Monash IVF (ASX:MVF): Just when you thought a difficult 5 year span was over…

In the decade since fertility provider Monash IVF (ASX:MVF) listed, it was not an easy journey. Only a few months ago, we thought the business had turned a corner and many others did too. Then…trouble struck. Is this a buy the dip opportunity, or a risk of catching a falling knife? Introduction to Monash…

Read MoreEBR Systems (ASX:EBR): Another heart-focused medtech that has gained FDA approval

Mere days after Artrya (ASX:AYA) obtained FDA approval for its heart-health technology, EBR Systems (ASX:EBR) has achieved that same feat. The company made a surprising 15% plunge on the day of the announcement, but is still worth A$200m more than when it first listed. Let’s take a look at how it got to this point…

Read MoreMTM Critical Metals investors likely to benefit from Trump tariffs

MTM Critical Metals just might be a beneficiary from any ‘Trump tariffs’. Investors in this company were facing an action-packed 2025 in front of them even in a more stable geopolitical environment. But the company could benefit, particularly from a ‘worst case’ scenario as far as Trump’s tariffs are concerned (i.e. where most or all…

Read More5 Best Performing Penny Stocks to Buy in April 2025

Penny stocks are often seen as risky investments because of their volatile nature and low trading volumes. However, for savvy investors, they offer the potential for substantial returns, especially if you can identify high-growth opportunities early. April 2025 could be a pivotal time for many penny stocks due to the dynamic nature of the market…

Read MoreAtturra (ASX:ATA): With a $53bn market opportunity, is this Australia’s next big tech star?

As a company that listed in 2021, Atturra (ASX:ATA) has performed much better than many would have thought. While many other IPOs during that year (the last of low interest rates worldwide) have crashed and burned, the opposite has been true of this company that listed with an ~$100m IPO and has nearly tripled since…

Read MoreOrthocell (ASX:OCC): All systems go for a US market roll out of its flagship Remplir nerve repair product

Orthocell (ASX:OCC) is the latest ASX biotech to obtain FDA approval. Its nerve repair product Remplir was already approved in Australia, New Zealand and Singapore, plus approval is pending in Canada and Thailand. But the US was the biggest piece of the US$3.5bn pie that is the company’s global addressable market, and now it is…

Read MoreSome ASX stocks could be hit by Trump Tariffs: Here are 6 in the Firing Line!

Trump Tariffs: They’re back with a vengeance and even worse than last time. During the first Trump administration, tariffs were mostly only imposed on China, but they’re back with a vengeance. On so-called Liberation Day, the administration revealed reciprocal tariffs on just about all countries. Australia is not exempt although it has escaped with a…

Read MoreHere’s How to Use AI to Pick Stocks and Whether or Not It is a Good Strategy

As Artificial Intelligence (AI) becomes more widespread, investors are asking how to use AI to pick stocks. We will cover how you can, but also whether or not you really should be using it. There’s no one size fits all answer, it all depends on your risk tolerance, goals, and your understanding of the specific…

Read MoreQoria (ASX:QOR) Just Secured an Ohio Education Deal! Could Trump’s Policies Give It a Nationwide Boost?

In a market where investors are shunning most stocks except those that might benefit from US President Donald Trump’s radical disruptive policies, Qoria (ASX:QOR) could be one to look at. One recent policy is abolition of the Department of Education, in a move aimed at handing power back to the states. And Qoria, could benefit.…

Read MoreShould you use your tax cut to invest in stocks? And how should you go about it?

Should you use your tax cut to invest in stocks? With another unexpected round of tax cuts starting from the middle of next year, unveiled in the federal budget earlier this week, this is a question facing many. This round isn’t that large – only $536 a year and little over $10 a week by…

