The Reject Shop (ASX: TRS) is making big bucks off cheap stuff

![]() Marc Kennis, November 1, 2022

Marc Kennis, November 1, 2022

The Reject Shop (ASX: TRS) is a discount variety retailer in Australia. The company sells grocery and home products online and through a network of 372 stores around the country.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

Get a 14-day FREE TRIAL to CONCIERGE now

Let’s take a look at The Reject Shop’s chart and see what moved its share price since the beginning of 2022.

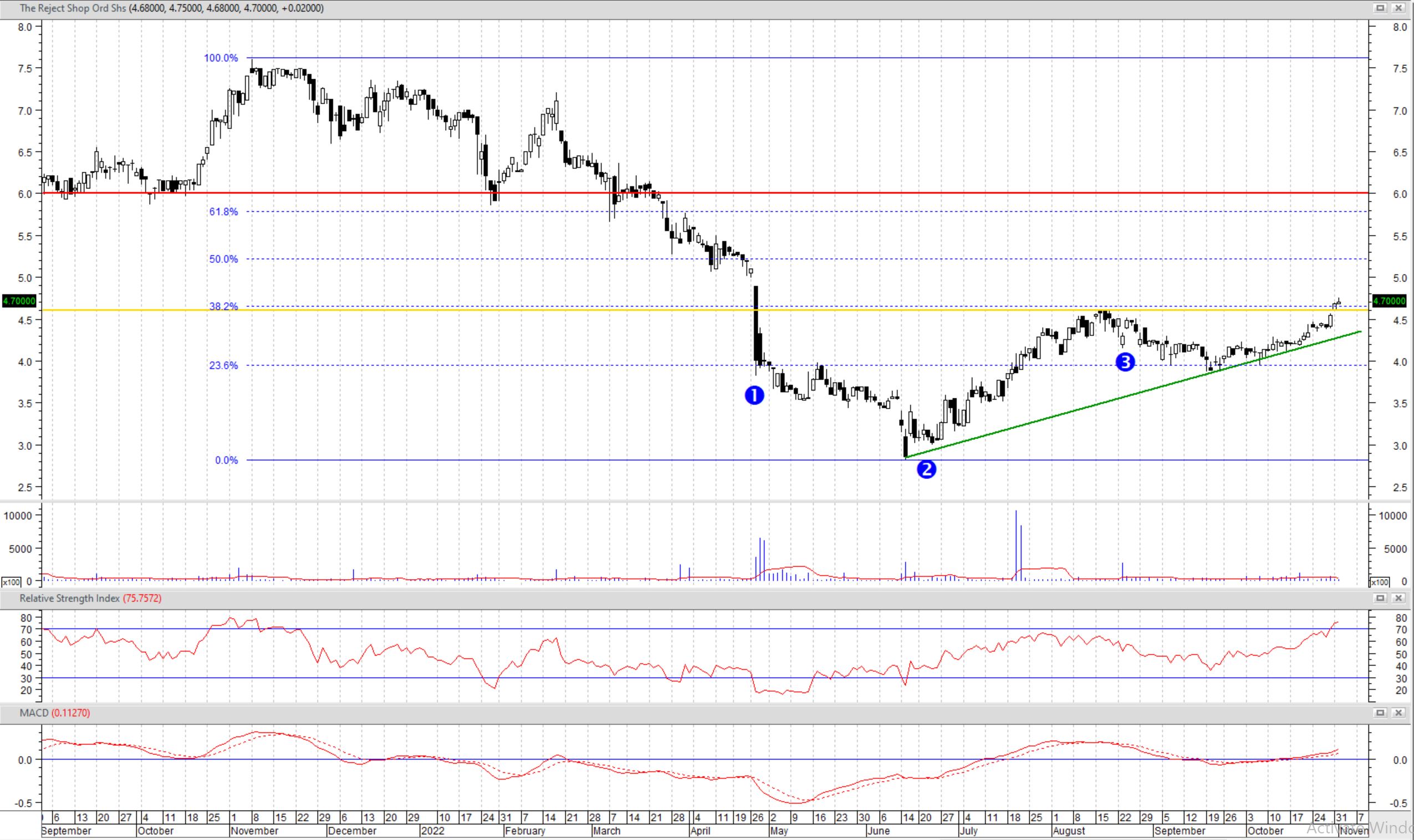

The Reject Shop, Daily Chart in Semi-log Scale (Source: Metastock)

Pandemic-driven panic buying sent The Reject Shop’s share price flying

The Reject Shop stores remained open throughout the pandemic and panic buying demand for cleaning products as well as other household goods helped its share price recover to its 2018 high of $8.00.

