3 best performing ASX shares in the week of 11 April 2022

![]() Marc Kennis, April 19, 2022

Marc Kennis, April 19, 2022

Best performing ASX shares

The three best performing ASX shares in the week of 11 April 2022 were CZR Resources (ASX:CZR), up 100%, 4DS Memory (ASX:4DS), up 38.2%, and Oncosil Medical (ASX:OSL), up 37.2%.

GET A 30-DAY FREE TRIAL TO STOCKS DOWN UNDER

1. CZR Resources (ASX:CZR)

Industry: Resources

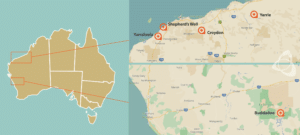

CZR Resources (ASX:CZR, formerly Coziron Resources Limited) is a mining company exploring for iron-ore and manganese deposits. The company has exploration focussed on the Yarraloola, Shepherd Well, Croydon Top-Camp and Yarrie Projects in the Pilbara region and Buddadoo Project in the Yilgarn region of Western Australia.

Market Cap: $56m

12 month high / low: $0.0065 – $0.018

2. 4DS Memory (ASX:4DS)

Industry: Technology

4DS Memory Limited (ASX:4DS) is s a semiconductor development company of non-volatile memory technology which is involved in research and development of interface Switching ReRAM technology for next generation storage in mobile and cloud. 4DS has facilities located in Silicon Valley.

Market Cap: $150M

12 month high / low: $0.0455 – $0.245

3. Oncosil Medical (ASX:OSL)

Industry: Healthcare

Oncosil Medical (ASX:OSL) is an Australian based and ASX listed medical device company focused on localised treatments for patients with pancreatic and liver cancer. OncoSil’s lead product, OncoSil is a first in class medical device with targeted radioactive isotope (Phosphorous-32), implanted directly into a patient’s pancreatic tumors via an endoscopi ultrasound.

Market Cap: $47m

12 month high / low: $0.033 – $0.105

Learn more about ASX-listed stocks with

Stocks Down Under!

Subscribe to Stocks Down Under today!

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…