Why Regis Resources (ASX: RRL) is jumping 10% higher today!

Regis Resources (ASX: RRL), a $980m gold producer, is one of the biggest gainers in the ASX 200 this morning. Regis’ shares dropped 30% in the previous 3 weeks following its annual mineral resource and ore resource statement. But today, share have rebounded ~10%.

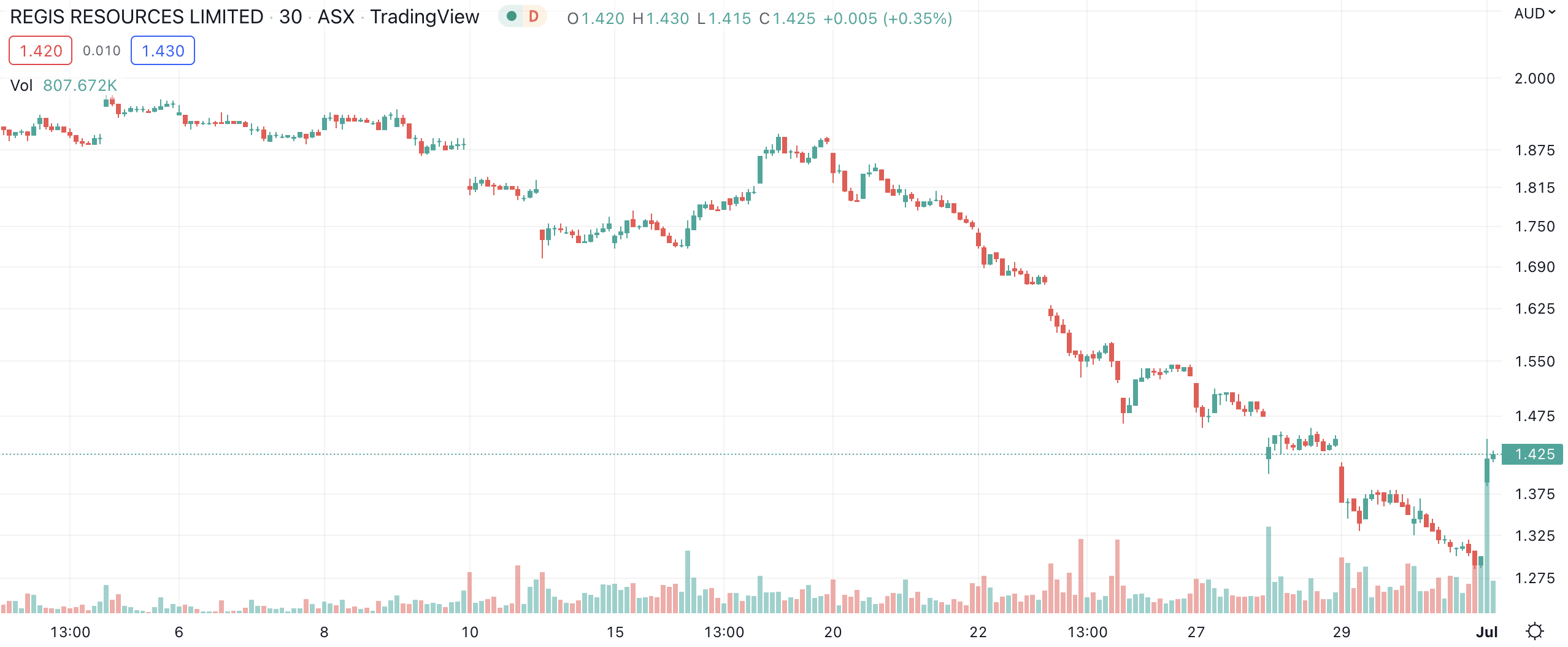

Regis Resources (ASX:RRL) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Is Twiggy getting into Regis Resources?

The catalyst for Regis Resources’ climb today has been attempts by billionaire and Fortescue boss Andrew ‘Twiggy’ Forrest to buy into the company. He already had a 4.9% stake in the company, owned through Wyloo – one of his private investment companies.

Forrest’s most famous stake in an ASX company is his iron ore mining company Fortescue (ASX: FMG). But he has picked up stakes in a handful of other companies too, including BWX (ASX: BWX), Bega Cheese (ASX: BGA) and Buru Energy (ASX: BRU).

Regis Resources is another one. He held a ~5% stake, but the AFR reported that he is seeking a further 15% stake.

He was willing to pay $1.48 per share, which is a 13.8% premium to yesterday’s closing price. Unfortunately, his broker Barrenjoeys couldn’t complete a deal for the entire stake, so the deal was put off.

What does this mean for Regis Resources?

Even though the deal collapsed, Regis Resources’ share price is still rising. Investors are evidently taking Twiggy’s bid as a sign that good times are ahead of the company.

And remember, Forrest still owns 4.9% and could easily try to acquire more shares on market in the near future. Taking a stake of 20% would be a particularly significant sign because it is all but certain he would have launched a takeover bid for the company.

As of 31 December 2021, Regis’ mineral resources are 9.9Moz and its ore reserves are 4.1Moz, which represented upgrades of 150koz and 140koz respectively.

Its FY22 results are due in August and the company is expecting to record 420-475koz in annual gold production, up 13% – 27% on FY21.

Regis Resources’ investors will likely be watching the company’s results closely in light of this week’s events.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…