Why is Kogan (ASX:KGN) up 14% today after a trading update that doesn’t look so great?

![]() Marc Kennis, November 24, 2022

Marc Kennis, November 24, 2022

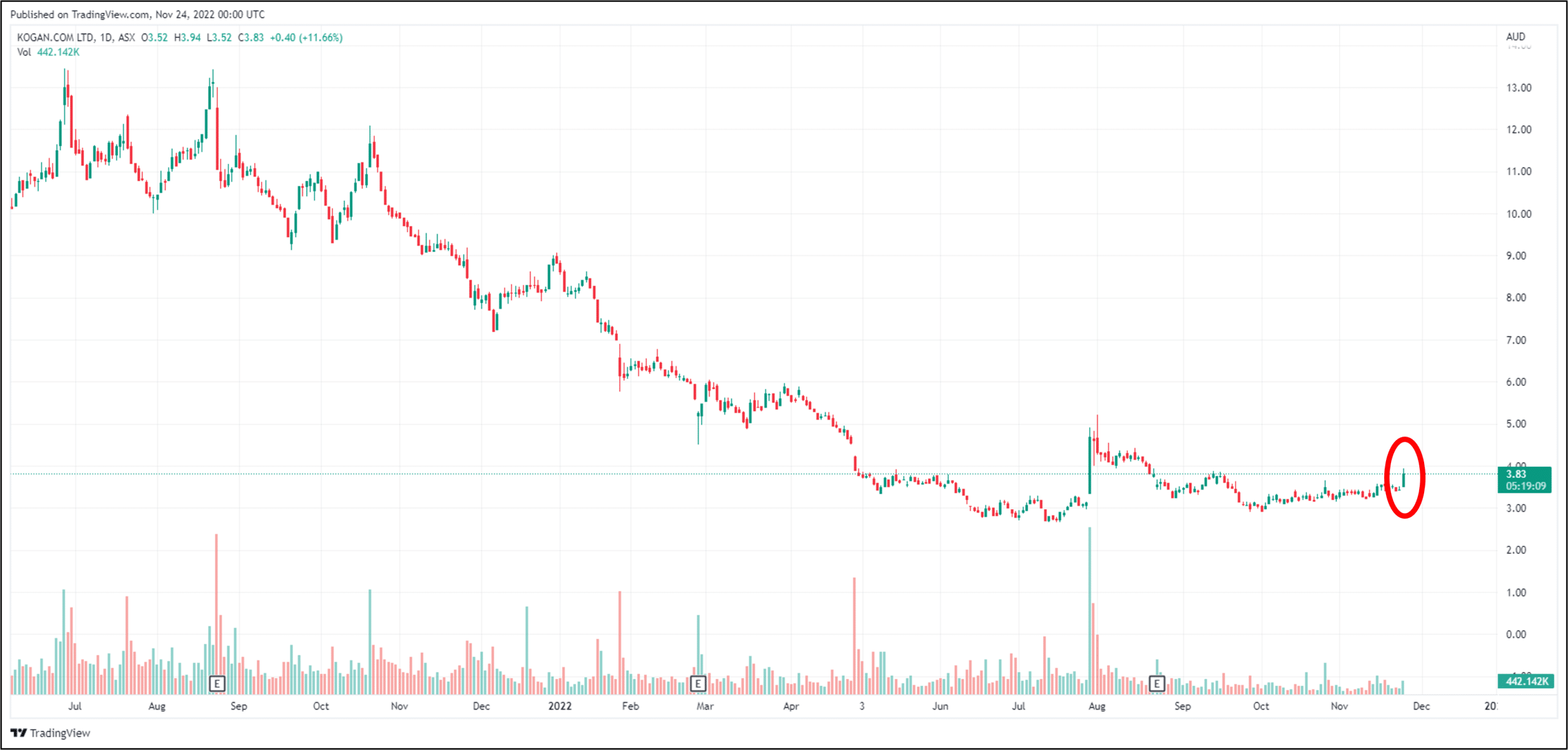

In its AGM presentation today, Kogan gave a trading update for the first few months of the fiscal year. Judging by the +14% share price move this morning, you’d think KGN announced great numbers. But sales actually dropped by 38% and gross profit fell by nearly 41% (?!). What’s going on here?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There were some positives in the trading update, specifically the company’s net cash position jumped by $21.3m. In addition, Kogan’s inventory keeps on dropping and now totals approximately $126m, down from around $147m in July. But overall, this trading update didn’t read well, in our view, with sales and profits declining substantially in FY23 year-to-date. So, something else must be at play.

Kogan (ASX:KGN) share price chart, log scale (Source: Tradingview)

Kogan has been punished too hard

We think the market is realising that the company’s shares have been punished too hard in the last two years. It’s share price dropped from a peak of more than $25 in October 2020 to below $3 in the middle of 2022. Granted, the share price was way too high back then, driven by pandemic-driven optimism around online sales, but a share price below $3 seems way too pessimistic given the company’s long term potential. Just look at the doubling of Kogan First subscribers in FY22.

Add to that the fact that KGN’s high inventory levels are coming down nicely now. This was a major sticking point for investors, who don’t like it if too much cash is tied up in inventories that are just sitting there. Just ask City Chic Collective (CCX). Cash should be put to work, or be returned to shareholders.

So, we may be looking at a pivotal moment for Kogan right now. If the market starts to re-evaluate Australian retailers’ potential, we could be at the beginning of a nice, longer term rebound of their share prices.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…