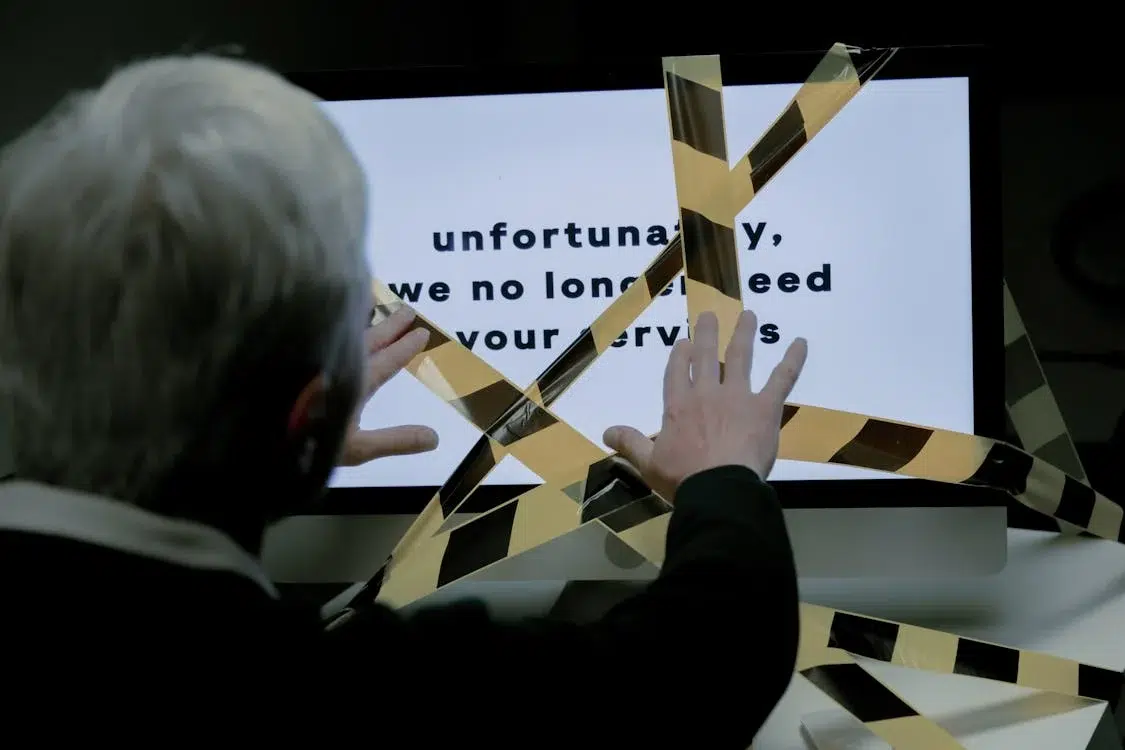

Read More4 ASX stocks that lost major clients and were never the same again

ASX stocks that lost major clients are more common than you might think. Many companies will make one of its major clients as a key sticking point, indicating that its product or service is useful to companies in the industry. But it only takes the loss of such a contract for the revenue to dry…

Read MoreSPC Global (ASX:SPG): A familiar name, but it’s now 4 companies in 1!

Very few Australians wouldn’t have either heard of SPC Global (ASX:SPG) or consumed some of its products (whether they know it or not). It sells canned and tinned fruits, particularly tomatoes as well as mangoes and peaches (amongst others) all grown and harvested in Victoria’s Goulburn Valley. But now, there is a lot more to…

Read MoreInfomedia (ASX:IFM) is set to rebound strongly in FY25 with the worst of the Tech Wreck behind us

Infomedia (ASX:IFM) is one tech stock that was unfairly sold off during the tech-wreck, but is gradually rebounding with a vengeance. The company has a long-term track record of growth, has remained profitable and is at the forefront of several trends in the automotive industry. Who is Infomedia? Infomedia, which was founded in 1987,…

Read MoreWeebit Nano in 2025: More licensing deals and a major qualification achieved

Investing in Weebit Nano in 2025 is an interesting proposition. Despite the Tech Wreck, it has been business as usual for the company, and this year is destined to be the company’s biggest yet. 2025 is less than 3 months old, but early signs are that good things are destined. Recap of Weebit Nano…

Read MoreLife360 (ASX:360): What other company lets you know where your loved ones are?

Life360 (ASX:360) is this week’s stock of the week. It is both an international and domestic stock, because the Silicon Valley-headquartered firm has been listed on the ASX since March 2019 and on the NASDAQ since June 2024. It isn’t yet profitable and probably should’ve been a while ago. But we think has made good…

Read MoreTruscreen (ASX:TRU): Taking a radical path to wide-spread commercialisation

Truscreen (ASX:TRU) is not taking the conventional path ASX medtech stocks take to market. Typically they seek approval in the US and then use that to set up shop across the world. Truscreen is instead starting its journey in Low-to-Middle Income Countries (LMICs). And even though shareholders may not realise it, this may actually be…

Read MoreClearVue Technologies (ASX:CPV): About to make big bucks from solar generating glass

ClearVue Technologies (ASX:CPV) may be one of the best ways for investors to gain exposure to the decarbonisation thematic. This company may not immediately strike out as an obvious candidate in the way that lithium or electric vehicle stocks might, but we think investors should give it a close look. Introduction to ClearVue Technologies…

Read MoreTemple and Webster (ASX:TPW): Here’s why there’s still more growth to come from this ecommerce furniture outlet

Temple and Webster (ASX:TPW) was one of several homewares and furniture companies to benefit from the pandemic as locked-down consumers spiced up their homes. Shares retreated as the country re-opened in 2022 and rising interest rates caused high-growth companies to be shunned by investors. But unlike many of its peers, Temple and Webster has undergone…

Read MoreRecce’s R327G passed its Phase 2 trial with a 93% primary efficiacy endpoint!

Recce Pharmaceuticals (ASX:RCE) has completed its Phase 2 ABSSSI Clinical Trial (Acute Bacterial Skin and Skin Structure Infections) for RECCE® 327 Topical Gel (R327G) and released the results earlier this week. The results were positive, and pave the way for commercialisation as early as 2026. How Recce got to this point Recce is a biotech…

Read MoreTeaminvest Private (ASX:TIP): The ASX’s most unique investment company!

