Helloworld’s FY23 trading update shows it’s recovering to pre-COVID levels

![]() Nick Sundich, November 30, 2022

Nick Sundich, November 30, 2022

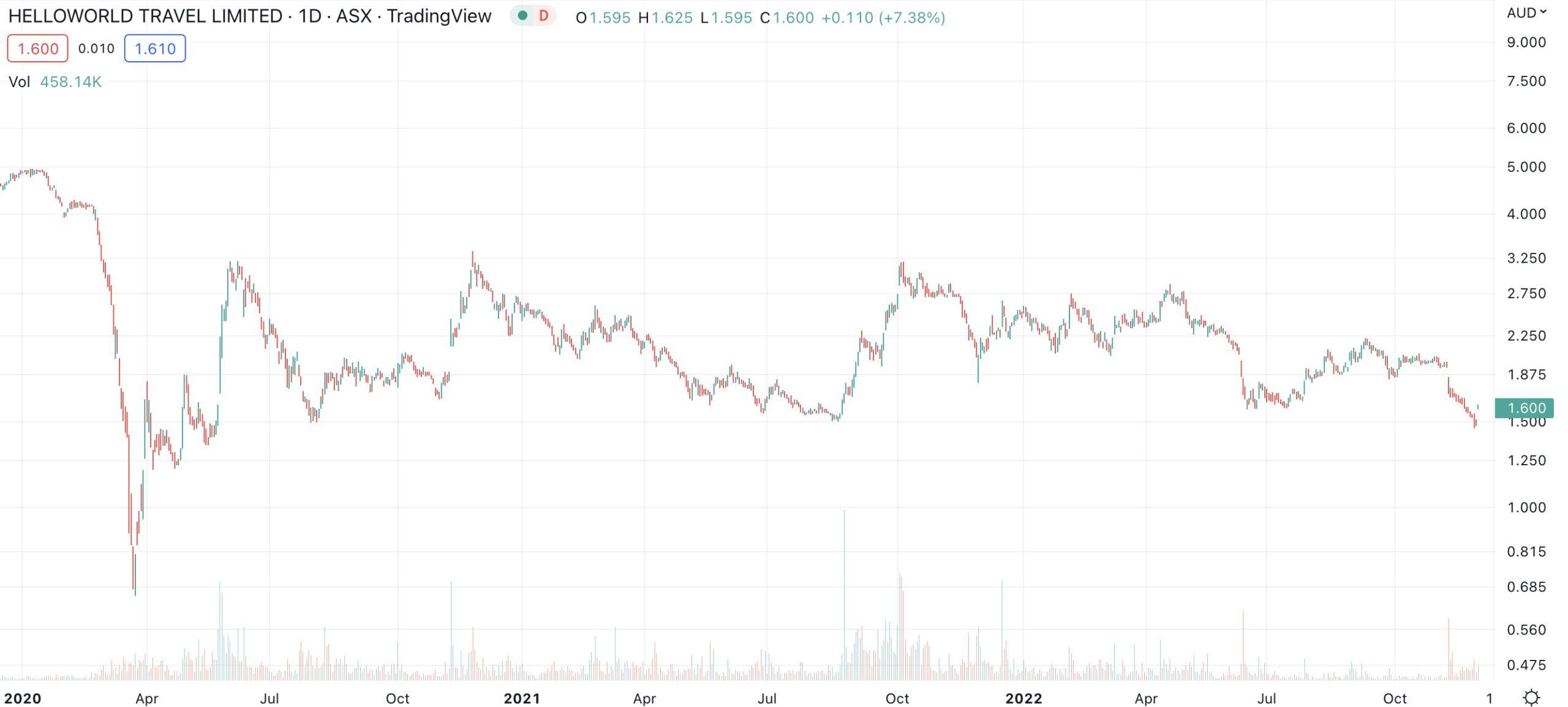

It has been mostly good news for travel stocks of late, but you wouldn’t know it judging by the share price of Helloworld (ASX:HLO). It has lost nearly half of its value since early May and it has attempted to arrest the slide with a trading update this morning.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Helloworld has suffered several blows

People have been returning to travel in CY22 so you might suspect it would all be good news for Helloworld. But, the company is just one of many companies in a highly competitive industry.

Helloworld arguably kicked an own goal in selling its corporate and entertainment travel business in Australia and New Zealand to Corporate Travel Management (ASX:CTD) in April for $175m. It also saw Qantas (ASX:QAN), slash commissions payable to it and cash out as a shareholder.

Helloworld’s financials paint a better picture

Helloworld has declined despite returning to profitability and paying a dividend again faster than its larger peers. In FY22 it made a statutory profit of $90m and paid a 10c a share dividend – a yield of 4.8% at the late August share price.

Although it suffered an EBITDA loss of $10.6m, this was down from $24.5m the previous year and it guided to a $22-$26m EBITDA profit for the current year.

FY23 looking better, but will it get rewarded?

This morning, it gave a trading update recording $8.5m in EBITDA for the year-to-date and $41.6m in revenue (up 180%). It reiterated its guidance for FY23 and also hired former Victorian politician Martin Pakula to its board.

This morning’s update sent its share price up 7% to $1.60.

Helloworld (ASX:HLO) share price chart (Graph: TradingView)

However, with Helloworld you’re not going to get the same high-margin exposure to the travel recovery as with other travel stocks, because Helloworld is a smaller player, has less exposure to the high-margin corporate sector and arguably didn’t exploit the pandemic to reduce its brick and mortar footprint as much as peers did. So, we prefer other names in this space.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…