What the interest rate hikes will do for the Big 4 Banks in 2022

The first cash rate hike in 11 years will impact the Big 4 banks

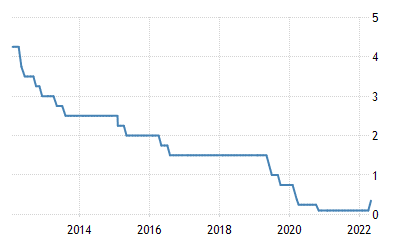

For the first time in over 11 years, the Reserve Bank of Australia (RBA) lifted interest rates on 3 May 2022; from a record low of 0.1% to 0.35%. Only a few months ago, it appeared there would be no rises until 2024, but now we could be set for several hikes over the next couple of years as inflation turns out not be transitory.

If you’re a shareholder in one of the Big 4 banks – ANZ (ASX: ANZ), CBA (ASX: CBA), Westpac (ASX: WBC) and NAB (ASX: NAB) – you would be happy and have every reason to be.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Despite the lending boom triggered by low interest rates, all of the banks were beginning to feel pressure, as depicted by the falls in their Net Interest Margins. All of the Big Four have now swiftly hiked interest rates. CBA was the first, doing so less than three hours after the rate decision on 3 May and NAB was the last, waiting until the next morning.

Which of the Big 4 Banks will benefit the most from rising interest rates?

At first glance, you might think ANZ simply because it has the lowest NIM at 1.58% and we certainly think management will be more relieved considering the company’s lack of market momentum and its technology troubles compared to its peers. But you could also argue that banks with a higher market share and better market momentum, particularly CBA (ASX: CBA) would benefit more.

Ultimately, only time will tell which banks benefit the most, but we think the banks with positive momentum (CBA and NAB) will continue ahead of those with lagging momentum (ANZ and Westpac). We do not think rising interest rates will be enough to help ANZ and Westpac overtake CBA and NAB.

RBA cash rate 2012-2022 (Source: Trading Economics)

How rising interest rates could be a bad thing for the banks

Nevertheless, any benefit the big banks will enjoy might be limited by four things: First the number of customers who have already locked in long-term fixed rates or may rush to do so now. We would also note that the Big Banks have already been lifting fixed rates since last year and this has failed to prop up their Net Interest Margins.

Second, the higher interest rates the banks will now have to pay to deposit holders. Third, decreasing demand for credit among prospective customers – who may decide against taking out credit or seek for it with a non-bank lender that can offer lower rates. And fourth, the increased risk of mortgage stress and bad debts.

Ultimately, all of these will depend on how much the big banks decide to raise rates. And none of them would want to raise rates to the extent that it causes demand to drop off – through a lack of new customers and existing customers opting to refinance – and lose market share.

Recent Big Bank Updates

- CBA: 1HY22 results

- NAB: 1Q22 results

- Westpac: 1Q22 results

- ANZ: 1HY22 results

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Big 4 Banks

- What is Net Interest Margin?

The Net Interest Margin is the difference between interest income from credit products, such as mortgages and personal loans, and the interest it pays to deposit holders.

- Will the Big banks raise interest rates?

All banks will inevitable pass on the rate hikes in order to improve their profitability.

- What are the Big 4 Banks’ Net Interest Margins?

As of 4 May 2022:

- ANZ Bank (ASX: ANZ): 1.58%

- NAB (ASX: NAB): 1.64%

- Westpac (ASX: WBC): 1.91%

- CBA (ASX: CBA): <2%. CBA last disclosed its NIM at the end of FY21 at 2.04% and although it has not disclosed it since, it has cited NIM pressure making it all but certain it is below 2%.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…