Teaminvest Private (ASX:TIP) may not be as prominent an investment company as Magellan or Wilson, but perhaps it has not been getting the attention it deserves. Originating roughly 2 decades ago as an informal club of business owners for investment education and stock-picking purposes, it has evolved into a company with $1.6bn in funds in…

Read MoreHere’s why the US$307m acquisition of Edge AI chip maker Kinara is big news for Nanoveu (ASX:NVU)

Edge AI chip maker Kinara is being bought by NXP Semiconductors (NASDAQ:NXPI) for US$307m, or nearly A$500m. NXP, a Dutch semiconductor manufacturer that is US listed and capped at over US$50bn, announced the all-cash purchase earlier this week. We think this is good news for ASX companies working on Edge AI chips, like Nanoveu (ASX:NVU).…

Read MoreHere’s how Australia’s Research and Development Tax Incentive Works

Australia’s Research and Development Tax Incentive (R&D Tax Incentive) regime can be useful for pre-commercialisation companies serving as a non-dilutive source of funding. Progressing new medical treatments or technologies to market is not a cheap exercise and it can be difficult to secure funding from investors (either debt or equity). Even if a company can…

Read MoreVinyl Group (ASX:VNL) is finding its groove in 2025

Vinyl Group (ASX: VNL) is the only ASX-listed company offering exposure to the music technology and media industries. It has undergone a major transformation in 18 months, now a business with a curated portfolio of interconnected brands that empower everyone in the music ecosystem. Vinyl Group’s brands Vinyl has several brands. The most important…

Read MoreoOh!media (ASX:OML): Talk of its demise has been greatly exaggerated!

See a massive billboard on an arterial road, and there is a good chance that oOh!media (ASX:OML) was behind it. It is great to have a dominant market position, but this has not prevented shares sliding over 25% in the past 12 months due to cost blowouts and a difficult position with the advertising market.…

Read MoreFirstwave Cloud Technology (ASX:FCT): A changed company with a plethora of market opportunities

It seems the Tech Wreck is finally over as plenty of technology stocks have been rebounding, although Firstwave Cloud Technology (ASX:FCT) hasn’t. One of the arguable reasons is that investors think the company has not changed from what it was a few years ago. The reality is that even though the company has the same…

Read MoreAlterity Therapeutics (ASX:ATH) more than doubled after its Phase 2 results, but its still only $80m

Alterity Therapeutics (ASX:ATH) hit the jackpot last week. Any clinical-stage biotech achieving a positive Phase 2 outcome is good news, because it depicts that the company’s drug is not just safe, but that it works too. But while some companies (like Paradigm (ASX:PAR)) are going after markets with existing drugs that need replacement, Alterity is…

Read MoreDGL Group (ASX:DGL): Will 2025 be better for DGL and its investors?

Poor DGL Group (ASX:DGL). It was a company that ran hard for several months in 2021, but has substantially retreated as inflation has eroded its margins. Is there hope for investors in this company? DGL Group DGL (ASX:DGL) is an end-to-end chemicals business operating across Australia and New Zealand. The company operates through three…

Read MoreFindi (ASX:FND): It’s quadrupled in 12 months off the back of financial services in India

Until Findi (ASX:FND) came along, there were practically no ASX companies making money from India (or at least not many of them). But not only has Findi ‘come along’, it has grown to a $200m company off the back of India, specifically its banking system. Introduction to Findi (ASX:FND) Findi is a banking company…

Read MoreHere are 3 ASX stocks fighting diabetes and the opportunity ahead of them

There aren’t many ASX stocks fighting diabetes, but the few that are have a big market opportunity ahead of them. And they are not just about fighting the condition directly but other ailments that can result from having diabetes. It is estimated that 537m people have diabetes globally and 3 out of 4 of them live…

Read MoreInvesting in Tech Stocks? Here are 5 key metrics you need to know!

Here are 5 key metrics you need to know if you’re investing in tech stocks! 1. Annual Recurring Revenue (ARR) ARR is a key metric used by subscription-based businesses to measure the predictable and recurring revenue they can expect over the course of a year. It represents the total revenue generated from all active…

Read MoreAdisyn (ASX:AI1): Next generation computer chips

Up until a few months ago, Adisyn (ASX:AI1) was just one of several managed technology services providers. It was in a lucrative industry, but one that was highly competitive. But the company capped off 2024 by acquiring an Israel-based company called 2D Generation (2DG). 2DG is in the semiconductor space, seeking to use graphene as…

Read MoreThe Top ASX Health Stocks for 2025: Here Are Our 5 Picks!

Here Are Our 5 Top ASX Health Stocks for 2025! Avita Medical (ASX:AVH) OK, first thing’s first. We know this ASX health stock fell 14% on January 8 after it announced a revenue downgrade for Q4. But the past is the past. The company told investors to expect $100-106m revenue in CY25, 55-65% above CY24.…

Read MoreHere are 6 ASX Stocks that had bad news over Christmas/New Year: And You May’ve Missed It!

6 ASX Stocks that had bad news over Christmas/New Year…and you may’ve missed it Integrated Research (ASX:IRI) This performance management solution stock told investors two days prior to Christmas that it did not have a good start to FY25. Investors were told that Total Contract Value would be $23-27m, down 39% from the prior corresponding…

Read MoreReadyTech (ASX:RDY) has terrific prospects to fly on the wings of Digital Transformation

ReadyTech (ASX: RDY) is one of the best tech stocks on the ASX, in our view. It has a track record of growth, serves inflation-proof end markets and is set for good growth in the years ahead. Who is ReadyTech? ReadyTech provides SaaS technology in Australia and operates in three segments: Education, Workforce Solutions…

Read MoreBeacon Lighting (ASX:BLX): One of our favourite ASX retailers with strong upside potential

Beacon Lighting (ASX:BLX) flies under many investors’ radar, but it really shouldn’t. The family-owned company sells lights and fans to retail and trade consumers and is the largest company in its industry. It has a proven track record of growth and has more catalysts to come. Beacon Lighting’s track record Beacon Lighting listed in…

Read More3 reasons we like Australian Ethical Investment (ASX:AEF) right now

Australian Ethical Investment (ASX: AEF) is one of the best ways to leverage the growth in ESG investing on the ASX, because it is right amid the action. The ESG fund manager has experienced significant growth in its customers and funds under management in the past few years, both due to increasing awareness and desire…

Read MoreAvita Medical (ASX:AVH): Will the FDA’s last minute Christmas present catapult it to new heights in 2025?

