South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

Nick Sundich, July 26, 2024

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped at $13bn – not a bad effort considering spin-off companies can sometimes be duds. Just ask Falcon Minerals (ASX:FAL) and Minerals260 (ASX:260) which came out of Chalice and Liontown respectively.

However, shares have retreated 20% in the last 12 months, a move capped off by a write-off of a couple of its projects. One of these was a nickel project, and South32 is hardly the first company to do so – in fact, we’re surprised it took until mid-2024 to do this. The other was a long-standing project where the company’s plans for future development raised eyebrows with environmental authorities. We’ll delve into whether or not this is a big deal in this article.

The bottom line about this company is – even with some short-term setbacks this year – it is one to look at. And there is one crucial reason. Namely, because the company has exposure to critical metals that many other companies (particularly large cap miners) lack.

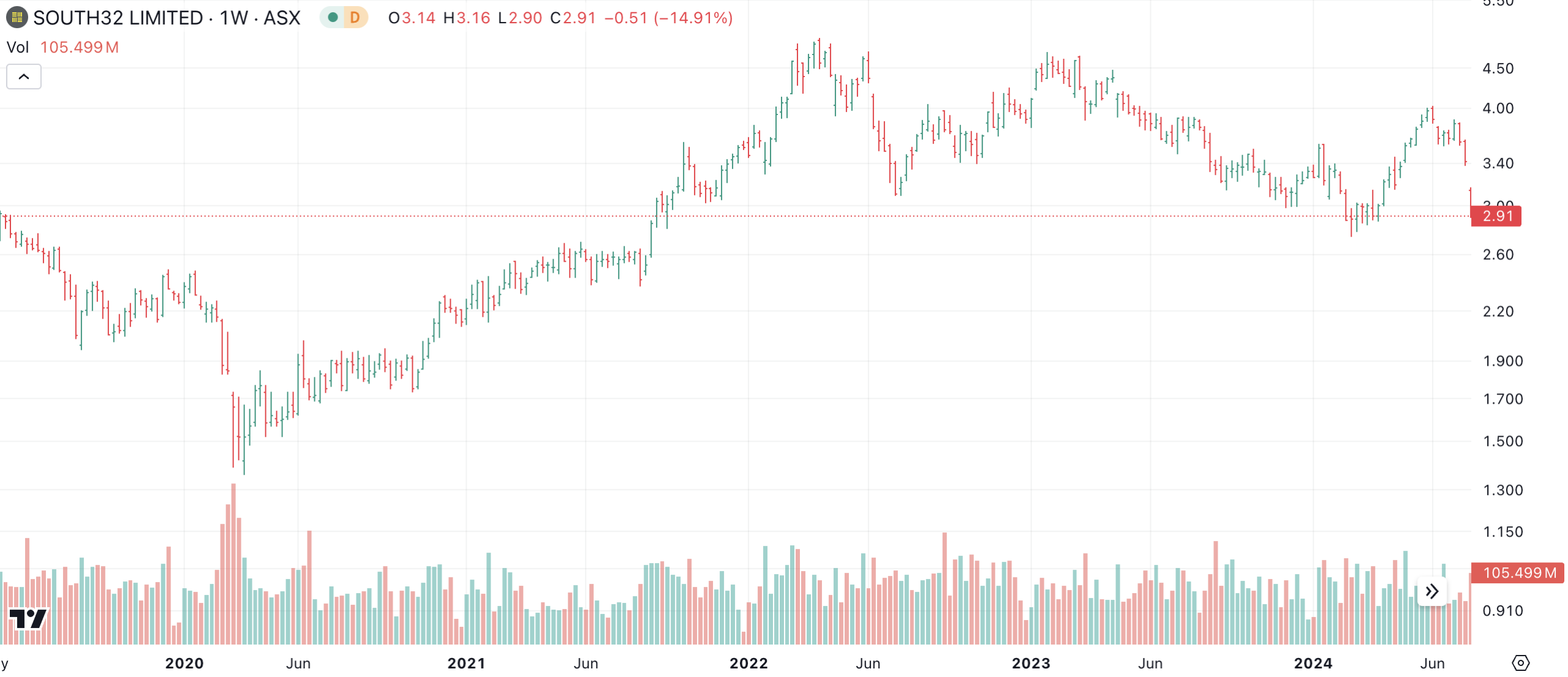

South32 (ASX:S32) share price chart, log scale (Source: TradingView)

