Qantas (ASX:QAN) jumps on solid profit upgrade for 1HY23

![]() Marc Kennis, November 23, 2022

Marc Kennis, November 23, 2022

Qantas (ASX:QAN) upgraded it’s profit guidance for the first half of FY23 this morning

The company cited strong domestic consumer demand as international capacity remains restricted. So, instead of travelling abroad, Australians are spending more time and money in Australia.

Fuel prices are still at high levels, though, with Qantas expected to spend $5bn of jet fuel this year, a company record. Still, it expects underlying profit before tax to end up $150m higher, at $1.35bn to $1.45nm, than it expected just 6 weeks ago.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

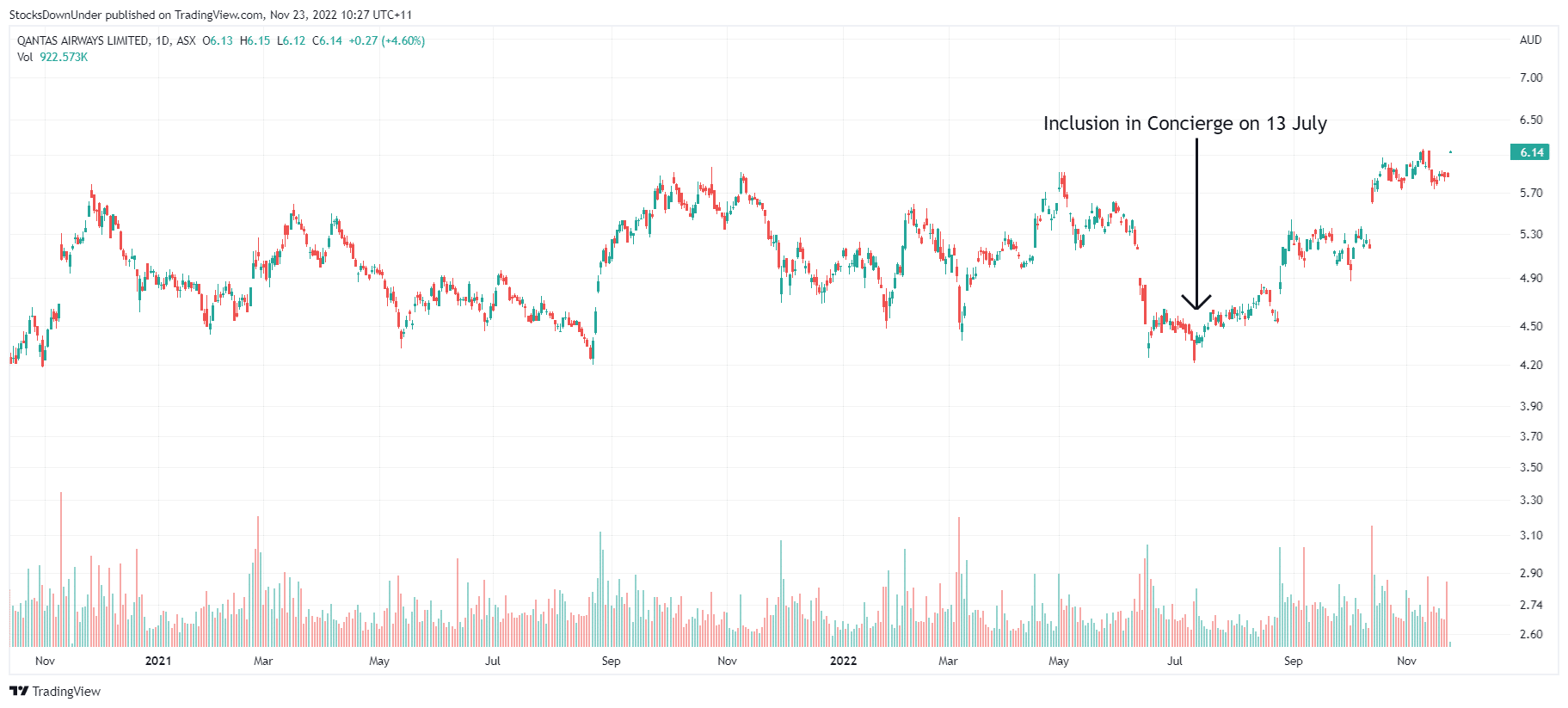

Qantas is a former Stocks Down Under Concierge stock that we made good money on for our subscribers. And it continues to perform with the share price up more than 5% today!

We believe this morning’s news also bodes well for a few of our current Concierge picks in the travel space. Check out Concierge today and get a FREE TRIAL now!

QANTAS chart, log scale (Source: Tradingview)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…