Avita Medical (ASX:AVH) received not one, but two Christmas presents from the FDA. On December 19, it announced 510(k) clearance for Cohealyx, a new collagen-based dermal matrix for use in tissue integration and revascularisation. The second, on December 23, was approval for Recall Go mini – a disposable cartridge that can treat smaller burn wounds…

Read MoreBoss Energy (ASX:BOE): Its Honeymoon Uranium Project is back in production! So why have shares had a bad 2024?

Boss Energy’s (ASX:BOE) South Australian project may be called Honeymoon, but it has been anything but that for investors. Boss Energy had a great 2022 and 2023, but a bad 2024 It had been a stellar couple of years in 2022 and 2023 as investors rode the uranium wave. After more than a decade…

Read MoreNuix (ASX:NXL) has tripled in 12 months! But is more growth to come?

Nuix (ASX:NXL) is set to close 2024 roughly triple what it opened the year at, although off highs seen in early November. This company has been one of the most controversial companies on the ASX since it listed. It is still down from its IPO price, but is several times higher than its all time…

Read MoreQPM Energy – Perfect timing for this ‘new’ Queensland gas play

This article is about QPM Energy, ASX: QPM. Heads up, one of us owns stock in this company. QPM whom, you say? If you’ve never heard of QPM Energy, you’re not alone. For a long time, this gas producer was called either Pure Minerals or Queensland Pacific Metals, and its goal was to develop, not…

Read MoreHere are 5 ASX biotechs expecting clinical trial results in the next few months!

Here are 5 ASX biotechs expecting clinical trial results in the next few months! Opthea (ASX:OPT) Opthea is developing a drug called Sozinibercept (formerly known as OPT-302) that targets wet AMD, the world’s leading cause of blindness. More than five years after successful Phase 2 results, it expects to report Phase III results in the…

Read MoreHere’s why Proteomics (ASX:PIQ) shareholders should brace themselves for a big 2025!

Proteomics (ASX:PIQ) is one of the healthcare stocks to watch in CY25, because it has not one, not two, but three diagnostic tests to be commercialised in Australia, the USA and Europe. It has been a long wait to get to this point, but investors can be confident that there is upside to be realised if…

Read MoreCollins Foods (ASX:CKF): At less than 8x EV/EBITDA, this stock looks finger lickin’ cheap

Collins Foods (ASX:CKF) is one of the few opportunities for ASX investors in the fast food industry. It has a reputation for being resilient to economic downturns, because cash-strapped consumers will theoretically turn to these outlets. Many fast food stocks such as McDonalds were amongst the few stocks to see sales growth during the GFC.…

Read MoreIsland Pharmaceuticals’ PROTECT clinical trial is delivering the goods!

Investors were evidently pleased with the results out of Island Pharmaceuticals‘ PROTECT clinical trial…at least if the company’s more than doubling in the past two months is anything to go by. The results don’t just offer hope to Island’s investors, but to people suffering from and vulnerable to Dengue fever, a virus that impacts 400m…

Read MoreHere are 6 ASX CEOs who departed their companies in 2024

Here are 6 ASX CEOs who departed their companies in 2024 Larry Diamond – Zip (ASX:ZIP) Since Afterpay’s acquisition, Zip (ASX:ZIP) has been the flagship BNPL company of the ASX. It managed to survive a cash crunch, a spectacular collapse in its valuation as interest rates rose, a merger attempt with Sezzle that ended up…

Read MoreHere are 6 of the worst performing ASX shares. Will they bounce back in 2025?

6 of the worst performing ASX shares. Will they bounce back in 2025? Imugene (ASX:IMU) down 65% in 2024 Imugene is an oncology biotech. It is still capped at over $250m but is well off all time highs. It has multiple cancer therapies that use CAR-T therapies. CAR-T is a therapeutic approach that utilises…

Read MoreViva Leisure (ASX:VVA): When will investors realise the truth about Australia’s 2nd largest fitness network?

The pandemic is ancient history by now, but seemingly no one told investors looking at Viva Leisure (ASX:VVA). Because this company still has not recovered to levels seen pre-pandemic even though it is a bigger and better business than it was before. Viva Leisure: Australia’s 2nd largest fitness network To briefly recap the company,…

Read MorePhosCo (ASX:PHO) has a big night in Tunisia

For years now PhosCo (ASX: PHO) has been labouring away at building a new phosphate mine in the small North African nation of Tunisia. The company discovered a phosphate deposit in the country which it called Chaketma way back in 2012 and the resource there currently stands at a not insignificant 146 million tonnes at…

Read MoreOFX (ASX:OFX): 5 months after backflipping on its growth promises, where to next?

