Dimerix (ASX:DXB): In Phase 3 for FSGS and so far, so very good!

![]() Nick Sundich, April 8, 2024

Nick Sundich, April 8, 2024

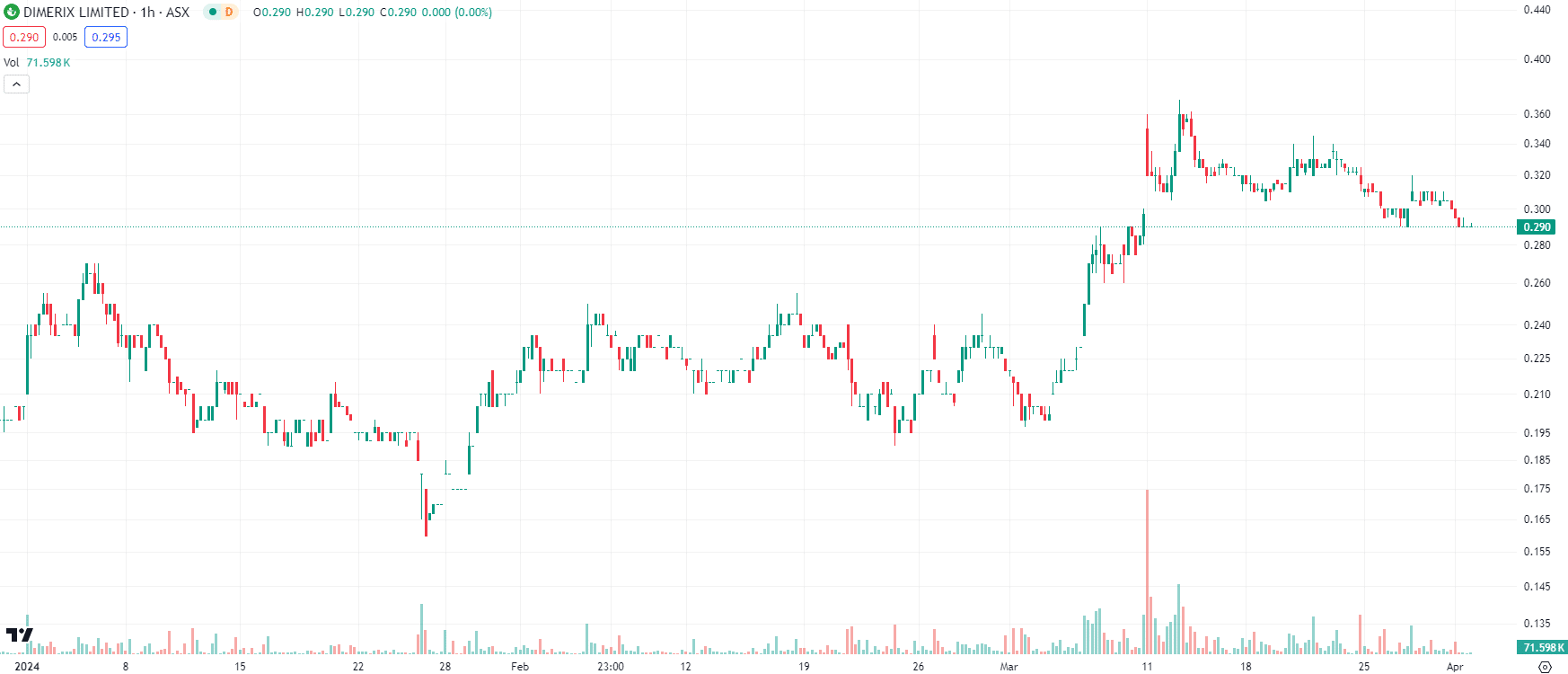

There aren’t many ASX biotech stocks in Phase 3, and even fewer with successful interim data, but Dimerix (ASX:DXB) is one such company. Although it has some way to go in the trial, results released last month were encouraging and bode well for its eventual commercialisation. The company’s shares have re-rated since the results, yet they still trade below the valuation of ASX biotechs in Phase 3 and we believe there’s significant potential for the gap to close in the months ahead.

Dimerix (ASX:DXB) share price chart, log scale (Source: TradingView)

Who is Dimerix (ASX:DXB)?

Dimerix is an ASX biotech that is focused on kidney disease. Its flagship asset DMX-200 is an oral anti-inflammatory drug called repagermanium, administered to patients already taking the current standard of care (the blood pressure medication known as an ARB) for the treatment of kidney disease. It is administered as a single capsule twice daily to patients already on background standard of care treatment.