The bear market and a CEO resignation took down The Reject Shop’s share price

With the economy coming out of the pandemic and the bear market of 2022, The Reject Shop’s share price started to retrace downwards its pre-pandemic levels of around $5.00 when the company announced the resignation of its CEO (point 1 on the chart).

The departure of the CEO responsible for The Reject Shop’s noteworthy performance during the pandemic caught the market by surprise and took TRS’s share price down to $3.00.

A new CEO appointment and the recovering market is helping TRS’s stock

In June 2022, TRS appointed a new CEO with previous senior roles in the retail industry, including Bunnings and Officeworks (Point 2 on the chart) and the markets started to recover around the same time, which helped TRS’s share price recover to $4.50 in August 2022.

The Reject Shop is buying-back its shares on-market

TRS announced an on-market share buy-back of up to $10m when it reported its FY22 results (Point 3 on the chart). At the current share price of around $4.50, a buy-back of $10m represents the purchase of approximately 5.8% of the issued capital. But the company leaves room to vary the size of the on-market share buy-back to up to 10% of the company’s issued capital, depending on business and market conditions.

The Reject shop’s management think its stock is too cheap

The decision for the share buy-back came after the company reported a cash position of $77.5m and no outstanding debt as of 3 July 2022. But it figured a share buy-back would deliver more value to shareholders than paying out dividends after its share price dropped more than 60 percent in less than a year while the company’s financial performance was broadly in line with previous years and the analysts’ expectations.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

New store openings are in more cost-effective locations

The Reject Shop has been closing its underperforming and loss-making stores, mostly located in shopping centres and CBD locations with expensive rental costs that don’t reflect customer foot traffic. The recent new store openings are predominantly situated in neighbourhood and strip locations in both metro and country areas.

The shift towards operating in more convenient locations can reduce the company’s operating costs and potentially even improve its sales as consumers in shopping centres have other options, such as Kmart, Target and Big W to choose from.

The Reject Shop stock is attractively valued

The company generated a net profit after tax of $7.9m from sales of $788m in FY22, which was relatively flat compared to FY21 results. It also ended the year with $77.5m in cash and $113m in inventory, and its shares are now trading at a price-to-tangible BV multiple of 1x.

Based on consensus analysts estimates, The Reject Shop’s stock is trading at a forward P/E multiple of 17.4x and EV/EBITDA multiples of 3.0x and 2.7x for FY23 and FY24 respectively. Given an expected 10% EBITDA growth for FY24 ,based on estimates from 6 analysts, we believe TRS shares are very cheap at the moment.

The increasing cost of living can help The Reject Shop’s sales

The global inflation of consumer goods prices, increasing interest rates, high fuel prices and a depreciating Aussie dollar are increasing the cost of living for Australians. The Reject Shop believes this helps sales of discounted and low-priced consumer goods and its position as a major Australian retailer should allow it to benefit from this trend.

The reject Shop’s FY22 report has also mentioned improving same-store sales in shopping centre locations as the foot traffic to the stores has been recovering since March 2022, following the easing COVID-19 situation.

Target price of $6.00

The Reject Shop’s share price has made a higher high by breaking above its previous high of $4.60 and now has validated the uptrend that started in June 2022 (the green trendline on the chart). We think with TRS’s improving business, its share price can grow alongside the current uptrend to reach the resistance of $6.00 (the red line on the chart).

Stop loss of $4.20

A confirmed break below $4.20 would mean the uptrend is broken and it would substantially reduce the chances of further share price appreciation in the short term. Longer-term investors can use the previous low of 3.85 as their stop loss level.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

Get a 14-day FREE TRIAL to CONCIERGE now

No credit card needed and the trial expires automatically.

Frequently Asked Questions about The Reject Shop

- Is The Reject Shop an Australian company?

Yes, The Reject Shop is based in Melbourne, VIC.

- Does The Reject Shop pay a dividend?

No, the company is using its cash to buy-back its shares on-market.

- Is The Reject Shop a BUY right now?

We think prices near $4.60 are attractive with a stop loss at $4.20.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…