IOUpay (ASX: IOU) gained over 15% this morning after unlocking a key market

![]() Nick Sundich, July 13, 2022

Nick Sundich, July 13, 2022

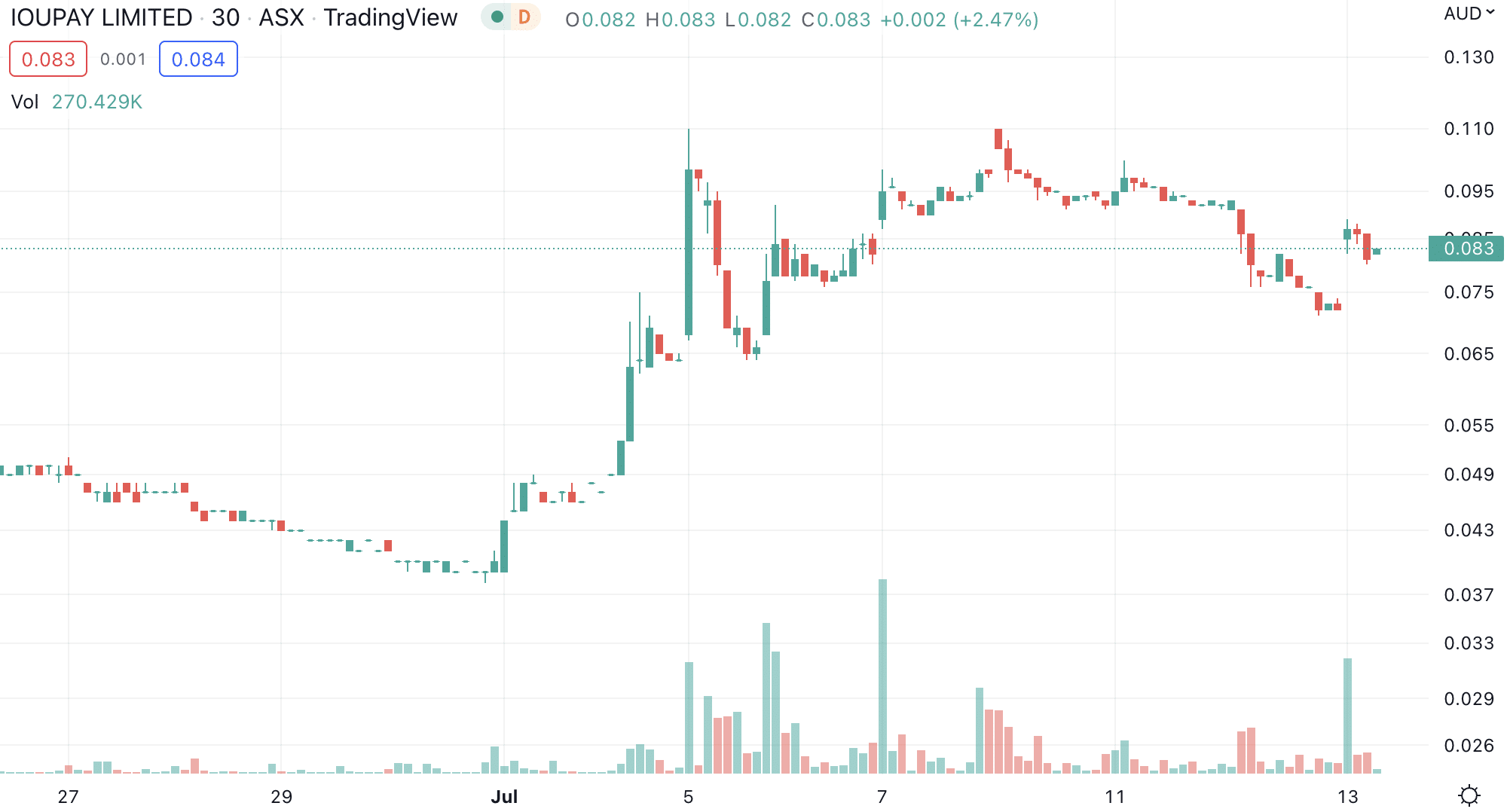

IOUpay (ASX: IOU) has been lifting itself out of the ASX cellar in recent weeks and the climb continued this morning. The Buy Now Pay Later (BNPL) and fintech sectors are under siege and IOUpay has not been immune, even though it targets Asia-Pacific markets where BNPL and fintech are still largely underpenetrated. The company’s climb in recent weeks has largely occurred without news, but not this morning.

IOUpay (ASX:IOU) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

IOUpay offering Islamic BNPL

One of IOU’s key markets is Malaysia, where the majority of the population (over 60%) are Muslims. The Islamic faith restricts the charging of interests, something that might make you think BNPL would be appealing to Muslims.

Well, this morning IOU’s offering received a ringing endorsement – specifically Shariah Compliance Certification from Shariah advisory firm Tawafuq Consultancy. The company also signed a Merchant Acquiring Services Agreement with PayHalal, a Shariah-compliant payment gateway and provider of Islamic digital financial services.

IOUpay told shareholders this deal positioned it to develop opportunities with Islamic banks and non-bank financial institutions and for expansion into other Muslim-majority populations.

Are IOUpay and other BNPL providers back from the dead?

With this news, and the rally of Zip (ASX:ZIP) after it tore up the merger deal with Sezzle (ASX: SZL), you might argue BNPL is on its way back with a vengeance.

Although IOUpay and Zip have received good news this week, we would remind investors that many of these companies still are some way from profitability with share prices well below all-time highs. IOU for example is down 86% since its February 2021 peak of 62 cents.

It’s positive that these companies have recognised that they need to become profitable, but it remains to be seen if they can do that before investors completely run out of patience.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…