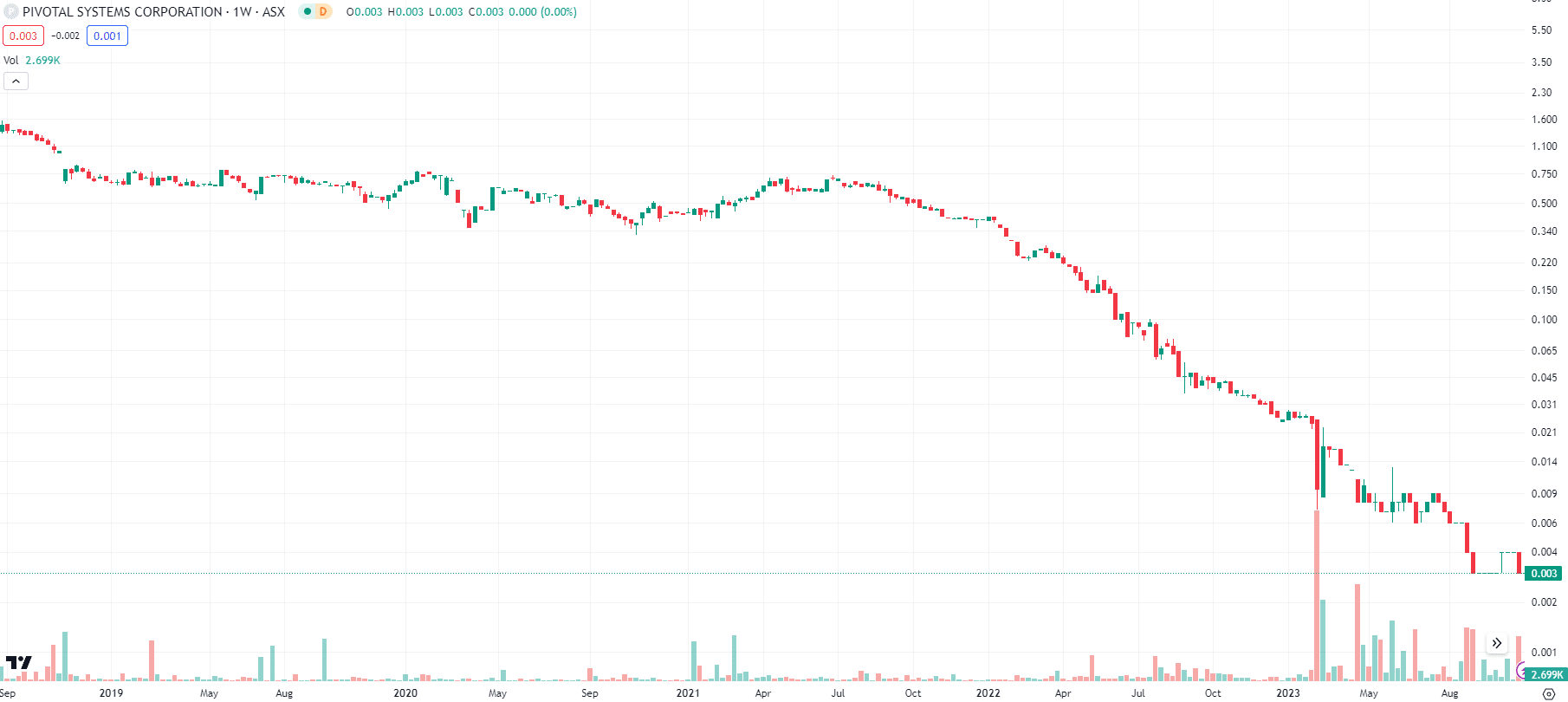

Pivotal Systems’ (ASX:PVS) acquirer could have at least bought shareholders dinner ahead of this 96% (!) discounted “deal”!

Typically when companies get taken over, investors receive a good premium to the current share price. Pivotal Systems (ASX:PVS) shareholders are not so lucky, though. They will receive A$0.0001 per share/CDI in cash, a discount of 96.6% from Friday’s closing price (!).

Calling this an M&A deal is an insult to M&A deals and we believe retail shareholders are getting royally screwed!

A recap of Pivotal Systems (ASX:PVS)

Pivotal makes Gas Flow Controllers (GFCs) and Flow Ratio Controllers (FRCs). These help stabilise and control the delivery of gases required in the semiconductor manufacturing process. Gases create the chemical reactions needed to shape a semiconductor’s electrical properties, but only if done correctly. You must control with extreme precision how much gas is used, the location where gases enter the reaction chamber, the speed at which gases enter and the mix ratio of gases in case a mix is used.

The semiconductor downturn nearly killed small chip equipment companies

Pivotal had a good book of clients and was revenue generating, something that can’t be said of all semiconductor tech stocks on the ASX. However, it underperformed as it kept burning cash given high capex requirements and didn’t do a good job of selling itself to investors. On top of all this, the semiconductor industry is highly volatile and share prices of even the biggest and best companies (i.e. your TSMC’s) have declined during the current semiconductor downturn and high interest rate environment.

For Pivotal Systems this has meant that the OEM’s that it sells its GFC’s to, like Applied Materials and Tokyo Electron, have ordered much less product from PVS, because the end customers, i.e. chip foundries and IDM’s, didn’t need as much new equipment in their fabs. A declining share price is the result.

The ASX exit deal

Pivotal has been eyeing a delisting for some time, first announcing concrete plans in February. It claimed there was interest from US-based investment firms and global ‘strategics’ that wanted to invest in the company, but couldn’t if PVS remained on the ASX. Within two months, it backflipped and raised $5.1m in fresh capital.

Today, the company unveiled concrete plans to shareholders. In other words, it entered a binding deal with acquirer OmegaX and will be delisting once the deal is done. This suitor is California-based, but there is scant information available about this company.

A done deal, but retail shareholders are once again getting shafted

PVS told investors that shareholders representing 52% of its common shares would vote in favour of the transaction. The deal is valued at US$18m, subject to customary working capital requirements. Unfortunately, retail investors are getting screwed because there is a long queue of creditors, including external debt holders and RBI Preferred stock holders. The company would also be repaying transaction expenses and bonuses.

So, retail CDI shareholders will receive A$0.0001 per share/CDI, representing a 96.6% discount (!) to the closing price of Pivotal’s CDIs on the day prior to entering into the merger agreement. That price is 1/10th of the smallest denomination that you can actually trade shares for on ASX.

Thank you very much PVS management!

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…