ASX Baby Boomer Stocks: Here are 5 we think will be big winners as Boomers retire and 5 losers

![]() Nick Sundich, June 11, 2024

Nick Sundich, June 11, 2024

Let’s take a look at ASX Baby Boomer Stocks. That is to say stocks that will benefit as Baby Boomers retire. Within 5 years, all Boombers will be 65 and older, and thus eligible for retirement under Australian law. This is not to say all will, but many will work less and move on to other things in their lives.

Whenever Baby Boomers have begun moving through a life phase, it has always been a boom for companies with exposure, and we think it’ll be no different this time. It is easy to point to healthcare companies as stocks that will benefit, given they will need healthcare more than in the past. But there will be other things that will go on. Some will have accumulated substantial wealth and will gradually pass it on over time. Companies that have relied on working Baby Boomers as customers will need younger generations as customers, or risk death, and this may be difficult for some companies.

Here is our list of 5 stocks that will win as Baby Boomers retire, and 5 that could lose.

5 ASX Baby Boomer stocks

Just for the record, we are excluding healthcare companies like Cochlear (ASX:COH) and Sonic Healthcare (ASX:SHL) because they are too obvious. These are companies you may not have thought of. The first two will benefit as the wealth transfer occurs.

WT Financial (ASX:WTL)

It has been a stereotype that millennials are shunning financial advice due to costs, in the post-Hayne Royal Commission world. Well, when they come into wealth, that will be different. WT Financial is not the only financial advisory company on the ASX, although it is one we like at the moment.

WT is a network operator with over 400 privately-owned practices compromising the group, including brands such as Wealth Today, Sentry Advice and Millennium3. In 1HY24, it made a $2.3m post-tax profit as well as $1.8m operating cash flow.

Australian Ethical (ASX:AEF)

Ethical investing is on the rise, and it is being driven by Millennials and Gen Z. They are far more likely to consider ethical investing companies, although they do not want to sacrifice concerns and are conscious of greenwashing.

Australian Ethical was established in 1986, but has seen significant growth in FUM in the last 5 years. Although many fund managers face a risk of funds outflowing as Boomers retire, the risk is less with this company because millennials that inherit wealth may be more inclined to use its funds.

Kelsian (ASX:KLS)

In retirement, one thing Boomers will do is travel. And Kelsian, formerly known as SeaLink Tourism, is Australia’s largest integrated multi-modal transport provider and tourism operator. The company operates resorts, ferries and even public transit services.

Beyond Boomers retiring, there are other mega tailwinds the company is exposed to including decarbonisation and population growth in its key markets (such as Queensland).

Ramsay Healthcare (ASX:RHC)

Ramsay is an operator of private hospitals in Australia, Europe and Asia. We know we said healthcare stocks are obvious. But this $10.8bn company may not stand out so much as companies with devices or drugs that treat conditions associated with aging.

At first glance you might say it is no match public hospitals. However, they are capacity-constrained, and suffer from government bureaucracy and inefficiency. This is not the case with private hospitals, and Boomers have the wealth to pay more.

Propel Funeral Partners (ASX:PFP)

It is said the only certainties in life are death and taxes and Propel Funeral Partners (ASX:PFP) is the set to be the only ASX company that makes its money from the former.

PFP’s larger rival Invocare (ASX:IVC) was taken over by TPG Capital for $1.8bn after a difficult few years, leaving PFP as the ASX’s only funeral provider, and the second largest in the company. If you haven’t heard this company’s name before, this is because it is not a provider in its own right but is an owner of several franchises. We think you are likely have heard of some of them – White Lady Funerals and Simplicity Funerals just to name a couple.

