Sovereign Metals (ASX:SVM): The owner of the world’s largest rutile deposit and second largest flake graphite resource

Sovereign Metals (ASX:SVM) is no small cap explorer – it is the owner of the world’s largest rutile deposit! Rutile is an important mineral sand used as a titanium dioxide feedstock for industrial purposes. As if the rutile wasn’t enough, it has exposure to graphite too at its project in Malawi.

Introduction to Sovereign Metals (ASX:SVM) and its project

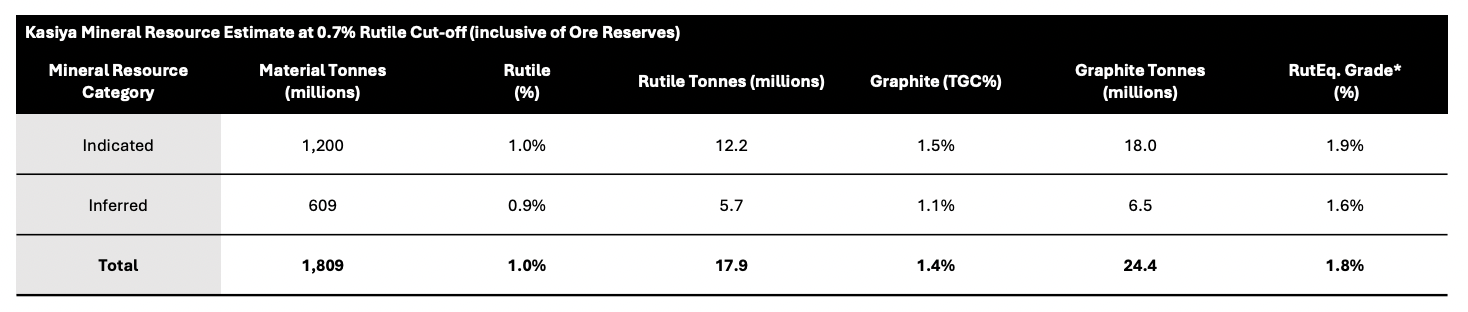

Sovereign Metals’ deposit lies on Malawi and is known as Kasiya. It has a Mineral Resource Estimate of 1.8Bt at 1.01% rutile and 1.32% graphite, equating to 18Mt of rutile and 24Mt of graphite. The former figure easily trumps Sierra Rutile’s 8.1Mt.

Source: Company

It is true that from a graphite perspective, Kasiya is no match for Syrah’s 146.3Mt Balama deposit, although it is ahead of deposits belonging to other companies including Black Rock and Magnis. But what is most important here is that Kasiya has the lowest cost flake graphite project in the world, a direct consequence of producing graphite as a co-product with rutile.

Sovereign Metals discovered the deposit in 2019 and it was the first rutile-dominant deposit found in over 7 decades. The PFS found a post-tax NPV of US$1.6bn (using an 8% discount rate), an IRR of 28% after tax, average annual EBITDA of US$415m and a consequential EBITDA margin of 64%. The mine is anticipated to last 25 years with an average annual production of 222ktpa rutile and 244ktpa graphite.

This PFS was optimised in late 2024 and this derived a US$2.3bn pre-tax NPV, US$16.4bn total revenue and a 27% IRR.

Sovereign Metals or Sovereign Risk?

What about Malawi you might ask? There are plenty of horror stories of ASX mining and resources stocks getting let down by jurisdictions – just ask Leo Lithium (ASX:LLL).

Malawi is a member of the Commonwealth and has a legal system based on the English common law. Mining is one of three sectors (the others being tourism and agriculture) that are a key focus of the country’s economic development strategies. The country’s President Lazarus Chakwera specifically told the UN General Assembly in 2022 that,’ The recent discovery in Malawi of the largest deposit of rutile in the world means that Malawi’s economic rise is imminent’.

Rio Tinto has confidence

In July 2023, Rio Tinto (ASX:RIO) invested in Sovereign Metals – $40.4m for an initial 15% stake. It has an option to acquire an additional 4.99% by the end of July 2024. The parties will collaborate to qualify Kasiya graphite – in other words, determine if the product will be acceptable to potential offtake partners.

There is also the option for Rio to become the operator of Kasiya on arm’s length terms and to have marketing rights to 40% of products. The parties will negotiate arrangements for an acceptable mine construction funding package. Another major shareholder is Sprott Asset Management which has an 8% stake, following the dilution resulting from Rio Tinto. The company’s management team owns 11% between them.

Speaking of confidence, one of Japan’s premier titanium metal producers did testing earlier in 2025 and confirmed the suitability of rutile from Kasiya for aerospace and industrial applications.