Only a few weeks ago, OFX (ASX:OFX) shares shed a third of their value after a weak 1HY24 trading update. The question we’ll explore here is the same one that should be asked after every intraday crash along the lines of this magnitude? Is it a short-term issue that’ll only mean a chance to buy…

Read MoreEML Payments (ASX:EML): Investors are optimistic its onwards and upwards from here, but its a long way back to the top

EML Payments (ASX:EML) investors had a good day yesterday with shares rising 25% after a trading update. The company reaffirmed its FY25 guidance of $54-60m EBITDA, and it recorded very strong revenue and EBITDA growth figures for the September quarter. Investors are happy that the company has delivered on previous promises to turn things around…

Read MoreDimerix (ASX:DXB): This exciting Phase 3 biotech could be about to follow in the footsteps of Telix and Neuren

Dimerix (ASX:DXB) is one of the few ASX biotechs in the middle of a Phase 3 trial, and it even has data showing the trial is a success. After years of hard work, the company has advanced its DMX-200 drug into a Phase 3 trial, and it has secured commercial deals worth over A$300m even…

Read MoreHere’s how to assess sovereign risk when investing and why it is so crucial

Blind Freddy could tell you assess sovereign risk when investing is one of the most important things to do. But too many investors don’t do it. The recent case studies of Leo Lithium (ASX:LLL) and Resolute Mining (ASX:RSG) depict it. Now you could just say don’t invest in countries where coups are almost a way…

Read MoreHere’s what Black Friday means for investors and which stocks will benefit from the $6.7bn bonanza?

Because it is coming up in less than a fortnight’s time, let’s take a look at what Black Friday means for investors in ASX stocks. You may think it is an obvious answer (hint: A bump in sales), but it is not that simple. What is Black Friday? And how did it spread to…

Read MoreHere are 5 ASX Indices other than the ASX 200 for Investors to Watch Eagerly

Here are 5 ASX Indices other than the ASX 200! ASX All Ordinaries The All Ordinaries is an indice that is actually older than the ASX 200, established back in 1979. At the time, the ASX was seeking to move away from regional indices and to establish one indice to measure the movement of…

Read MorePropel Funeral Partners (ASX:PFP): The last surviving funeral provider on the ASX

It is said the only certainties in life are death and taxes and Propel Funeral Partners (ASX:PFP) is the only ASX company that makes its money from the former. Its larger rival Invocare (ASX:IVC) was taken over by TPG Capital for $1.8bn last year after struggling for some time prior. Propel has had good fortune…

Read MoreHere are 5 ASX Consumer stocks defying the Cost of living crisis

Here are 5 ASX Consumer stocks defying the Cost of living crisis! Cash Converters (ASX:CCV) OK, there is an argument to be made that Cash Converters shouldn’t be on this list of consumer stocks doing well right now. This is because CCV is not the case of a company defying the cost of living…

Read MoreRecce’s Phase 2 ABSSSI Clinical Trial is on Track and Producing Outstanding Results

There are encouraging signs from Recce Pharmaceuticals‘ (ASX:RCE) Phase 2 ABSSSI Clinical Trial (Acute Bacterial Skin and Skin Structure Infections). The trial, is nearing completion, but the results to date have led to a Non-Data Safety Monitoring Board reviewing the trial unanimously recommending it continue. Not only have there been no serious adverse events, but…

Read MoreMaas Group (ASX:MGH): Why investors should keep a keen eye on it in FY25!

It is a tough time to be a construction company, but Maas Group (ASX:MGH) hasn’t fared that bad all things considered. This company, which is roughly double its IPO price, recorded another good FY24 result, and investors took note of it. But the company is still very reasonably priced. Meet Maas Group Maas Group…

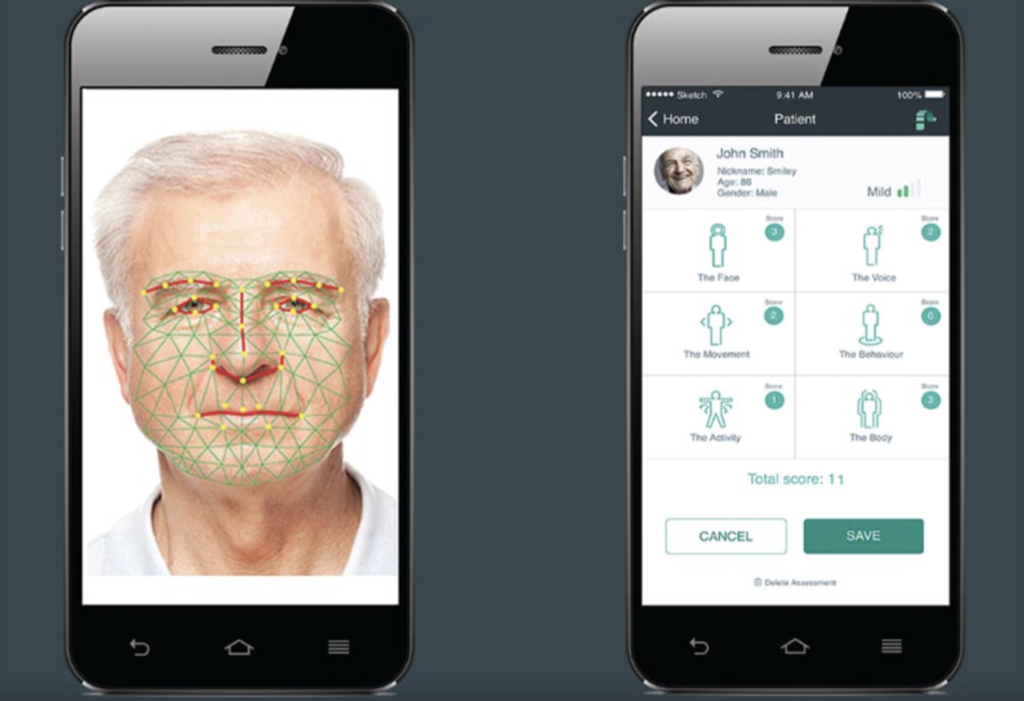

Read MorePainChek (ASX:PCK): Will 2025 be the year it finally makes progress and enters the US market?

