company for FOS Lighting, a lighting manufacturer and distributor. There aren’t too many of these listed on the ASX, with the only other being Beacon Lighting (ASX:BLX).

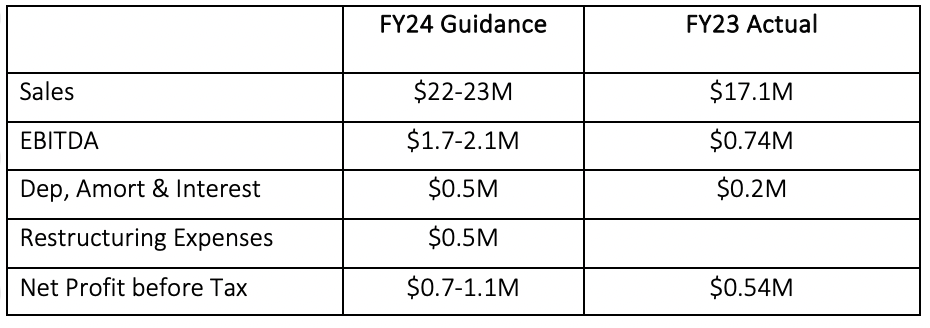

FOS had not issued guidance when it released its FY23 results, but had stronger than expected trading figures, ad was benefiting from an acquisition made a few months into the financial year. And so it issued guidance that was well ahead of last year’s results.

Source: Company

Eureka (ASX:EGH)

Occupying the minds of this seniors accomodation provider has been a takeover bid from fellow ASX-listee Aspen (ASX:APZ) that Eureka has dismissed as undervaluing the company. The company has told investors that it expects underlying EBITDA of $15-15.3m, representing 19-21% growth from last years’ $12.6m. It also advised Earnings Per Share of 3c. This figure is 7.1% higher than the estimate made in Aspen’s bidder’s statement and also implies an EPS for the 2nd half of the year as 8.3% higher than the 1st half.

Boom Logistics (ASX:BOL)

You may have guessed this company as being an industrial company, but you may not have guessed it provides crane and lifting services. The company previously advised investors to expect revenue of over $235m and a profit of over $5.5m. These figures have been upgraded to $240m and $6m respectively. The company told investors this guidance was due to operational efficiencies and recent tender wins.

Tower Insurance (ASX:TWR)

This company uses October 1-September 30 as its financial year, but that did not stop it from upgrading its guidance earlier. Investors had been previously been told to expect a profit of $22-27m, but now can expect a profit of at least $35m. This was due to lower than expected business as usual claims, following the damage of Cyclone Gabrielle that dented its profit in the year before.

Growthpoint (ASX:GOZ)

Growthpoint is a REIT that has a diversified portfolio in the office and industrial spaces. Its previous guidance was FFO of 22.5-23.1cps, but this was upgraded to 23.2-23.6cps. Its distribution guidance of 19.3cps was unchanged. The better than expected result was credited to better than expected office leasing and lease surrender fees.

The office REIT sector has not recovered from the pandemic with uncertainty as to what the ‘new normal’ looks like so far as working in the office or remotely is concerned. Even if you’ll be working in the office some of the time, that still means less office space, and ironically the giving up of leases seems to have contributed to the result here. Growthpoint has 40% of its leases expiring between FY24 and FY26.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…