3 Best Performing ASX shares in week 5, 31 January 2022

![]() Marc Kennis, February 7, 2022

Marc Kennis, February 7, 2022

Best performing ASX shares

This week it’s all about resources. FAR Ltd (ASX:FAR) went up 78.1%, while Renascor Resources (ASX:RNU) jumped 47.6%. Lastly Rumble Resources (ASX:RTR) rose 46.7% and rounds out the top 3 best performing ASX shares last week.

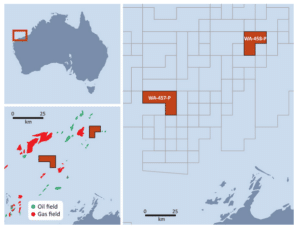

1. FAR Ltd (ASX:FAR)

Industry: Energy

FAR Ltd (ASX:FAR) is exploring for and developing oil and gas deposits. Its conducting activities are focused on identifing and evaluating new exploration projects, while the company is also working on the monetisation of oil exploration and its production interests.

Market Cap: $65M

12 month high / low: $0.64 – $1.53

2. Renascor Resources (ASX:RNU)

Industry: Basic Materials

Renascor Resources (ASX:RNU) is an Australian-based company focused on the development of economically viable minerals. Renascor has a tenement portfolio and holds interests in key mineral provinces of South Australia. The principal activity of the group during the financial year was mineral exploration, development and evaluation.

Market Cap: $587M

12 month high / low: $0.033 – $0.31

3. Rumble Resources (ASX:RTR)

Industry: Basic Materials

Rumble Resources (ASX:RTR) is an Australian-based mineral exploration company with a clear strategy of organic growth via the generation of a pipeline of quality high grade base and precious metal projects, critical review against stringent criteria, provide optionality to complete low cost systematic exploration to drill test for high grade discoveries on multiple projects.

Market Cap: $341m

12 month high / low: $0.091 – $0.80

Learn more about ASX-listed stocks with

Stocks Down Under!

Subscribe to Stocks Down Under today!

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…