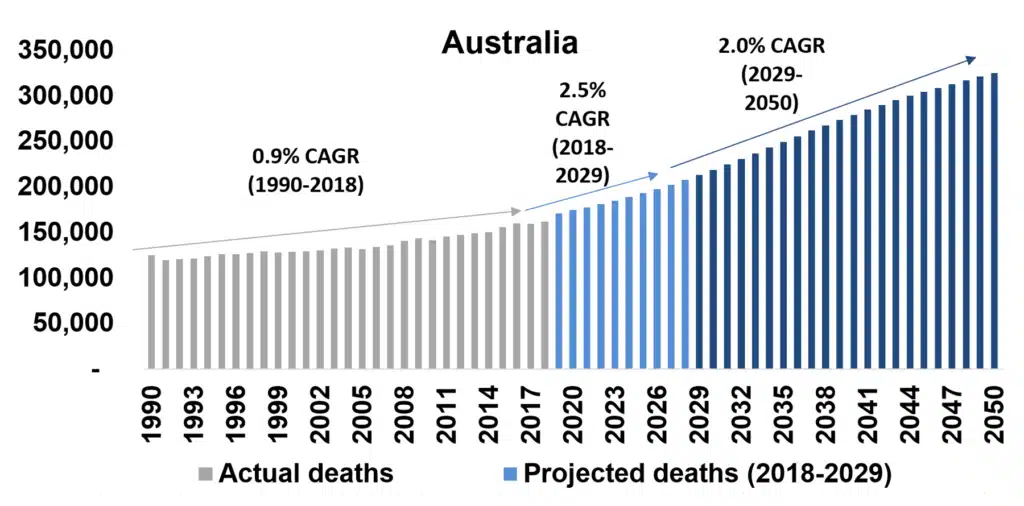

It is also worth noting that funerals are a 24-hour, labour-intensive business with extensive planning and various facilities. And none of this comes cheap. Deaths in Australia are set to continue to grow in the years ahead. And Propel is the 2nd largest provider in the market with operations in 144 locations. Finally, just take a look at the below chart. You can see there’ll be a lot of demand in the years to come.

Source: Company

Losers:

G8 Education (ASX:GEM)

This may be a light-hearted choice that may not ultimately be a loser. But with more time to yourself, one thing Boomers might want to do is look after their grandchildren or other younger relatives. For cash-strapped parents, it is a more logical choice to have grandparents rather than pay childcare providers.

Magellan (ASX:MFG)

As superannuation and other assets are drawn down on, this means many asset managers’ FUM will fall. Magellan is a blatantly obvious company to pick on here because it has suffered a rapid FUM decline over the past few years due to institutional outflows.

Of course, it is not just Magellan’s problem. A KPMG report found that in FY23, Mercer, Colonial First State, AMP, BT and Insignia had combined outflows of $10.6bn. Of course, this is not true of all fund managers. Australian Ethical is doing well. And certain industry super funds such as Hostplus are doing better because younger workers tend to be defaulted into them when they first start working, and just never leave.

Beacon Lighting (ASX:BLX)

Beacon Lighting is one of our favourite ASX stocks, but we cannot shy away from the fact that there’s potential for it to be a loser. Millennials are currently entering their peak income years and are likely to spend on products without doing a full home renovation – lights and ceiling fans. At the same time, they are worse off than Baby Boomers were at their age, and Boomers are less likely to upgrade homes if they are living in retirement villages or as ‘grey nomads’.

Endeavour (ASX:EDV)

Endeavour operates hotels, alcohol and gaming facilities. Gen Z-ers drink 20% less than millennials on average, who also drink less than older generations. They are aware of the dangers and effects of alcohol to their own personal health and to broader society. If you don’t want to take our word for it, just look at the fact that alcohol companies are pushing quickly to roll out alcohol-free beverages.

IAG (ASX:IAG)

Insurance could be an industry to lose. We’ve just picked IAG because it is one of the largest insurers on the ASX with exposure to consumer brands. Brands fitting under the umbrella include NRMA, CGU, SGIO, SGIC and WFI.

Many insurers may not insure older persons, such as for driving or for medical conditions (especially pre-existing). And Millennial and Gen Z consumers haven’t taken up insurance as much, except for life insurance which is included with many superannuation funds by default. A report by Deloitte found that Australia is 60-80% underinsured, indicating there is an opportunity to pounce on, but one that has not been penetrated.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…