PainChek (ASX:PCK) has among the most admirable medical technologies there is, in the form of an app that can detect pain in non-verbal patients. Unfortunately, there has been pain for investors along the way. When it was announced that it was participating in a clinical trial the Morrison government was investing $5m in back in…

Read MoreCalmer Co (ASX:CCO): It’s the only ASX stock in the fast-growing kava space!

If you haven’t heard of kava before, you probably haven’t heard of Calmer Co (ASX:CCO), but you’ll be hearing a lot more about both in the years ahead. Calmer Co, once named after its flagship Fiji Kava brand, is the only ASX-listed company in the kava space. Kava is a beverage in the South Pacific…

Read MoreHere’s what 2025 holds for Archer Materials (ASX:AXE) and why investors should be excited

Let’s take a look at what 2025 holds for Archer Materials (ASX:AXE), a company that is making a steady journey toward commercialising its 12CQ and Biochip technologies. During the last few months, the company has taken major steps in its journey and is poised for a big 2025. Recap of Archer and its technologies…

Read MoreWhat will happen to Rex shareholders? Will they get any money back?

Since the end of July, Rex shareholders have been unable to buy and sell shares, owing to their company being in administration and suspended from trading on the ASX. What will happen to them? That’ll depend on what becomes of Rex, and whether or not it resumes trading. Rex could well have a future, but…

Read MoreClose the Loop (ASX:CLG): Why has the once buoyant metals recycling business halved since its FY24 results?

Close the Loop (ASX:CLG) is one of the few opportunities for investors wanting exposure to the waste management industry. CLG listed in 2021 with a market capitalisation of $65.9m, and closed its first trading day with a value of over $100m. It purported to be, ‘Australia’s most advanced vertically integrated design, manufacturing, collection and recycling…

Read MoreIsland Pharmaceuticals (ASX:ILA): One of the rare ASX biotechs fighting mosquito diseases – and it’s in Phase 2

Island Pharmaceuticals (ASX:ILA) is one of the few (if not the only) ASX-listed Biotechs that is focused on mosquito diseases, primarily Dengue fever. Mosquito diseases, such as Dengue, are expensive to treat and are expected to proliferate due to climate change and the consequential boom in the mosquito population. But maybe Island Pharmaceuticals can help.…

Read MoreHere’s why you’ll see more ASX biotechs focus on Asia in the years ahead!

Investors should expect to see more ASX biotechs focus on Asia in the years ahead. And there are good reasons why. For many companies, the golden market has been the USA, given its population and stringent regulator the Food and Drug Administration (FDA). If a company can commercialise a drug in the USA, it can…

Read MoreSo your company announced a non-binding MOU: Is it a genuine deal or desperate puffery?

When you’re invested in a microcap stock, you might hear it has signed a ‘non-binding MOU’ (short for Memorandum of Understanding). It is said that the journey of a thousand miles begins with the first step. Are they the first step of a long journey, or just desperate puffery? What is a ‘non-binding MOU’?…

Read MoreBaby Bunting (ASX:BBN): FY25 will be better, but will investors give it the recognition?

Baby Bunting (ASX:BBN) is the poster child for what’s been happening retailers in a cost of living crisis…on steroids. This company is Australia’s largest specialty nursery retailer and one-stop-baby shop, having grown from one family-run shop which was opened in Melbourne in 1979. Remaining headquartered in Victoria to this day (with its national distribution in…

Read MoreThe Webjet demerger is complete, but which side of the demerger will win?

Earlier this week, the Webjet demerger was complete. The entity known as Webjet (ASX:WEB) still owns the consumer facing businesses including the Webjet travel agency as well as the GoSee and Trip Ninja businesses. But…it is now known as Web Travel Group. And more importantly, the wholesale hotel bookings business WebBeds is (as of last…

Read MoreHere’s why you should attend Semiconductor Australia 2024 – Australia’s premier semiconductor industry event

In 3 weeks time, on 24 October, Semiconductor Australia 2024 will take place in Sydney. Hosted by BluGlass, Sharecafe and Semiconductor Sector Service Bureau, the event will be held at Deloitte’s Sydney offices. Here’s why it is such a major occasion and why you should consider attending in person or online. What is…

Read MoreUniversal Store (ASX:UNI): Positioned to benefit in FY25 as Millennials and Gen Z spend with a vengence

Let’s take a look at Universal Store (ASX:UNI), a chain of casual fashion stores aimed at Millennial and Gen Z customers (think 18-35 year olds). It is a good business, but was hit by perceptions that its customers will cut back their spending because they feel the brunt of the cost of living crisis. We…

Read MoreHere Are The Top 5 Websites for Stock Market News & Analysis in Australia

For Australian investors and traders, staying informed about stock market news is essential for making smart decisions. With a range of websites now providing real-time data, expert analysis, and market insights, investors have the tools to navigate the ever-changing world of stocks. This article highlights five of the most reliable websites offering stock market news…

Read MoreBubs Australia (ASX:BUB): One of the few infant formula stocks building a post-China future

Bubs Australia (ASX:BUB) just might have a future beyond China. After the pandemic shut down the infant formula trade, companies that had previously been reliant on China sought other markets in the ASEAN region such as Vietnam. An infant formula shortage in the USA in 2022 led to a number of stocks, led by A2…

Read MoreIntelligent Monitoring Group (ASX:IMB): It is Australasia’s largest independent security monitoring provider and is up >200% in 12 months!

