Baby Bunting (ASX:BBN): FY25 was a better and investors finally gave it recognition, but did they get ahead of themselves?

After being the poster child for what’s happening retailers in a cost of living crisis, Baby Bunting (ASX:BBN) appears to be in better shape.

This company is Australia’s largest specialty nursery retailer and one-stop-baby shop, having grown from one family-run shop which was opened in Melbourne in 1979. Remaining headquartered in Victoria to this day (with its national distribution in the outer Melbourne suburb of Dandenong), it boasts over 6,000 product lines and well as having parenting rooms in store as a point of difference.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Baby Bunting struggled through the cost of living crisis

At first glance, Baby Bunting shouldn’t have suffered at all, because people don’t stop having babies…right? Yes, but consumers do have alternatives such as Coles, Woolworths, K-Mart, Big W, Target and (of course) Amazon, just to name a few. The same prams, car safety seats and nappies, but at a lower price. Adding insult to injury, cost inflation hit the company substantially, slashing margins.

Shares shed 80% of their value from April 2021 to June 2023 and CEO Matt Spencer stood aside after more than a decade in charge. And it has been a subdued period since then. But is a better period ahead.

Baby Bunting hired former Afterpay executive Mark Teperson as its CEO. Its sales for FY24 were only down 3.4% and just fell short of $500m. The company’s profit fell from $9.9m to $1.7 on a statutory basis and from $14.5m to $3.7m on a pro forma (i.e. underlying) basis.

However, the company tried to sell investors the message that things were turning around. It pointed to initiatives such as the renegotiation of terms with suppliers and ‘simplification of elements of our pricing structure’. And the company boasted that it had 800,000 active customers, a renewed $70m debt facility with NAB and encouraging trading to start FY25. Specifically, total sales grew 3.5%, although this was only 2% on a like for like basis. Investors were told to expect a 40% gross profit margin (which had been achieved in early trading) and for a $9.5-12.5m NPAT.

Assumptions underpinning these were comparable store sales growth of 0-3%, a 40% gross profit margin, wage inflation of 3.7% and remaining costs of doing business remaining within company forecasts and $10-13m of capital expenditure. It assumed ‘no significant changes in economic and retail trading conditions, and no significant increase in sea freight expense’.

FY25 was better

In the end, Baby Bunting was correct in its expectations. In 1H25, the company delivered 2.4% revenue growth and profit growth of 45% on a statutory basis and 37% on an underlying basis. It opted not to pay a dividend but reiterated its full-year guidance of a $9.5-12.5m profit.

The most recent update came on May 1 when the company reported 2H25 sales were up 3.7% and year to date stores were up 2.9%. It updated its profit guidance to $10-12.5m, although a significant proportion of sales would be attributable to the final 6 weeks.

BBN’s final results were $521.9m revenue, up 4.7%, and a $12.1m profit which was within guidance and 228% up. Its gross profit margin exceeded its 40% target and claimed that its refurbishment program delivered 28% sales uplift. Active customers were up 4.5% to 828,000. And its net debt position improved from $13m to $4.6m.

Good things expected in FY26

For FY26 it guided to:

- 4-6% comparable store sales growth, albeit with only 1.5-3% growth in the first half and 6-8% in the 2nd half due to refurbishment closures in some stores

- A $17-20m profit,

- A 41% gross margin,

- $30-35m capex fully funded by operating cash flow.

This all assumed no significant changes in economic & retail trading conditions, and no significant increases in shipping expenses. Investors sent the stock up 40% in a day and over 70% in the next month.

At its AGM in October, Baby Bunting reiterated its guidance and advised that it achieved 3.5% total sales growth and 2.2% comparable store sales growth (a figure that is 5.6% excluding the 6 stores closed for refurbishment). Its total store network was 77 stores and its refurbishment program ‘Store of the Future’ would see 11-12 during FY26, 3 of which would be re-opening during October 2025.

