Mad Paws (ASX:MPA) looks like it is immune to inflation, so why are investors still deaf to its story?

Nick Sundich, June 27, 2023

What’s not to like about Mad Paws (ASX:MPA)? It is one of the few ASX stocks with exposure to the pet market and is seemingly immune to inflation – at least, if today’s trading update is anything to go by.

So, why is it down over 50% since its IPO and hardly budged today?

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Mad Paws releases a solid trading update

As FY23 draws to a close, Mad Paws released a trading update. It is expecting $24.5-$24.5m which would be up 146% on a reported basis and up 60% on a pro forma basis.

Whilst so many other consumer facing stocks are reporting downgrades left right and centre as consumers cut back their spending, Mad Paws is going in the opposite direction.

So why are investors seemingly tone deaf to this company? It is down over 50% since its IPO.

Mad Paws (ASX:MPA) share price chart, log scale (Source: TradingView)

Top line good, but the bottom line…not so much

Without giving specific details, Mad Paws boasted that it had seen continued improvement in EBITDA margins and was on track for EBITDA positivity in Q1 of FY24.

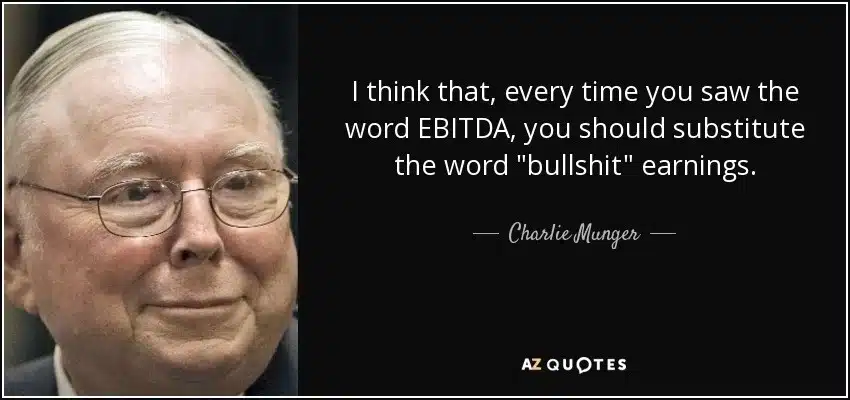

Investors seemingly are in the mindset of Charlie Munger.

Not a word was said about (proper) profitability.

Still, Mad Paws told shareholders there was a lot to look forward to. In particular, it boasted about plans to expand its Pet Chemist range and a new website. When (or indeed if) it will make any difference to the bottom line is anyone’s guess.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…