Intelligent Monitoring Group (ASX:IMB) has had a terrific FY24. It made >$40m EBITDA, went from being the 3rd largest company in its industry to the largest and set the foundations for future growth. Introduction to Intelligent Monitoring Group (ASX:IMB) Intelligent Monitoring Group is a provider of security solutions. It is Australasia’s largest independent…

Read MoreHere’s what you need to know about the TGA Special Access Scheme and why its a game changer for ASX biotechs

For ASX biotechs wishing to commercialise drugs in Australia, the Therapeutic Goods Administration (TGA) Special Access Scheme is the next best thing to regulatory approval. Therapeutic goods need to be included on the Australian Register of Therapeutic Goods (ARTG), prior to being sold, imported or exported from Australia. However, the Special Access Scheme provides a way…

Read MoreHow Many Stocks Should You Have in a Portfolio?

The amount of shares to buy can be an instrumental choice that might define your investment strategy and serve as the means to reach your financial goals. More specifically, it will be a question of balance between such important factors as your risk tolerance, investment objectives, and portfolio diversification for U.S. investors. In this extensive…

Read MoreInvion (ASX:IVX): Using Photodynamic Therapy to fight cancer

Unless you’re a professional dermatologist, you may not have ever heard of Photodynamic Therapy, let alone thought of it as an option to fight cancer as Invion (ASX:IVX) is doing. Invion may not appear to be an appealing investment at first glance, given its status as a ‘penny stock’ with a share price as a…

Read MoreBio Gene Technology (ASX:BGT): Commercialising a new class of insecticides

Bio Gene Technology (ASX:BGT) ASX-listed AgTech company developing two compounds – Flavocide™ and Qcide™ – as insecticides. Investors may hear the word insecticide and think that Flavocide™ and Qcide™ are just another couple of consumer insect sprays (such as Mortein) and wonder whether the market really needs it. How can Bio Gene’s compounds stand out…

Read MorePrescient Therapeutics (ASX:PTX): About to take the plunge into a Phase 2 trial against T-Cell Lymphoma

There’s plenty of ASX oncology biotechs conducting clinical trials, but Prescient Therapeutics (ASX:PTX) is one of the closest to commercialisation. The company is about to start Phase 2 for T-Cell Lymphoma and successful data here could suffice to appease the FDA without a Phase 3 trial, given the lack of treatment options currently available, but…

Read More5 crucial things to look for in the annual report of an ASX company that may give you an advantage over other investors

5 crucial things to look out for in the annual report of an ASX company! The ASX reporting season is not quite over yet. ASX companies have an additional month to file annual reports. Some may have already submitted their report and released it at the time of their annual results, while others may only…

Read MoreHumm Group (ASX:HUM): Its no Big 4 Bank, but has defied the market in 2024

Humm Group (ASX:HUM) has not had the year you might expect to a financier that is not either a Big 4 Bank or Macquarie (ASX:MQG). Interest rates appear to have peaked, and many financiers have not benefited as much as you might expect due to intense industry competition, as well as expectation that rates are…

Read MorePercheron Therapeutics (ASX:PER): Releasing Phase II data by the end of CY24, and successful data could lead to a major re-rate

It has been less then a year since Antisense Therapeutics changed its name to Percheron Therapeutics (ASX:PER). It is common for biotech companies to change their name when they pivot to new indications and/or to new assets, but this was not the case with Percheron. It is still focused on Duchenne Muscular Dystrophy (DMD), a…

Read MoreProteomics International Laboratories (ASX:PIQ): It thinks its got a great DKD detection test, but do regulators agree?

Proteomics International Laboratories (ASX:PIQ) is one of the larger companies that will be presenting at next month’s Life Sciences Conference. Capped at over $100m, its flagship product is PromarkerD, a predictive test for Diabetic Kidney Disease (DKD). Like all up and coming healthcare stocks, it has a great idea, but execution is the key. And…

Read MoreCyclopharm (ASX:CYC): Meet the latest ASX health stock making money from the USA!