Truly ESG friendly

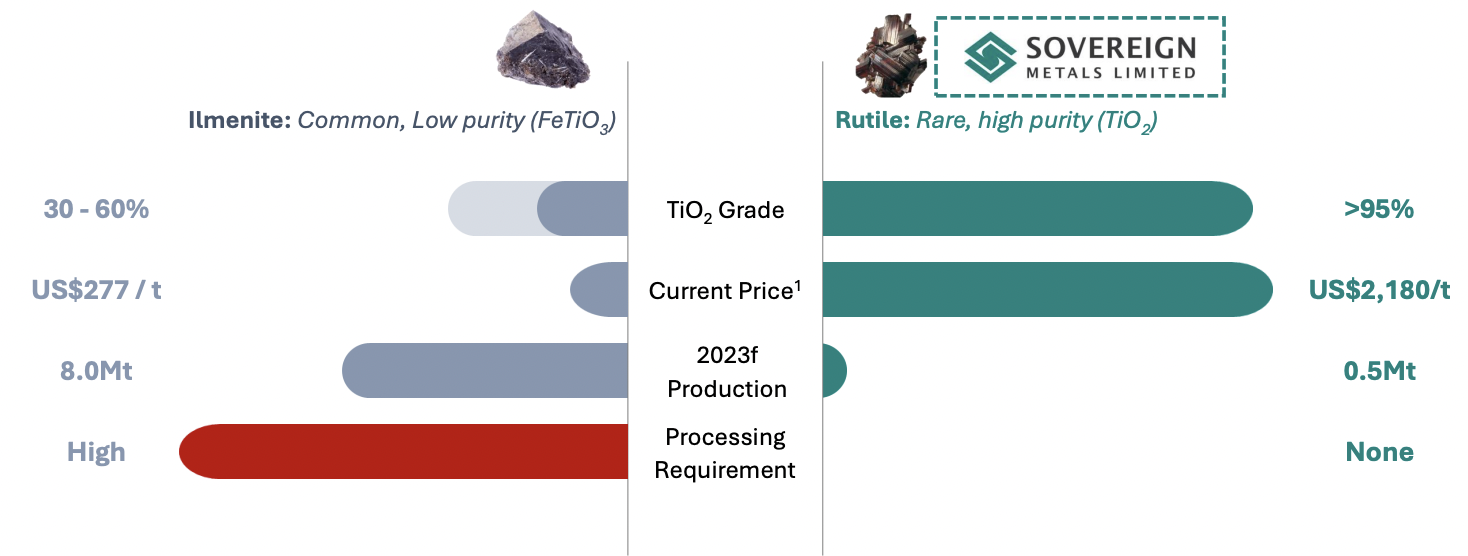

Now, all developers and explorers that are prospecting for a battery metal will claim to be ESG friendly just because of their metal. However, this company really can claim to be. Rutile is truly the most environmentally friendly way to produce titanium. This is because mined natural rutile can be directly produced into pigment whilst other forms (such as titania slag and synthetic rutile) need upgrading processes prior to production that are emissions intensive.

Source: Company

When in full production, Kasiya will emit 35-53% less than titania slag and synthetic rutile per tonne of titanium dioxide pigment produced. We also note that Kasiya is a low carbon sustainable operation that will be 100% powered by renewables with progressive land rehabilitation.

Key risks

The key risks facing Sovereign Metals are commodity pricing and the inability to meet capex requirements. Sovereign will need US$597m to bring the project into full production. However, it must be borne in mind the project will be bought into production over 2 stages with the second taking 5 years from the first. The second stage could theoretically be funded with free cash flow. Rio Tinto’s ringing endorsement of the company should provide investors with confidence.

The price of rutile is harder to track because it is not publicly traded. But it is hard to see the price going down. This is because on one hand, rutile supply is expected to decline 52% over the next decade as ~200kt of rutile supply gradually comes off the market as mines belonging to Sierra Rutile and Base Resources exhaust their resource. The other, titanium feedstock is expected to grow by a CAGR of 2.7% over the next decade.

Conclusion

There aren’t too many developers that can boast of having ‘the world’s largest project’ and having Rio Tinto as an investor – not just a farm-in partner but as the company’s largest shareholder. Sovereign Metals is one of them so is one for investors to watch.

The next major milestone will bea DFS for Kasiya which will come in Q4. We’ll be watching with fascination.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…

ReadyTech (ASX:RDY) Down 57%, Where’s the Operating Leverage?

ReadyTech Soft Half Keeps Pressure on the Stock ReadyTech has had a rough 12 months. The stock has fallen from…

Adisyn (ASX:AI1) Graphene Makes Drones Harder to Detect

Big Step in Drone Stealth With Graphene Adisyn (ASX:AI1) has successfully completed an early proof of concept demonstrating that graphene…