Sonic Healthcare (ASX:SHL): Australia’s biggest pathology stock is available at a bargain price

It is not often that you can buy a blue-chip stock at a bargain price, but Sonic Healthcare (ASX:SHL) is such an opportunity.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Introduction to Sonic Healthcare (ASX:SHL)

Sonic Healthcare is a medical diagnostics company, headquartered in Sydney but with operations around the world. It operates medical centres, pathology and radiology services. Radiology is medical imaging while pathology is analysing samples of bodily fluids or specimens for the purposes of diagnosing medical conditions.

The company employs 42,000 people globally and has strong market positions. Even in the USA, it is the third-largest private pathology provider. It was founded in 1934 and listed on the ASX in 1987. It has grown both organically and through M&A. Looking at its healthcare peers on the exchange, only CSL (ASX:CSL) has a larger market capitalisation.

A COVID boom and then a bust?

Sonic was one of the largest providers of COVID-19 tests during the pandemic and the benefit showed in its results.

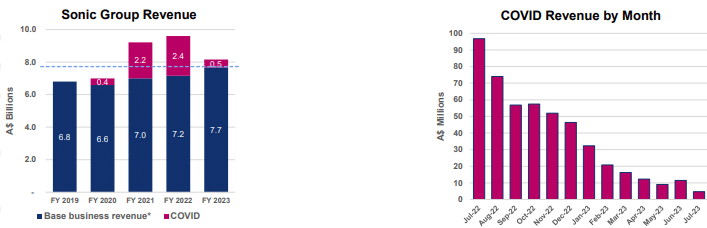

In FY19, Sonic made $6.2bn in revenue and a $550m profit. But then everything started pick up from March 2020. In FY20, $6.9bn in revenue and a $558m profit. In FY21, $8.8bn in revenue and a $1.3bn profit. Things peaked in FY22 with $9.3bn in revenue and a $1.5bn profit before the company recorded $8.2bn in revenue and a $685m profit (the latter figure down 53%).

However, Sonic’s non-COVID revenue increased 11% from $6.9bn to $7.7bn while COVID revenues slumped from $2.4bn to $485m. So this business was always far from a one-trick pony. Its core business was always growing and it has well and truly been weaned off COVID revenues. In FY23, it made $7.7bn in non-COVID revenues and just $485m in non-COVID revenues.

Source: Company

Consider that SHL’s core business is very diverse, with revenues coming from several different geographies and divisions. This is not to say the COVID boom was a bad thing – instead of distributing the extra cash to shareholders, it used the funds to pay down debt and enhance its scale in existing markets.

In FY25, the company made $9.64bn revenue and $1.725bn EBITDA, both of which were up 8%. Its profit was $514m, up 7% and operating cash flow was $1.3bn EBITDA, up 21%. A dividend of $1.07 per share was paid. Let’s look at some of the company’s individual segments. Its Australia/New Zealand pathology business made $2.1bn revenue, 22% of the company’s total and 6% organic growth.

The USA business contributed $2.1bn too but it declined by 1% due to some local contract headwinds. Europe Lab Medicine contributed $4bn which was 4% organic growth. The UK was the strongest European market with 14% organic growth. The total growth was significantly supported by initiation of the new Hertfordshire & West Essex NHS outsource contract.

Sonic completed the acquisition of LADR Laboratory Group in Germany (effective July 1 2025), which is expected to meaningfully contribute to European revenues in FY26 and beyond. LADR recorded EU370m revenue and EU50m EBITDA in 2024 and the company promised it was EPS accretive already.

Australian radiology contributed $970m, or 10%, while the balance was non-core services such as medical centres and occupational health.

What’s not to like?

Investors did not like the company’s results because it missed consensus and there were mixed signals. There were concerns about whether SHL’s capital allocation and growth strategy would deliver return profiles.

The company guided to $1.87-1.95bn EBITDA for FY26 which would be 13% higher than FY25. Although no full year revenue guidance was given, the company indicated it would be slightly skewed to the second half. Still, the company indicated it would see an increased interest expense of the mid to high teens and this assumed current rates prevailed.

For FY26, it is trading at 18.2x P/E and 1.2x PEG. This is based off consensus of $11bn revenue and $1.24 EPS or a $612m profit. Estimates for 2024 are $11.5bn revenue and a $682m profit.

Sonic is a long-term growth play

Yes, Sonic is an AI play. In 2021, it bought into Harrison.ai, to develop AI solutions for pathology, including a chest X-ray AI tool and CT brain AI application. It has another joint venture with a company called Franklin.ai that will see the pair complete an anatomical pathology AI product that would eventually be deployed within Sonic and sold globally. The company is good at delivering capital returns being a fan of share-buybacks (although it took a break in FY24) and paying a dividend of $1.06 per share (yielding over 3%).

One risk the company was facing was the prospect of a merger between Healius (ASX:HLS) and Australian Clinical Labs (ASX:ACL), a deal that would’ve created a competitor bigger than them. Thankfully for Sonic, the ACCC has poured cold water on this deal.

The ageing population at home and abroad will inevitably be to the company’s benefit. As the nation gets older, there’ll be a need for more medical tests – diagnostic imaging and pathology. And as such a large provider, Sonic is in prime position to benefit.

ESG investors fear not, there’s an angle for you too. Yes, healthcare stocks generally are good ESG elements because of how they improve human life. But Sonic goes above and beyond with several initiatives underway. Among them: Adding sustainability clauses to new supplier contracts and achieving ESG certifications from MSCI and ISS ESG.

Our valuation

There are rarely opportunities to buy very good companies at bargain prices, but we think Sonic Healthcare is one of them. We think investors are too concerned about the company’s growth and that the company will re-rate if it can continue delivering the goods. Granted, it may take until later in CY26 when the company delivers full-year results.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…