Cyclopharm (ASX:CYC) is a rare species – an ASX stock that has just cracked the US market, but where the share price has not matched its sales. Granted, it is early days, and perhaps Cyclopharm has not had the uplift other companies have had, given it only just sold on US$250,000 generator and made over…

Read MoreAussie Broadband (ASX:ABB): A likeable telco that can reach for the skies again

Aussie Broadband (ASX:ABB) is a good illustration of a Telco stock you can like (as opposed to Telstra). Since listing on the ASX in 2020 at $1 per share it has substantially grown its customer base, revenues and, consequently, its share price. It went as high as $5.95 in late April 2022 before dipping after informing…

Read More6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This $88.4m company is none other than Brisbane’s first NRL team. And while it is no ASX 200 company, the Red Hill-based team made $75.2m in revenue (up 26%) and a $5.6m post-tax profit (up 74%)…

Read MoreRecce Pharmaceuticals investors are excited despite the market volatility – and there’s good reason

Recce Pharmaceuticals investors are amongst the few investors in ASX stocks that have a reason to smile right now. Their company has significantly outperformed the broader ASX, sitting in positive territory while the rest of the market has been volatile. Although there weren’t any announcements out of Recce – other than the completion of its…

Read MoreRetail Food Group (ASX:RFG): The most underrated ASX fast food stock might be about to boost its profile

Retail Food Group (ASX:RFG) is flying under many investors’ radars, and we think it is simply because its share price is below 10c. This company is actually worth nearly $200m, but its 2.5bn shares on issue makes it look like a penny stock to some investors. Nothing could be further from the truth. What has…

Read MoreAuswide and MyState are merging, will the Big 4 Banks be watching closely?

The biggest market news on August 19, 2024 was that Auswide and MyState are merging. The two small cap bank stocks, the former of which hails from Tasmania while the latter from the Queensland town of Bundaberg, may seem like an unlikely match at first glance, but the merger makes sense for both companies. …

Read More6 of the best performing ASX All Ords stocks in the past year

6 of the best performing ASX All Ords stocks in the past year Clarity Pharmaceuticals (ASX:CU6) Clarity is a late-stage clinical biotech, testing its Targeted Copper Theranostics (TCT) technology in a pivotal clinical trial. TCT is a radiation-based therapy that delivers treatment directly to the cells rather than the outside. This is the type…

Read MoreAs lower interest rates loom, here are 6 ASX stocks that will benefit from forthcoming rate cuts

Here 6 ASX stocks that will benefit from lower interest rates! AGL Energy (ASX:AGL) You might think AGL is on this list because people will have an easier time paying their electricity bills. Not quite for two reasons: First, Blind Freddy could tell you that, and Second, people are still paying their bills. We…

Read MoreCurvebeam AI (ASX:CVB): Could this company be the next Pro Medicus?

Not many ASX medtech companies can boast of a then US President elect as a patient, but Curvebeam AI (ASX:CVB) is one of them. And there’s good reason too – because its technology can detect injuries and fracture risk where its peers cannot. CurveBeam AI and the secret sauce behind its technology CurveBeam AI…

Read MoreActinogen Medical (ASX:ACW): Will history repeat itself? Can it bounce back from a troublesome Phase 2 trial?

If you thought you were having a bad Monday, spare a thought for Actinogen Medical (ASX:ACW) shareholders who saw their shares more than halve following the market opening. The catalyst was results of a Phase II trial that investors perceived to be a flop. How could this be when the company announced the,’…

Read MoreIf my company gets hit by a ASX Price Query, what does it mean and is it good or bad?

An ASX price query, or a speeding ticket, is commonly issued to ASX companies that record unexpected share price movements without underlying news. Is this really a big deal for companies? The typical format of an ASX price query The ASX will send the company a letter, sometimes pausing trading until the letter is responded…

Read MoreIs another boom in ASX BNPL stocks brewing? And how would Mk. 2 differ from Mk. 1

Is a new era on the horizon for ASX BNPL stocks? After a boom that lasted from Afterpay’s May 2016 IPO to its acquisition in the September quarter of CY21, there was a crunch in the sector. Rising interest rates and inflation sent many companies – Openpay, Laybuy, Sezzle, Payright and Zebit just to name…

Read MoreDoes Adore Beauty (ASX:ABY) have a better future ahead of it?

Let’s take a look at Adore Beauty (ASX:ABY). We know the IPO was horrible and the ghosts of it still plague the company today. But with its founder long gone, and a recent trading update showing positive signs – is a better future ahead of it? Adore Beauty has never recovered from its IPO…

Read MoreStock options: Here’s how investors can use them to their advantage

Do you hold Stock options? If so, you could be in a ‘no-lose’ situation as an investor. If your company rises, you may have the chance to lock in a healthy capital gain. But even if it doesn’t, you may not end up losing a single cent. For the companies, while it is setting a…

Read MoreThese ASX biotechs are working with the US Department of Defence to bring new drugs to market and have a bright future ahead

Think of ASX stocks working with the US Department of Defence, and investors might imagine defence stocks or perhaps even critical mineral project developers. This is not completely untrue. The list of stocks working with the US Department of Defence includes critical mineral companies such as Lynas (ASX:LYC), which was granted US$258m back in March…

Read MoreYour invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of issuer-sponsored research from Pitt Street Research in 2023 and 2024. The current share price is well below the valuation range suggested in that research (see pittstreetresearch.com/freelancer), we think largely because of the bear market for…

Read MoreHere’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to sell their drugs or devices, especially in the USA. So the next time you see an announcement that an ASX-listed company has had their drug or device approved for reimbursement, you should wonder why a…

Read More6 ASX stocks at risk of delisting in the next 12 months

A couple of weeks ago, a list of ASX stocks at risk of delisting was released on the market announcements platforms. The ASX has the right to remove stocks for breaking listing rules (such as failing to lodge the report) or if it is appropriate for some other reason. But it was rare to see…

Read More