South32 is different a decade on from its demerger

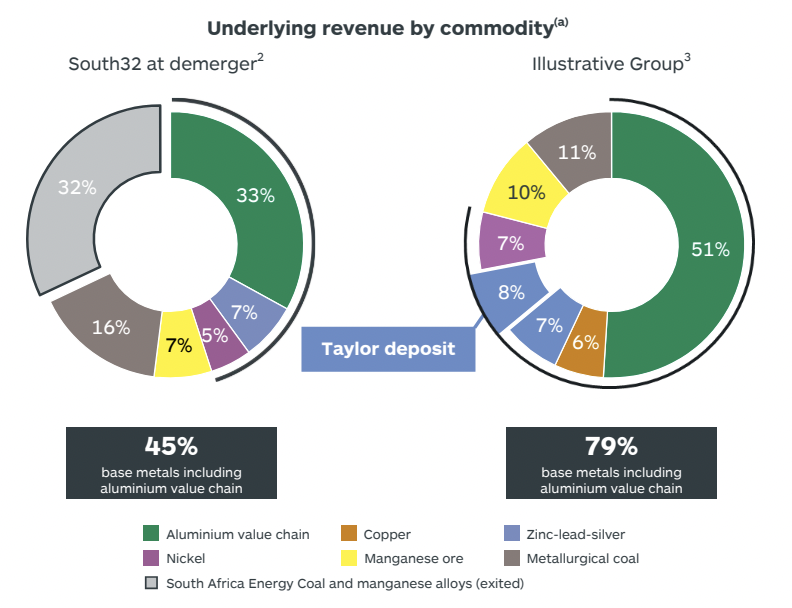

Just look at how the company’s revenue mix has changed in the last decade.

Source: Company

You may have noticed that the company has singled out the ‘Taylor deposit’. It is a zinc-lead-silver deposit in Arizona that the company made a Final Investment Decision on back in February. First production is expected in the next 3-4 years and will have an initial operating life of 28 years and production of 3Mt by 2031. The project’s NPV is US$686m and the IRR is 12%.

Hermosa is the only advanced mine development project in the United States as of 2024 that could produce manganese and zinc – two federally designated critical minerals. Manganese is a highly underrated battery metal, and zinc is an important metal used to galvanise iron and steel to protect against corrosion. South32 already has exposure to zinc through its Cannington operation in Australia, although Hermosa will take the company from being a modest producer to a major producer. As for manganese, South32 supplies 10% of this commodity from its mine in the NT?

You’ll notice that is also has growing exposure to copper, and derives a majority of its revenue from aluminium, with operations in Brazil, South Africa and Western Australia. On top of all of this, the company has several greenfield exploration prospects, in Australia and the Americas.

The company’s time to shine could be FY25

South32 has been impacted by commodity prices, but these are expected to turnaround. In particular, alumina is expected to rally over the next couple of years – Goldman Sachs predicts pries to rise from US$1.02 a pound in 2023 to US$1.27 per pound in 2025 and US$1.33 per pound in 2026.

Analysts have a mean target price of A$3.76, a 25% premium to the current share price. Although revenues for FY24 are expected to be $11.7bn, down from $13.7bn in FY23, FY25 is expected to see a bounce-back to $12.7bn. The company’s EBITDA for FY24 is expected to similarly retreat, but then bounce back in FY25 to levels similar to FY23 – $3.8bn. You can obtain the company at just 3.9x EV/EBITDA and 7.9x P/E.

Granted, this is not that much of a discount compared to fellow aluminium player Rio Tinto which is 4.5x EV/EBITDA and 8.8x P/E for FY25. Nonetheless, consensus estimates expect stagnation for the next few years for Rio Tinto and little share price growth. We also observe that it is not as if Rio Tinto is broadening its exposure to a critical mineral in the way that South32 is.

But what about the setbacks?

We need to address the elephants in the room, namely some recent setbacks the company has suffered. Cyclone Megan substantially hit South32’s NT manganese project and the associated loading wharf. The company told investors at the time it assessed the damage that it would take 12 months to resume production. And from there it is anyone’s guess as to how long it will take to get back to normal.

There was also bad news from the company’s latest quarterly update. Yes, the update contained some some good news including that it would meet 98% of its copper production guidance and costs were in line with the current guidance on a unit basis. However, the company impaired Worsley Alumina by US$554m and Cerro Matoso by US$264m, both pre-tax. There was some other bad news including a 5% downgrade its alumina guidance, although it was the impairment that made the headlines.

Worsley Alumina is an aluminium refinery operation in Boddington, WA which the company has 86% of. The reason for the Worsley downgrade was a recommendation by the WA Environmental Protection Agency (EPA) that it could only proceed with its development plans for its future subject to conditions that would impact its viability. Although the company appeals and expects an answer by the end of this calendar year, it decided to make the impairment that reduces the carrying value to just over US$2bn. The company has not been specific about what conditions would most impact operations, although some include emissions limits, a requirement to ensure the land rehabilitated was at least equal to the area mined, and to protect old-growth forest and sections with less than 30% of native bushland remaining.

Meanwhile, with respect to Cerro Matoso, this was simply because of the current situation with nickel prices, that has not improved in 2024. South32 now has a carrying value of just $54m, and the company noted prices will continue to place pressure on operations.

The bad news provides an opportune time to consider South32

Buying the dip is a risky strategy, but one that can pay off in circumstances where setbacks that have caused a decline in the share price are short-term in nature. We think this is the case with South32. If:

- aluminium prices recover in the next couple of years,

- recovery at the company’s NT manganese operations don’t take longer than expected, and

- Taylor progresses on track,

We expect investors will see some good days ahead.

What are the Best ASX stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…