The long-term growth opportunity

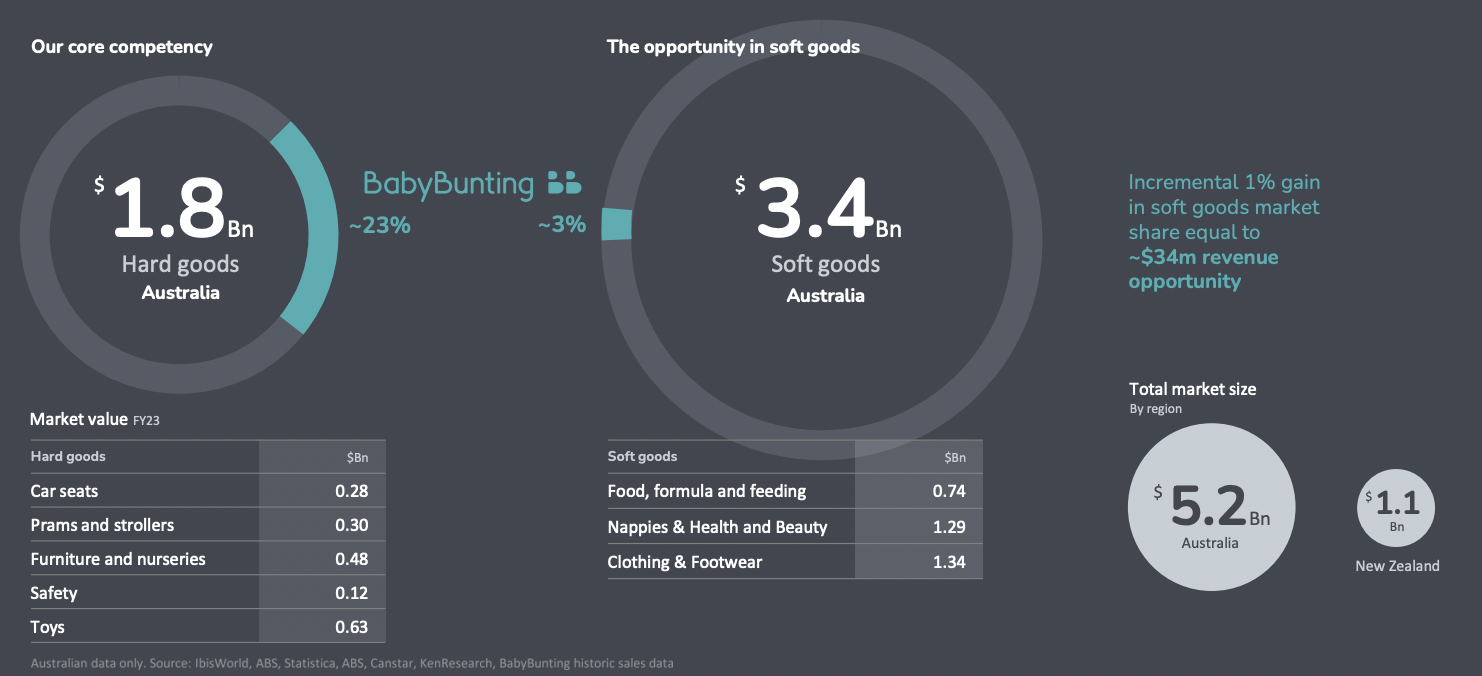

Many investors may not recognise that Baby Bunting never had that large a market share to begin with. It only boasts a 23% share in so-called ‘hard goods’ and a mere 3% in so-called ‘soft goods’, as outlined below.

Source: Company

It hopes that its refurbishment program can help growth, noting that its refurbished stores almost always showed an increase in new customers, transaction sizes and gross profit.

There’s no doubt that if Baby Bunting can increase its market share, shares could continue to re-rate. There is a Catch 22. It cannot grow its market share without investing in its stores and in marketing, and it can only invest so much while still increasing margins, and if it does not increase its margins, investors will turn on the stock, just as they did during the cost of living crisis.

Conclusion

Analysts covering Baby Bunting call for $571.2m in revenue and a $17.5m profit in FY26, followed by $622.6m in revenue and an $22.9m profit in FY27. These estimates put the company at 23x P/E and just 0.6x PEG for FY26. Nonetheless, the mean share price is $2.96, ja slight discount. Estimates range from $3.60 to $2.50, showing a divergence of opinion, but still a scepticism that it can reach 2021 highs once more.

Overall, we would be reluctant to answer the question as to whether or not Baby Bunting is a buy for the time being, purely based on technical movement, even if the multiples look reasonable and the guidance looks like it is on track. If we had to give a clear cut answer, probably yes, but the biggest risk is the company missing its guidance.

But we be more confident in this company in 4-6 months time, if we can see good 1H26 results. Yes, we know it is growing again and it it will be investing to grow…but so will the Great White Shark from Seattle.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…