ARBs, such as irbesartan and losartan, are the current standard of care treatment for kidney diseases generally. Irbesartan itself was formerly a blockbuster drug for Sanofi and Bristol-Myers Squibb, known as Avapro when it was approved by the FDA in 1997 for the treatment of hypertension.

What is FSGS?

DMX-200 is targeting a condition known as Focal Segmental Glomerulosclerosis (FSGS). When you have FSGS, the filters (glomeruli) of your kidneys become inflamed and are damaged by scarring. This makes the filters “leaky” and allows protein from your blood to collect in your urine (proteinuria). For patients with FSGS, the kidneys’ ability to purify (clean) the blood is impaired. This can lead to kidney failure that may eventually requires dialysis or a kidney transplant, and neither are cheap exercises, nor do they deliver that strong prognosis for patients. Indeed, more than half of people who get FSGS and then a kidney transplant will get re-occuring FSGS. There are no drugs specifically approved for FSGS anywhere in the world. Any drugs that are used target symptoms rather than the disease itself.

To date, DMX-200 has illustrated solid results for FSGS, passing a Phase 2a trial in 2020. The company entered a Phase 3 study that, if successful, could lead to approval in the US, the EU and potentially China. Last month, the company unveiled the first interim analysis based on the proteinuria efficacy endpoint of the study.

Good initial news from the Phase 3 trial

The trial is being conducted on 72 random patients and indicated that DMX-200 is performing better than placebo in terms of reducing proteinuria (elevated protein in the kidney) in a much larger cohort than the prior Phase 2 study (comprising of eight patients). An interim analysis comprising a futility assessment was conducted to gauge whether the trial has efficacy and whether it will meet its objective if completed – and the answers were affirmative. The successful interim analysis outcome is a key milestone for the company and suggests that DMX-200 may result in improvement in kidney function when included to the standard of care in patients with FSGS.

Post notifying the company of the interim analysis results, the trial’s Independent Data Monitoring Committee (IDMC) also stated that it had no safety concerns related to DMX-200. IDMC also recommended that the ACTION3 clinical trial to continue as planned. This, in turn, further validates the strong safety profile of DMX-200.

Moving into part 2 of the trial

The ongoing Phase 3 trial is currently being conducted at over 70 clinical sites in 11 countries including Australia, New Zealand, Taiwan, Hong Kong, France, Denmark, the UK, Spain, Argentina, Brazil, and the US. New clinical sites have also been planned at China, Malaysia, Italy, Germany, Portugal, and Mexico to further enhance the recruitment process.

The positive results from the Phase 3 Part 1 trial have paved the way to move ahead with Part 2 of the study. The Part 2 will have approximately 144 patients enrolled for 35 weeks’ treatment and will include children up to 12 years old as well as adults.

Next results expected by mid-2025

The outcome of the second interim analysis is expected by mid-CY25 and will be very crucial as it is designed to capture evidence of proteinuria and kidney function (eGFR slope), which is expected to generate sufficient evidence to support conditional marketing approval. In our view, this will significantly boost the company’s growth prospects, as Dimerix will gain early market access in select geographies.

This may seem like a while away, but there could be other milestones before then. In particular, we see the execution of further licensing deals (including for the US and China) as possible milestones.

Commercialisation deal is already in place

Dimerix already has a partnership with Advanz Pharma, giving Advanz rights to commercialise DMX-200 in the European Economic Area, the UK, Switzerland, Canada, Australia and New Zealand as well as a right of first offer to commercialise DMZ-200 for other indications in any of these territories. The territories with exclusive rights are likely to deliver to A$230m in upfront and milestone payments plus royalties. The deal with Advanz was a major catalyst last year, and we believe further deals could have a similar impact.

The company has recently raised A$20m at $0.30 per share. This should provide sufficient funds to take Dimerix through the second interim analysis and the completion of the ACTION3 Phase 3 Clinical trial, including eligible R&D rebates.

Valuing Dimerix

Our parent company, Pitt Street Research, has published 2 reports on Dimerix this year, the most recent of which was at the end of March. Based on a DCF approach, assuming successful commercialisation with Advanz, the most recent report deriving equity value is $346.7m in a base case and $456.8m in a bull (or optimistic) case. This equates to $0.64 per share in the base case and $0.84 in the bull case, based on the current number of shares on issue.

Check out the full Research Reports on Dimerix by Pitt Street Research HERE!

Dimerix is one of a kind

There are few ASX biotechs in Phase 3, but Dimerix is one of them. Nonetheless, it is valued below comparable Phase 3 companies like Opthea (ASX:OPT), even those without interim data. If the company continues on the right path, there’s little reason why the gap should not close in the months ahead.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…