Helloworld’s FY23 trading update shows it’s recovering to pre-COVID levels

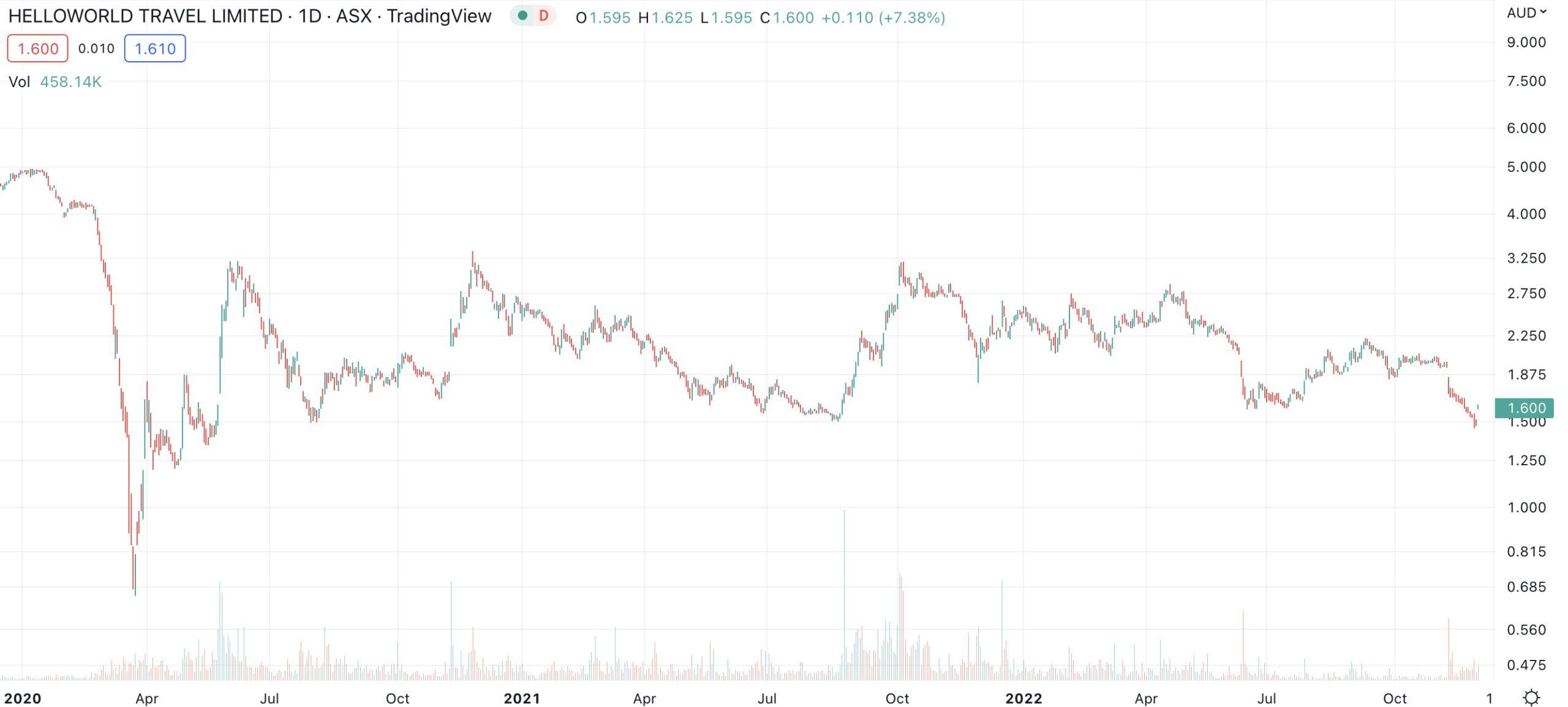

It has been mostly good news for travel stocks of late, but you wouldn’t know it judging by the share price of Helloworld (ASX:HLO). It has lost nearly half of its value since early May and it has attempted to arrest the slide with a trading update this morning.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Helloworld has suffered several blows

People have been returning to travel in CY22 so you might suspect it would all be good news for Helloworld. But, the company is just one of many companies in a highly competitive industry.

Helloworld arguably kicked an own goal in selling its corporate and entertainment travel business in Australia and New Zealand to Corporate Travel Management (ASX:CTD) in April for $175m. It also saw Qantas (ASX:QAN), slash commissions payable to it and cash out as a shareholder.

Helloworld’s financials paint a better picture

Helloworld has declined despite returning to profitability and paying a dividend again faster than its larger peers. In FY22 it made a statutory profit of $90m and paid a 10c a share dividend – a yield of 4.8% at the late August share price.

Although it suffered an EBITDA loss of $10.6m, this was down from $24.5m the previous year and it guided to a $22-$26m EBITDA profit for the current year.

FY23 looking better, but will it get rewarded?

This morning, it gave a trading update recording $8.5m in EBITDA for the year-to-date and $41.6m in revenue (up 180%). It reiterated its guidance for FY23 and also hired former Victorian politician Martin Pakula to its board.

This morning’s update sent its share price up 7% to $1.60.

Helloworld (ASX:HLO) share price chart (Graph: TradingView)

However, with Helloworld you’re not going to get the same high-margin exposure to the travel recovery as with other travel stocks, because Helloworld is a smaller player, has less exposure to the high-margin corporate sector and arguably didn’t exploit the pandemic to reduce its brick and mortar footprint as much as peers did. So, we prefer other names in this space.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Stockland (ASX:SGP): Working on a $30.7bn portfolio of communities

Stockland is one of the largest ASX property stocks as well as one of the longest listed (having joined the…

Here’s how to choose shares for your superannuation fund, and whether or not an SMSF make sense

This article outlines how to choose shares for your superannuation fund. We will fall short of outlining which specific shares…

5 Beaten-Down ASX Stocks That Could Bounce Back with a Vengeance in February 2026!

ASX Stocks That Could Bounce in February The start of 2026 has been brutal for several quality ASX names. While…