NAB shareholders enjoy a 4.7% dividend yield as earnings and profits jump 8%

NAB shareholders will end FY22 (the 12 months to 30 September) with a $1.51 per share dividend, thanks to a solid financial performance by the Big Four Bank. After coming out of the Hayne Royal Commission worse than any of the Big Four Banks, things have turned around for the bank, which has captured a significant share of the credit binge amidst the pandemic.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

NAB’s profit and earnings grow by 8%

NAB’s statutory net profit was $6.89bn and its cash earnings were $7.10bn, both up 8.3% on FY21. Revenues grew by 8.9%, its loan book rose 9.3% and deposits rose by 11.3%.

Record low interest rates during the pandemic led to an uptick in lending. All the banks saw this but NAB was able to capture a significant share due to its superior technology & higher reputation for customer service. It made $104bn in new loans, lent $122bn to businesses and finished FY22 with a break-even Net Promoter Score (NPS) – the highest of any Big Bank.

NAB shareholders should be pleased

NAB shareholders enjoyed a $1.51 per share dividend, a yield of 4.7% at the current share price and 18.9% higher than last year’s $1.27 per share payout.

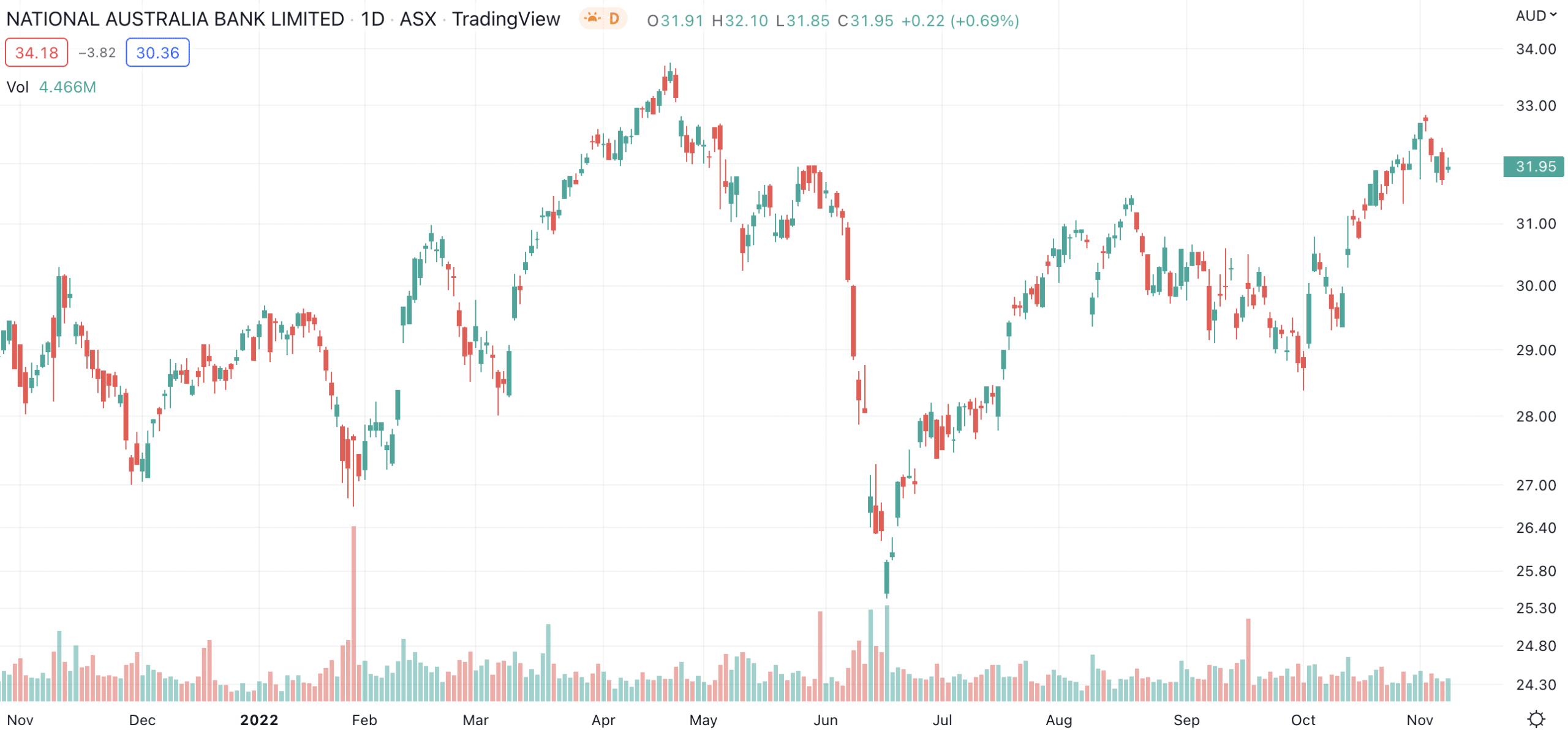

Their company is also the best performing Big Four Bank with a 10% share price gain in the last 12 months, a period in which the ASX 200 has lost 7%.

NAB (ASX:NAB) share price chart (Graph: TradingView)

What does FY23 hold for NAB shareholders?

As CEO Ross McEwan noted, a decade of falling interest rates has well and truly come to an end, and this is beginning to show in its results. The Net Interest Margin (NIM) for the full year was only 1.65%, shareholders can expect this to increase in FY23.

The company also promised to continue investing in its technology to ensure it could meet customers’ needs quicker than competitors. One example was NAB East Tap, a mobile payment solution for small businesses allowing phones to be used as EFTPOS readers and for payments to be settled on the same day.

However, NAB shareholders should be wary of three things. First, rising deposit rates; Second, the potential of new home loan customers to manage higher repayments as they come off low fixed rates; and third, broad macroeconomic conditions which could impact its earnings in the business segment (which were 43% of earnings in FY23).

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…